Gulfport Energy Stock Fair Value – GULFPORT ENERGY Appoints Michael Hodges as Chief Financial Officer

April 9, 2023

Trending News ☀️

Gulfport Energy ($NYSE:GPOR) has announced the appointment of Michael Hodges as its new Chief Financial Officer. Hodges is an experienced oil and gas executive who has held senior positions in leading companies including BP and Apache Corporation. Gulfport Energy is a publicly traded oil and gas exploration and production company based in Oklahoma City, Oklahoma. It operates throughout the United States, with a focus on the Appalachian Basin, the Anadarko Basin, and the Utica Shale.

The company primarily engages in the acquisition, development, exploration and production of oil and natural gas properties. It has become a leader in the natural gas exploration and production industry and is one of the largest operators in the Utica Shale. Gulfport Energy is listed on the NASDAQ under the symbol GPOR.

Market Price

The news of the appointment caused a slight drop of 0.6% in the company’s stock price, as it opened at $82.2 and closed at $79.5, compared to the previous closing price of $80.0. GULFPORT ENERGY is confident that Michael Hodges’ expertise will be an invaluable asset going forward. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Gulfport Energy. More…

| Total Revenues | Net Income | Net Margin |

| 2.33k | 412.86 | 64.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Gulfport Energy. More…

| Operations | Investing | Financing |

| 739.08 | -458.3 | -276.78 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Gulfport Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.53k | 1.65k | 46.13 |

Key Ratios Snapshot

Some of the financial key ratios for Gulfport Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 27.0% | 126.8% | 23.7% |

