Herbalife Nutrition Stock Fair Value Calculator – Herbalife Ltd. Trading at 41% Discount to Fair Value Estimate of US$23.25

May 5, 2023

Trending News ☀️

Herbalife ($NYSE:HLF) Ltd. is a global nutrition company, providing science-based products for a healthier lifestyle. It has recently been trading at a 41% discount to its fair value estimate of US$23.25 per share. This assessment has been determined through the use of a 2 Stage Free Cash Flow to Equity analysis. The 2 Stage Free Cash Flow to Equity analysis is a method of stock valuation that examines the present value of future cash flows generated by the company’s operations, subtracting out all costs associated with the financing of such operations. The analysis therefore gives an indication as to whether the stock is currently undervalued or overvalued based on the estimated future cash flows.

Herbalife Ltd. is known for its quality nutritional products and innovative health and wellness programs. The company continues to enjoy strong revenue growth, particularly from its global nutrition clubs, which provide their customers with personalized nutrition plans and education to help them lead healthier lifestyles. With this in mind, it appears that Herbalife Ltd. may be an attractive long-term investment given its current discounted price and strong revenue growth prospects.

Analysis – Herbalife Nutrition Stock Fair Value Calculator

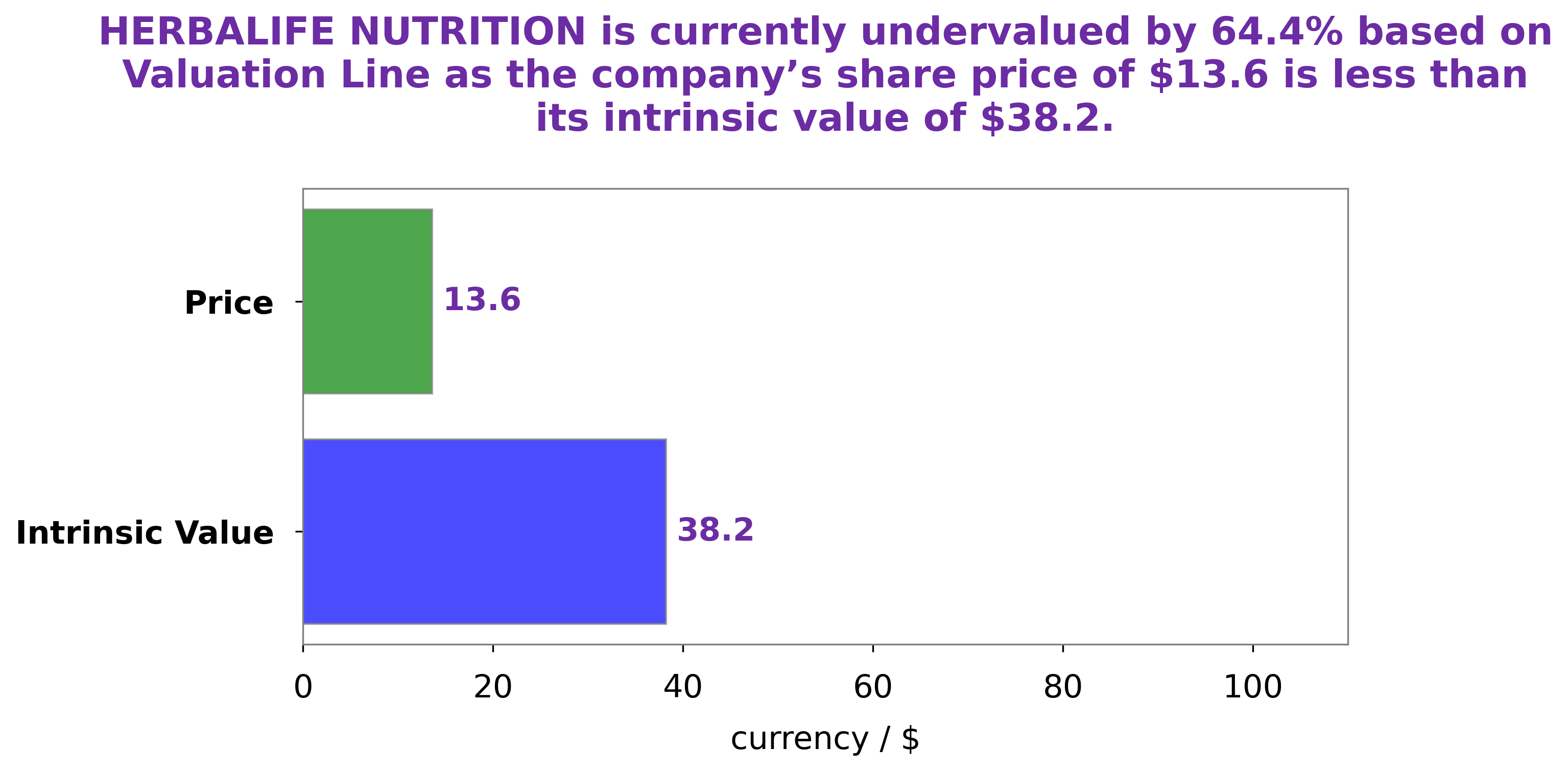

At GoodWhale, we have conducted a careful analysis of HERBALIFE NUTRITION‘s fundamentals in order to determine its fair value. Our proprietary Valuation Line has calculated the fair value of HERBALIFE NUTRITION stock to be around $38.2 per share. However, the current market price of HERBALIFE NUTRITION shares is $13.6, representing a staggering 64.4% discount to its fair value. This means that HERBALIFE NUTRITION is currently undervalued and offers investors an opportunity to buy into the stock at a discounted rate. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Herbalife Nutrition. More…

| Total Revenues | Net Income | Net Margin |

| 5.12k | 252.4 | 4.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Herbalife Nutrition. More…

| Operations | Investing | Financing |

| 268.2 | -145.2 | -218.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Herbalife Nutrition. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.69k | 3.91k | -12.93 |

Key Ratios Snapshot

Some of the financial key ratios for Herbalife Nutrition are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.0% | -2.6% | 9.4% |

| FCF Margin | ROE | ROA |

| 2.4% | -24.2% | 11.2% |

Peers

