Interdigital Intrinsic Value – InterDigital Nominates Samir Armaly to Serve on Board of Directors

April 26, 2023

Trending News 🌥️

INTERDIGITAL ($NASDAQ:IDCC): InterDigital, Inc. is a publicly-traded company that focuses on technology solutions for the mobile and wireless industry. It is a leader in the development and monetization of wireless technologies and is a developer of mobile and digital multimedia technology. The company recently announced its nomination of Samir Armaly to serve on the board of directors at the upcoming annual shareholder meeting on 7 June. Armaly has extensive experience in the technology industry and has held executive roles at various international businesses. He was most recently the Global Vice President of Corporate Strategy and Business Development at Hewlett Packard Enterprise, where he was responsible for global strategy, M&A, and venture investments.

He also has experience in consumer electronics, enterprise software, and digital media. The board of directors believes that Armaly’s experience and expertise will be a valuable addition to the InterDigital team. His knowledge and skills will help to advance the company’s technology solutions, as well as bring an important perspective to its strategic decision making. Armaly’s proposed election to the board of directors will provide InterDigital with a greater breadth of knowledge and expertise that will be invaluable as the company continues to grow and innovate.

Market Price

Following the news, stocks of InterDigital decreased by 1.3% from $70.8 to $69.8 at the close of the trading day. It is speculated that Armaly’s expertise in technology, international development and finance will be beneficial to the company. InterDigital hopes that his presence in the board will help them to create higher value for their shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Interdigital. More…

| Total Revenues | Net Income | Net Margin |

| 457.79 | 93.69 | 22.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Interdigital. More…

| Operations | Investing | Financing |

| 286.04 | -314.71 | 18.6 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Interdigital. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.9k | 1.17k | 24.43 |

Key Ratios Snapshot

Some of the financial key ratios for Interdigital are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.8% | 59.6% | 32.1% |