| FCF Margin | ROE | ROA |

| 11.9% | 66.7% | 13.6% |

Analysis – Gulfport Energy Stock Fair Value

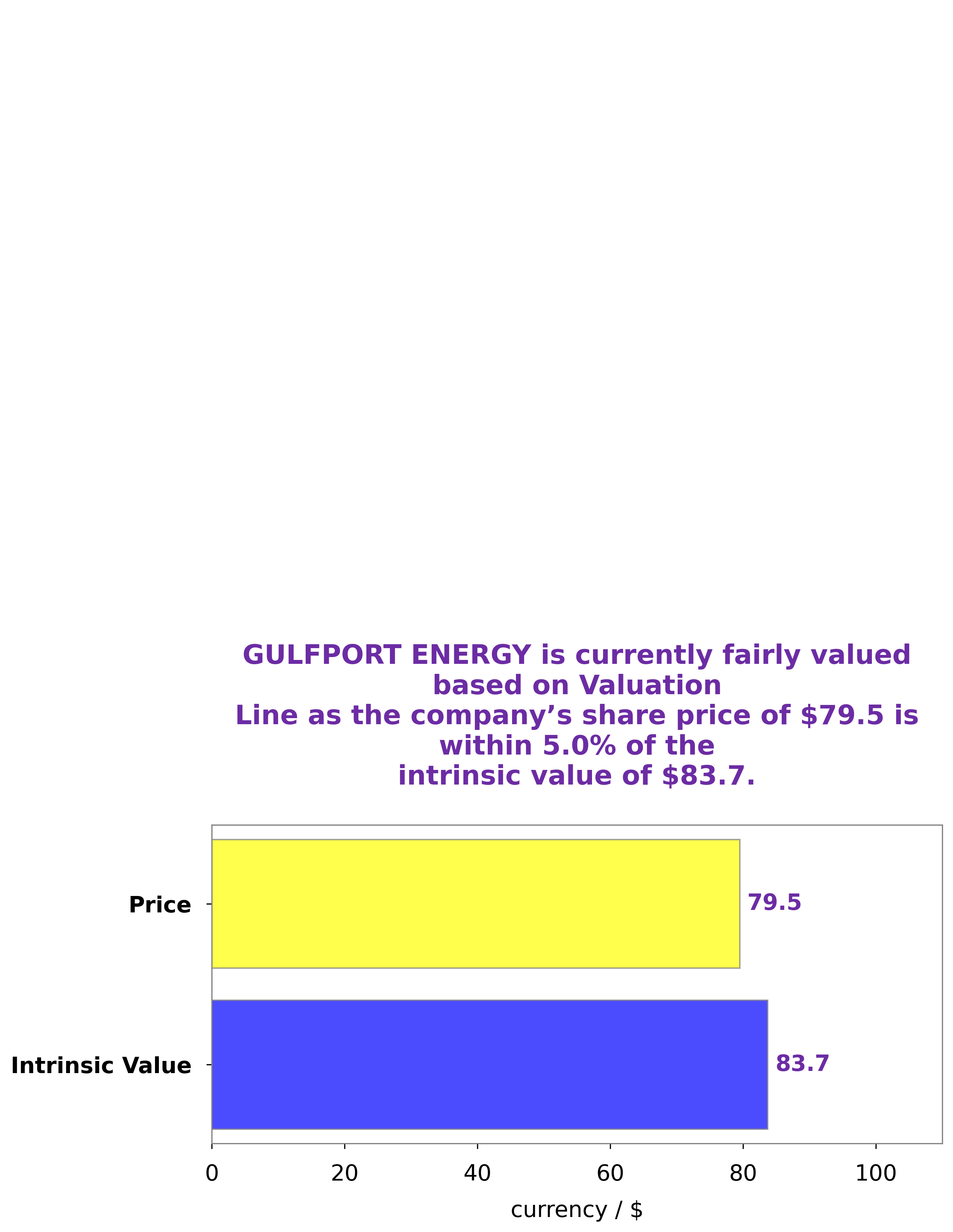

At GoodWhale, we analyzed the fundamentals of GULFPORT ENERGY and made a thorough analysis. Our proprietary Valuation Line indicated that the fair value of GULFPORT ENERGY share is around $83.7. However, the stock is currently traded at $79.5, which is a fair price but slightly undervalued by 5.0%. Therefore, it might be a good investment opportunity if investors are willing to take the risk. More…

Peers

Gulfport Energy Corp competes with a number of other companies, including Byron Energy Ltd, Kolibri Global Energy Inc, and Devin Energy Corp, all of which strive to be the top provider of energy-related services and products. As companies strive to increase their market share and customer base, the competition between Gulfport Energy Corp and its competitors has become fierce.

– Byron Energy Ltd ($ASX:BYE)

Byron Energy Ltd is an oil and gas exploration and production company. It has a market cap of 119.63M as of 2022 and a Return on Equity of 15.55%. The market capitalization of a company is an indicator of its size and reflects the total value of all its outstanding shares. A higher market cap typically indicates that the company has the confidence of investors and is making solid business decisions. The Return on Equity (ROE) measures the rate of return on the investment provided by shareholders. A higher ROE indicates that the company is successfully making use of investor funds and is performing effectively.

– Kolibri Global Energy Inc ($TSX:KEI)

Kolibri Global Energy Inc is an energy company that specializes in producing and distributing renewable energy sources such as solar, wind, and geothermal. The company has a market capitalization of 143.18M as of 2022, which is a reflection of the company’s financial strength and market performance. The company also boasts a Return on Equity (ROE) of 38.16%, which is a measure of the company’s profitability. This high rate of return indicates that investors are confident in the company’s ability to generate profits.

– Devin Energy Corp ($OTCPK:DVNGF)

Devin Energy Corp is an energy company based in Texas that specializes in the exploration and production of natural gas and oil. The company has a market cap of 6.55k as of 2022, which is relatively small compared to other energy companies. Despite its small size, Devin Energy Corp has managed to achieve a Return on Equity (ROE) of 2.58%, which is high compared to the industry average. This indicates that the company is using its equity efficiently and effectively to generate returns for its shareholders.

Summary

Gulfport Energy Corporation has tapped Michael Hodges as the company’s new Chief Financial Officer. Hodges brings a wealth of experience in the oil and gas sector to the role, having served in senior financial positions for companies such as Southwestern Energy Company, Anadarko Petroleum Corporation and Forest Oil Corporation. This appointment is seen as a positive step for Gulfport Energy, as investors look to Hodges to help the company maintain disciplined financial practices while growing its production and reserves. In particular, analysts anticipate strong financial strategies in capital allocation, cost control and overall performance.

Recent Posts