They have a broad product line including weight management, targeted nutrition, and energy and fitness products. They have a presence in over 90 countries and 6.4 million independent distributors. Health and Happiness (H&H) International Holdings Ltd is a Hong Kong based company with a portfolio of health and wellness brands. Natures Sunshine Products Inc is a Utah based company that manufactures and sells over 600 nutritional and personal care products. Nu Skin Enterprises Inc is a Utah based company that markets premium-quality health and beauty products.

– Health and Happiness (H&H) International Holdings Ltd ($SEHK:01112)

Health and Happiness (H&H) International Holdings Ltd is a health and wellness company that focuses on improving the lives of people around the world. The company has a market cap of 4.77B as of 2022 and a Return on Equity of 12.89%. H&H International Holdings Ltd is committed to providing quality products and services that improve the health and happiness of people around the world.

– Natures Sunshine Products Inc ($NASDAQ:NATR)

Natures Sunshine Products Inc is a market leader in the dietary supplement industry. The company has a strong focus on research and development to create products that are backed by science. Natures Sunshine Products Inc has a market cap of 173.79M as of 2022, a Return on Equity of 9.59%. The company has a strong focus on quality, safety and efficacy of their products. Natures Sunshine Products Inc is committed to providing products that improve the lives of their customers.

– Nu Skin Enterprises Inc ($NYSE:NUS)

Nu Skin Enterprises, Inc.’s market cap is $2.02 billion as of 2022 and its return on equity is 16.08%. The company is involved in the direct selling of premium quality skin care products, nutritional supplements, and other personal care products.

Summary

Herbalife Nutrition is a global nutrition company that offers a range of products to support a healthy and active lifestyle. An investing analysis of the company shows that the stock is trading at a 41% discount to the fair value estimate of US$23.25. Using the two-stage free cash flow to equity model, investors can get an insight into the potential upside in the stock. The analysis also reveals that the company’s return on invested capital is steadily increasing, indicating that the company is generating more profits with each dollar invested.

Additionally, its debt-to-equity ratio is below 1, which shows that the company has adequate liquidity to cover liabilities and sustain growth. Furthermore, the company’s strong dividend track record and substantial share repurchases illustrate the management’s commitment to rewarding shareholders.

Recent Posts