GlobalFoundries Surges on Strong 3Q Results, Outlook

November 9, 2022

Trending News ☀️

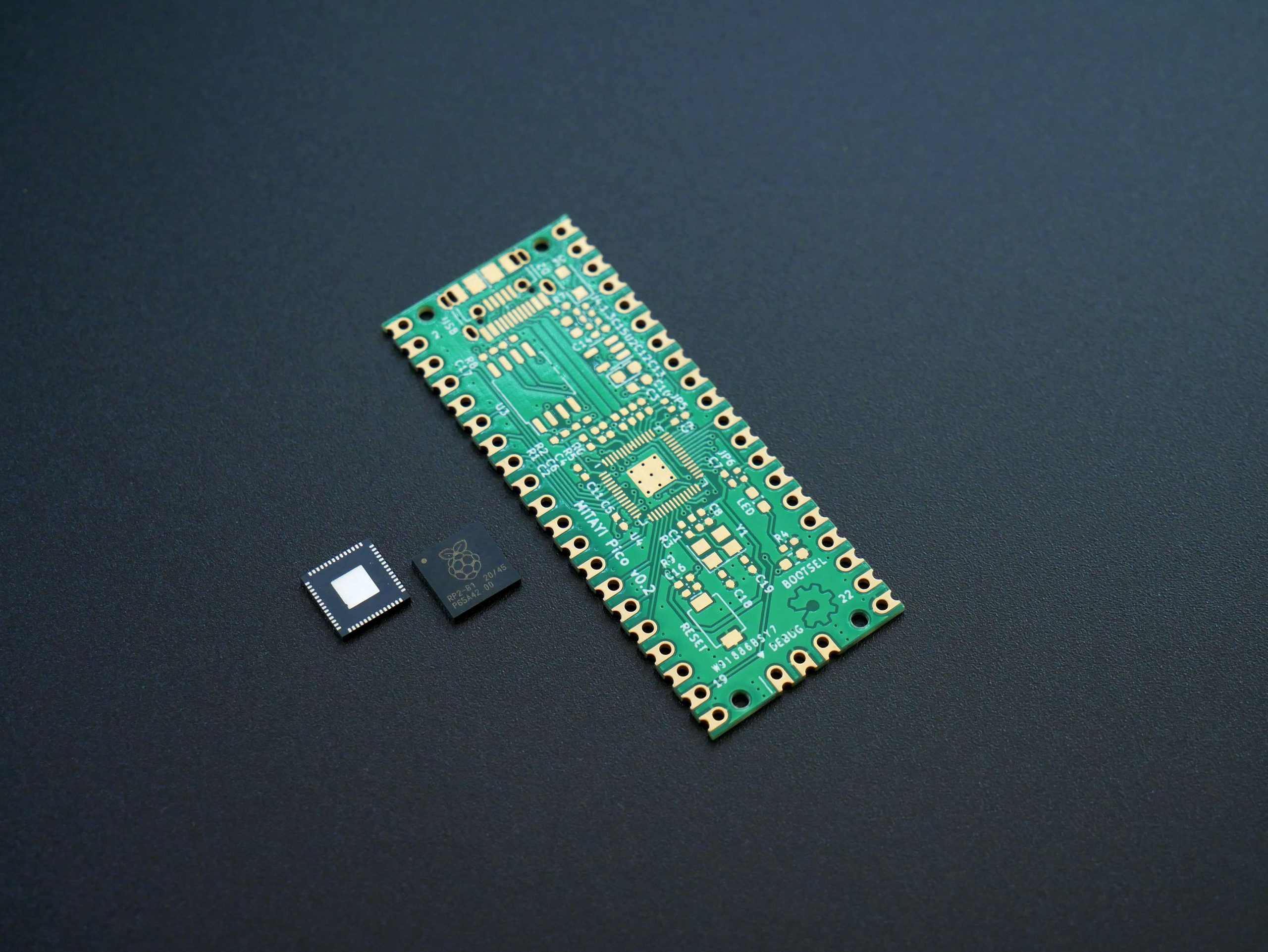

Globalfoundries Inc Intrinsic Value – GLOBALFOUNDRIES ($NASDAQ:GFS): GlobalFoundries Inc. is a American semiconductor company based in Santa Clara, California. The company is a leading provider of foundry services, which are used in the manufacture of semiconductor chips. This was up 22% year-over-year and beat analyst estimates. The company also issued a strong forecast for the fourth quarter.

