Harley-davidson Intrinsic Value Calculation – Harley-Davidson Elevates Riding Experience with New CVO Motorcycles Powered by Milwaukee-Eight VVT 121 Engine

June 9, 2023

🌥️Trending News

HARLEY-DAVIDSON ($NYSE:HOG): The company has now taken its Touring line to the next level of performance and style with the introduction of two new Custom Vehicle Operations (CVO) models – the CVO Street Glide and CVO Road Glide. Both are powered by the Milwaukee-Eight VVT (Variable Valve Timing) 121 engine, a superior engine that brings an all-new level of power and performance to the Touring line. With this announcement made on June 7, 2023, Harley-Davidson has once again demonstrated its commitment to providing riders with a truly elevated riding experience. The Milwaukee-Eight VVT 121 engine is designed to provide unparalleled power, easier starting, smoother running and improved fuel economy. It also features an advanced air intake system and improved exhaust system for maximum performance.

Not only is the engine powerful, it is also stylishly adorned with a chrome treatment that will turn heads wherever you ride. Harley-Davidson has once again pushed the boundaries of motorcycling with their new CVO models. Both the CVO Street Glide and Road Glide offer riders a truly elevated riding experience, thanks to the Milwaukee-Eight VVT 121 engine. With its superior power and performance, you can be sure that your Harley-Davidson will always deliver an enjoyable and thrilling ride.

Stock Price

HARLEY-DAVIDSON announced the launch of their new custom CVO (Custom Vehicle Operations) motorcycles, powered by the Milwaukee-Eight VVT 121 engine, which promises to elevate the riding experience for riders. On Thursday, HARLEY-DAVIDSON stock opened at $35.4 and closed at $34.8, down by 1.4% from previous closing price of 35.3. The new CVO motorcycles come with improved power and torque, a lighter frame, and an adjustable suspension system. The Milwaukee-Eight VVT 121 engine provides a smooth and powerful ride and better fuel efficiency than previous engines.

Additionally, the engine is designed for superior durability and reliability. The new CVO models also feature the latest in styling, with custom finishes and details that give them a unique look. They come with advanced rider technology such as a full color touch screen display, adaptive cornering lighting, and enhanced Bluetooth connectivity. With their improved performance, advanced technology, and sleek design, these motorcycles are sure to provide a memorable ride for years to come. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Harley-davidson. Harley-Davidson_Elevates_Riding_Experience_with_New_CVO_Motorcycles_Powered_by_Milwaukee-Eight_VVT_121_Engine”>More…

| Total Revenues | Net Income | Net Margin |

| 6.05k | 823 | 13.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Harley-davidson. Harley-Davidson_Elevates_Riding_Experience_with_New_CVO_Motorcycles_Powered_by_Milwaukee-Eight_VVT_121_Engine”>More…

| Operations | Investing | Financing |

| 455.82 | -722.46 | 460.13 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Harley-davidson. Harley-Davidson_Elevates_Riding_Experience_with_New_CVO_Motorcycles_Powered_by_Milwaukee-Eight_VVT_121_Engine”>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 12.03k | 8.93k | 20.12 |

Key Ratios Snapshot

Some of the financial key ratios for Harley-davidson are shown below. Harley-Davidson_Elevates_Riding_Experience_with_New_CVO_Motorcycles_Powered_by_Milwaukee-Eight_VVT_121_Engine”>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.7% | 24.3% | 17.1% |

