Joint Corp Stock Intrinsic Value – THE JOINT CORP. JYNT Broadens Reach to Puerto Rico with Franchise Deal for Two Clinics

April 8, 2023

Trending News 🌥️

The Joint Corp ($NASDAQ:JYNT). (JYNT), a publicly traded company that specializes in chiropractic and physical therapy services, recently announced that it has successfully broadened its reach to Puerto Rico by signing a franchise agreement for two clinics. This is the first franchise deal for The Joint Corp. in the Caribbean and marks an important milestone in the company’s ongoing expansion efforts. The Joint Corp. operates chiropractic clinics that feature convenient hours, affordable pricing, and no appointment necessary.

This new franchise deal in Puerto Rico is expected to open up additional opportunities for The Joint Corp. to grow its presence in Latin America and the Caribbean. The Joint Corp. is a publicly traded company listed on the NASDAQ stock exchange. The Joint Corp. is committed to providing accessible and affordable care to customers while creating a professional environment that empowers employees and helps them grow their careers.

Share Price

Monday proved to be a difficult day for JOINT CORP, as their stock opened at $16.9 and closed at $16.4, a decline of 2.7% from the previous closing price of 16.8.

However, this setback was soon overshadowed by the news that JOINT CORP had signed a deal to open two franchises in Puerto Rico. This move will help broaden the company’s reach across the island, as well as bring their services to those who may not have previously been able to access them. They will offer the same range of services as those offered at JOINT CORP’s other clinics across the country, including physical therapy, chiropractic care, and medical massage. This move will also create jobs in Puerto Rico, as JOINT CORP plans to hire local professionals to staff the clinics. This latest move is part of JOINT CORP’s ongoing effort to expand their operations and services across the U.S. and its territories. The new franchises in Puerto Rico are sure to be a major contributor to the company’s success, both financially and through offering their services to those who need them most. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Joint Corp. More…

| Total Revenues | Net Income | Net Margin |

| 101.91 | 1.18 | 1.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Joint Corp. More…

| Operations | Investing | Financing |

| 11.08 | -20.78 | 0.33 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Joint Corp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 91.94 | 59.54 | 2.23 |

Key Ratios Snapshot

Some of the financial key ratios for Joint Corp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.1% | -11.0% | 2.4% |