| FCF Margin | ROE | ROA |

| 53.1% | 12.9% | 4.8% |

Analysis – Interdigital Intrinsic Value

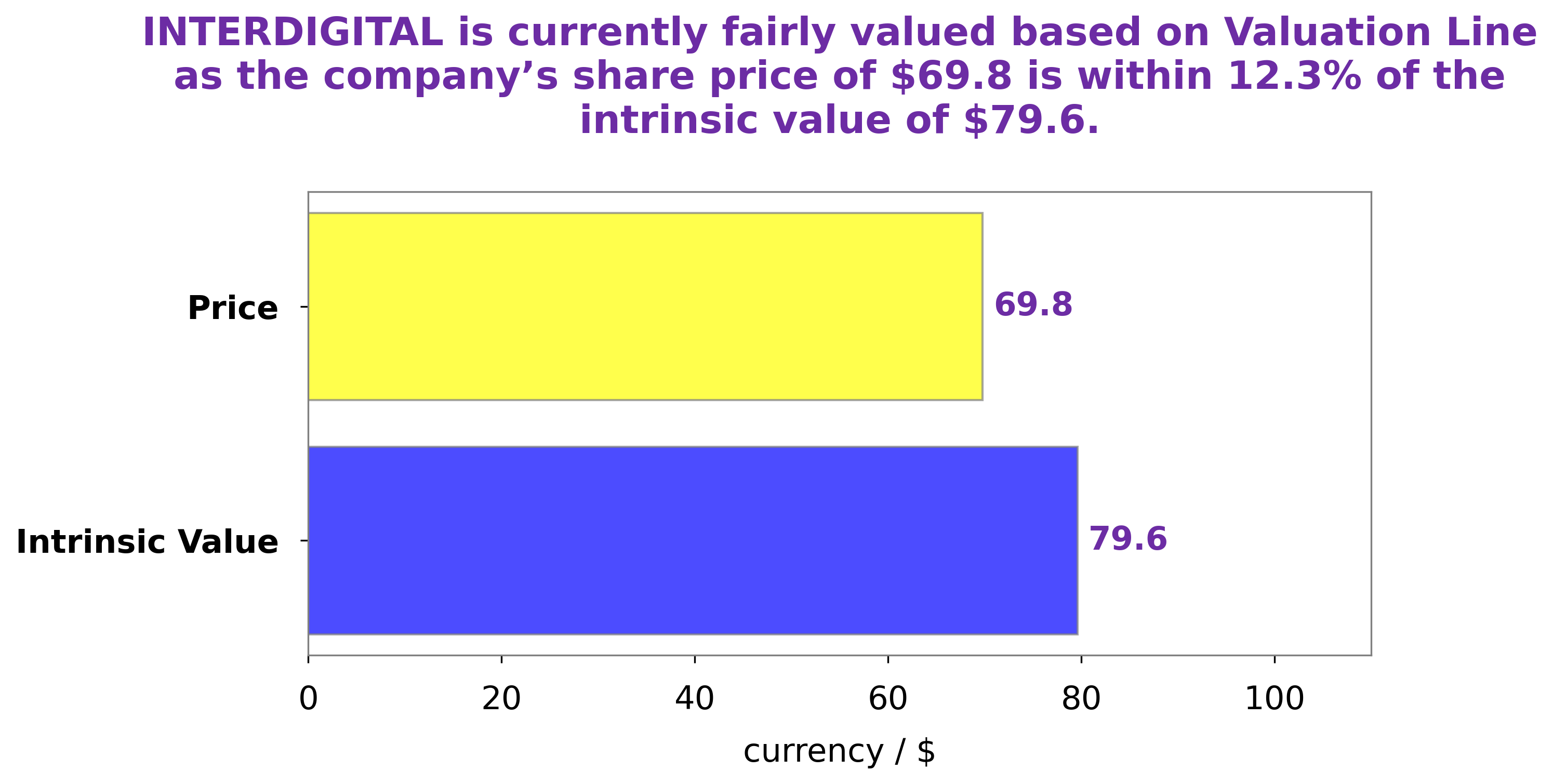

GoodWhale has conducted an analysis of INTERDIGITAL‘s wellbeing and the results are in. Our proprietary Valuation Line found that the fair value of INTERDIGITAL share is currently around $79.6. However, currently, INTERDIGITAL stock is traded at $69.8, signifying that it is undervalued by 12.3%. As a result, investors may find this a good opportunity to get a good deal on INTERDIGITAL stock. More…

Peers

They offer advanced wireless solutions and services to device manufacturers, network operators, and other industry stakeholders worldwide. They compete with WI FI Wireless Ltd, Affluence Corp, and Hammer Technology Holdings, all of whom provide similar solutions and services to the wireless industry.

– WI FI Wireless Ltd ($OTCPK:WFWRF)

Hammer Technology Holdings is a technology company with a current market cap of 33.5 million as of 2023. The company specializes in providing advanced technological solutions to businesses, ranging from IT services to software development. Hammer Technology’s Return on Equity (ROE) is -7.43%, indicating that the company has failed to generate a return on its shareholders’ equity. This figure is below the industry average of 7.4%, suggesting that the company is facing challenges in generating profits and returns for its investors. Despite its low ROE, Hammer Technology Holdings remains a leader in providing high-end technological solutions and services to businesses across the globe.

Summary

InterDigital is an attractive investment for those looking for a high-return opportunity. The company has consistently achieved strong financial performance, and its stock price has been steadily increasing. With the selection of Samir Armaly to the board of directors, InterDigital is poised to continue its positive trajectory. Armaly has an extensive background in technology and telecommunications.

He is expected to bring valuable insights to the company’s strategy and operations, which could result in further growth. Analysts predict that this move could be beneficial for the company’s long-term sustainability and profitability. Investors should pay close attention to InterDigital in the coming weeks and months.

Recent Posts