| FCF Margin | ROE | ROA |

| 4.7% | 22.3% | 5.4% |

Analysis – Harley-davidson Intrinsic Value Calculation

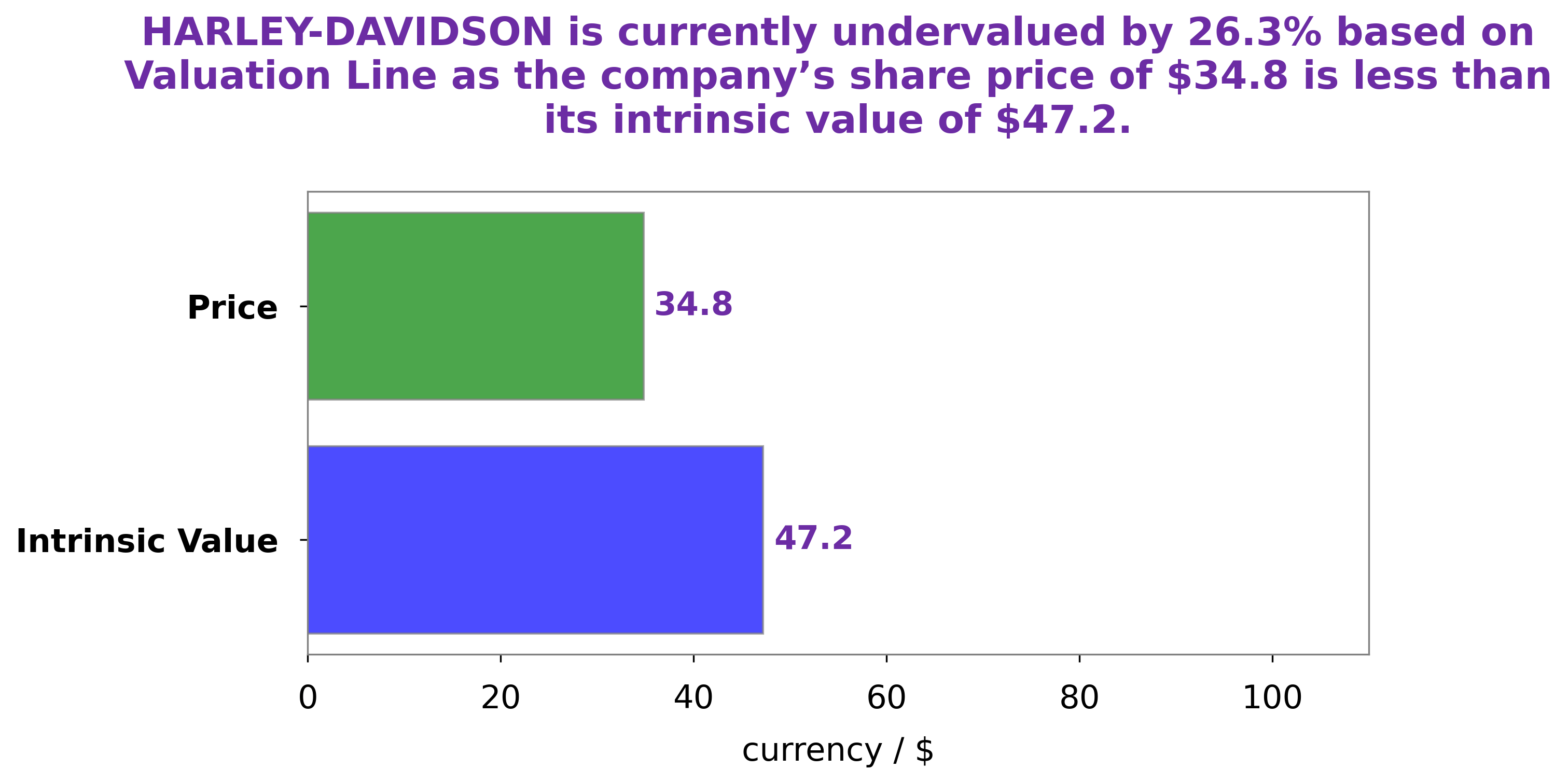

At GoodWhale, we conducted an in-depth analysis of HARLEY-DAVIDSON‘s fundamentals. Based on our proprietary Valuation Line, we concluded that the fair value of HARLEY-DAVIDSON share is around $47.2. This means that currently HARLEY-DAVIDSON stock is traded at $34.8, undervalued by 26.2%. This may be a good opportunity for investors to consider entering the market and buying HARLEY-DAVIDSON stocks. More…

Peers

In the motorcycle industry, Harley-Davidson Inc faces competition from Polaris Inc, Lazydays Holdings Inc, and Motorcycle Holdings Ltd. Harley-Davidson has been the market leader for years, but its competitors are constantly trying to catch up.

– Polaris Inc ($NYSE:PII)

Polaris Inc is a American manufacturing company based in Minnesota. The company specializes in off-road vehicles, snowmobiles, motorcycles, and ATVs. Polaris is also a leading manufacturer of electric vehicles.

The company has a market cap of 5.52B as of 2022 and a ROE of 32.56%. Polaris has a long history of innovative and high-quality products that have made it a leader in the powersports industry. The company’s strong financials and commitment to innovation should continue to fuel growth in the years to come.

– Lazydays Holdings Inc ($NASDAQ:LAZY)

Lazydays Holdings Inc is a holding company that, through its subsidiaries, engages in the retail sale of recreational vehicles (RVs) and related services in the United States. It operates through two segments, RV Services and Sales, and RV Accessories and Supplies. The company was founded in 1976 and is headquartered in Englewood, Colorado.

As of 2022, Lazydays Holdings Inc had a market cap of 129.7 million and a return on equity of 41.96%. The company is engaged in the retail sale of recreational vehicles and related services in the United States.

– Motorcycle Holdings Ltd ($ASX:MTO)

Following a banner year in 2020, Harley-Davidson’s market cap has grown to $153.03M. The company’s ROE has also grown to 13.44%. Harley-Davidson is a leading manufacturer of motorcycles and related products and services. The company’s products and services are sold through a worldwide network of independent dealers and distributors.

Summary

Harley-Davidson has recently announced the launch of its two new custom vehicles, the CVO Street Glide and CVO Road Glide, which are powered by the Milwaukee-Eight VVT 121 engine. Investing analysis of Harley-Davidson shows that the company has strong name recognition, a loyal customer base and a solid balance sheet. Many investors believe that Harley-Davidson’s sales could benefit from a resurgence in motorcycle sales in the U.S., as well as increased popularity in international markets.

Additionally, the company’s focus on innovative technology and expanding its lineup of electric motorcycles could be a major positive catalyst for its stock. As a result, some investors are bullish on Harley-Davidson’s long-term prospects.

Recent Posts