GlobalFoundries has seen strong demand for its foundry services due to the continued growth of the semiconductor industry. The company is well-positioned to benefit from the continued demand for chips used in a variety of applications, including mobile devices, data centers, and automotive.

Earnings

GlobalFoundries Inc. has reported strong financial results for the second quarter of its fiscal year 2022. Total revenue for the quarter was $7480.1 million, up 13.6% from the same period last year. Net income was $491.7 million, down 296.4% from the previous year.

The company attributed the strong results to “continued progress in executing our business strategy.” Looking ahead, GlobalFoundries said it is “well positioned to capitalize on the growing demand for semiconductor manufacturing services.”

Price History

GLOBALFOUNDRIES INC surged on strong 3Q results, with the stock opening at $61.1 on Tuesday. The company’s share price has been on the rise since the announcement of its strong third-quarter results and outlook for the future. Media coverage has been mostly positive, with investors bullish on the company’s prospects.

VI Analysis – Globalfoundries Inc Intrinsic Value

The company’s fundamentals reflect its long-term potential, but the stock is currently overvalued by 6%. The company’s financials indicate that it is a strong company with a solid foundation, but the current stock price does not reflect this. The company has a strong balance sheet and a healthy cash flow, but the stock price does not reflect this.

The company is a leader in its industry, but the stock price does not reflect this. The company has a strong future, but the stock price does not reflect this.

VI Peers

With the technological advances in the semiconductor industry, the competition between foundries has become increasingly fierce. GLOBALFOUNDRIES Inc, a leading foundry company, has been locked in a battle with its competitors, Advanced Micro Devices Inc, Taiwan Semiconductor Manufacturing Co Ltd, and Intel Corp. In order to maintain its competitive edge, GLOBALFOUNDRIES has made significant investments in cutting-edge manufacturing technologies and has been aggressively expanding its production capacity.

– Advanced Micro Devices Inc ($NASDAQ:AMD)

Advanced Micro Devices, Inc. (AMD) is an American multinational semiconductor company based in Santa Clara, California, that develops computer processors and related technologies for business and consumer markets. AMD’s main products include microprocessors, motherboard chipsets, embedded processors and graphics processors for servers, workstations and personal computers, and embedded systems applications.

As of 2022, AMD has a market cap of $93.57 billion and a return on equity (ROE) of 4.13%. The company’s products are used in a variety of electronic devices, including personal computers, game consoles, and servers. AMD is a leading supplier of microprocessor technology for the PC market.

– Taiwan Semiconductor Manufacturing Co Ltd ($TWSE:2330)

Taiwan Semiconductor Manufacturing Co Ltd is a semiconductor foundry. The company has a market cap of 10.29T as of 2022 and a Return on Equity of 22.34%. Taiwan Semiconductor Manufacturing Co Ltd is the world’s largest dedicated semiconductor foundry and one of the largest fabless semiconductor companies. The company offers a comprehensive set of IC design enablement tools, libraries, IPs, design services, advanced packaging, test and yield optimization solutions to help customers accelerate time-to-market.

– Intel Corp ($NASDAQ:INTC)

Intel Corp. is an American multinational corporation and technology company headquartered in Santa Clara, California, in the Silicon Valley. It is the world’s largest and highest valued semiconductor chip manufacturer based on revenue and is the inventor of the x86 series of microprocessors, the processors found in most personal computers (PCs). Intel supplies processors for computer system manufacturers such as Apple, Lenovo, HP, and Dell. Intel also manufactures motherboard chipsets, network interface controllers and integrated circuits, flash memory, graphics chips, embedded processors and other devices related to communications and computing.

The company’s market cap is $108.48B as of 2022 and has a return on equity of 19.16%. Intel Corp is a technology company that designs and manufactures computer processors and other components. The company is headquartered in Santa Clara, California, in the Silicon Valley.

Summary

If you’re looking for a company with strong fundamentals and a bright future, then GLOBALFOUNDRIES Inc. is a great choice. The company reported strong 3Q results and issued an upbeat outlook, sending its stock price soaring. With a strong balance sheet and a commitment to innovation, GLOBALFOUNDRIES is well-positioned to continue growing and providing investors with healthy returns.

Recent Posts