| FCF Margin | ROE | ROA |

| 2.3% | 4.9% | 1.7% |

Analysis – Joint Corp Stock Intrinsic Value

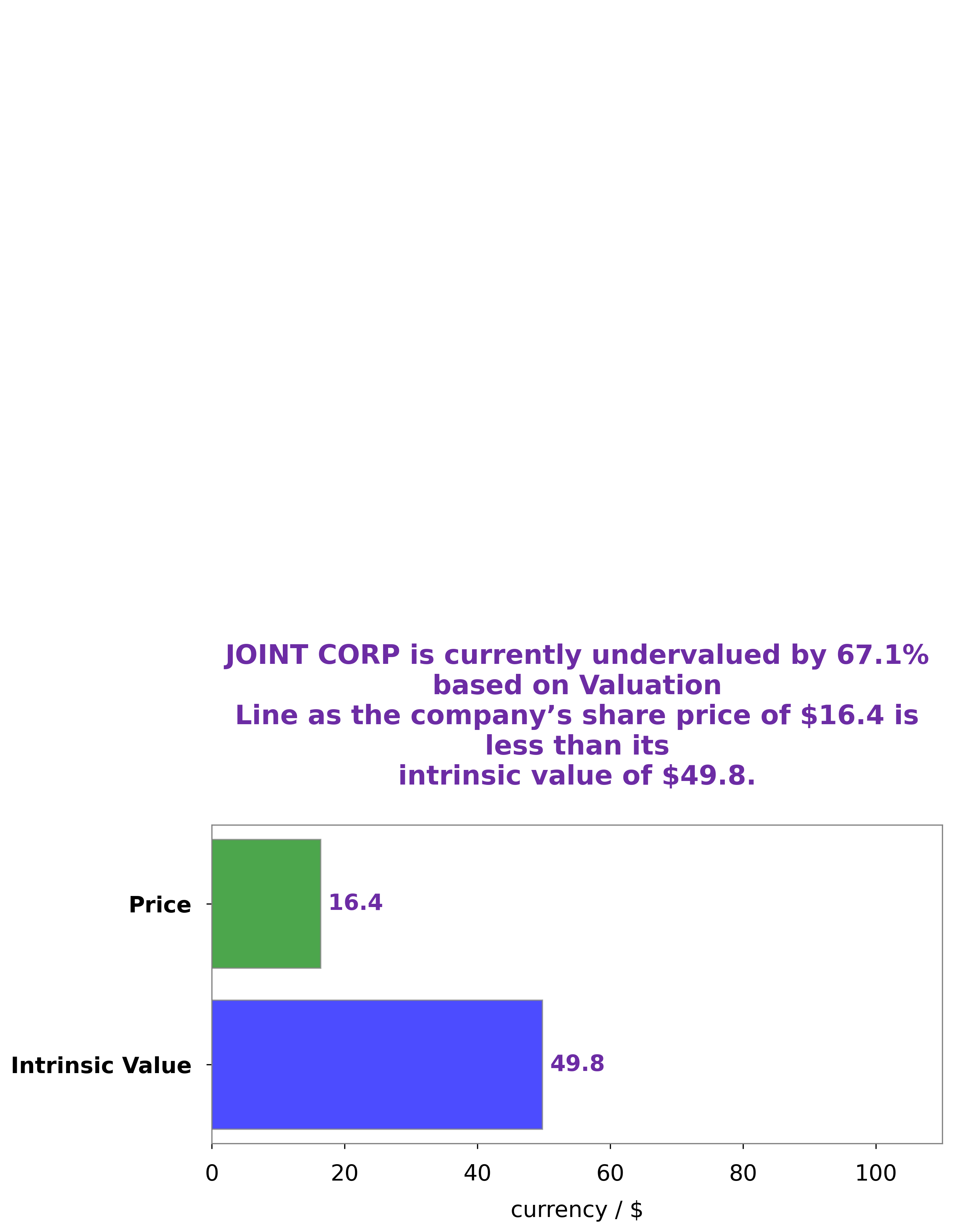

At GoodWhale, we have analyzed the financials of JOINT CORP and our proprietary Valuation Line has found that the fair value of JOINT CORP share is around $49.8. However, the current stock price of JOINT CORP stands at $16.4, indicating that it is undervalued by 67.1%. This implies that there is a great potential for investors to earn considerable returns from investing in the company at its present stock price. More…

Peers

The Joint Corp is a publicly-traded company that owns and operates chiropractic clinics in the United States. The company was founded in 1999 and is headquartered in Scottsdale, Arizona. The Joint Corp’s main competitors are Ethema Health Corp, PT Sejahteraraya Anugrahjaya Tbk, and Ensign Group Inc.

– Ethema Health Corp ($OTCPK:GRST)

Ethema Health Corp is a healthcare company with a focus on providing services to the underserved population. The company has a market cap of 1.86M as of 2022 and a Return on Equity of -25.22%. The company’s mission is to provide quality healthcare to those who need it the most. Ethema Health Corp has a strong commitment to social responsibility and provides services to the community through its clinics, mobile units, and outreach programs. The company has a long history of serving the underserved and is dedicated to providing quality care to its patients.

– PT Sejahteraraya Anugrahjaya Tbk ($IDX:SRAJ)

Pt Sejahteraraya Anugrahjaya Tbk is an Indonesian company that focuses on the construction and engineering sector. The company has a market cap of 1.54T as of 2022 and a return on equity of 2.06%. The company has been involved in various large-scale construction projects in Indonesia, such as the construction of the Jakarta-Cikampek Toll Road and the Trans-Java Toll Road.

– Ensign Group Inc ($NASDAQ:ENSG)

The Ensign Group is a holding company for a number of healthcare service providers. Its operations are primarily in the United States, with a focus on skilled nursing and assisted living facilities. The company also provides home health, hospice, and senior living services.

Ensign has a market cap of 4.77B as of 2022. Its return on equity is 19.3%. Ensign’s focus on skilled nursing and assisted living facilities gives it a strong position in the healthcare services industry. The company’s size and scale give it the ability to provide a wide range of services to its customers. Ensign’s focus on quality care and customer service is evident in its high return on equity. Ensign is a well-run company that is well-positioned to continue growing in the healthcare services industry.

Summary

Investors may be interested in Joint Corp (JYNT) as the company has recently expanded to Puerto Rico, signing a franchise deal for two clinics. Joint Corp is an operator of chiropractic clinics that offers services such as spinal adjustments, peripheral joint treatments, and corrective exercises. The company’s business model is focused on driving volume of customers through its franchised network. Joint Corp is well positioned to capitalize on its momentum in the Puerto Rican market and continue to grow its franchise base.

Recent Posts