Evertec Intrinsic Value Calculator – UBS Group AG Increases Holdings in EVERTEC, by 28.4% in 4th Quarter

June 3, 2023

🌥️Trending News

UBS Group AG recently announced an increase of 28.4% in their holdings of EVERTEC ($NYSE:EVTC), Inc. shares during the fourth quarter. EVERTEC is a leading full-service transaction processor in Latin America and the Caribbean, offering electronics payment processing services, merchant acquiring services, and other technology-driven services. With a strong presence in Puerto Rico, the United States, and Latin America and the Caribbean, EVERTEC is well-positioned to continue to be a leader in the region’s electronic payments industry. The increase in UBS Group AG’s holdings is likely to add significantly to the financial security of EVERTEC, and could attract similar investments from other major financial firms.

Analysis – Evertec Intrinsic Value Calculator

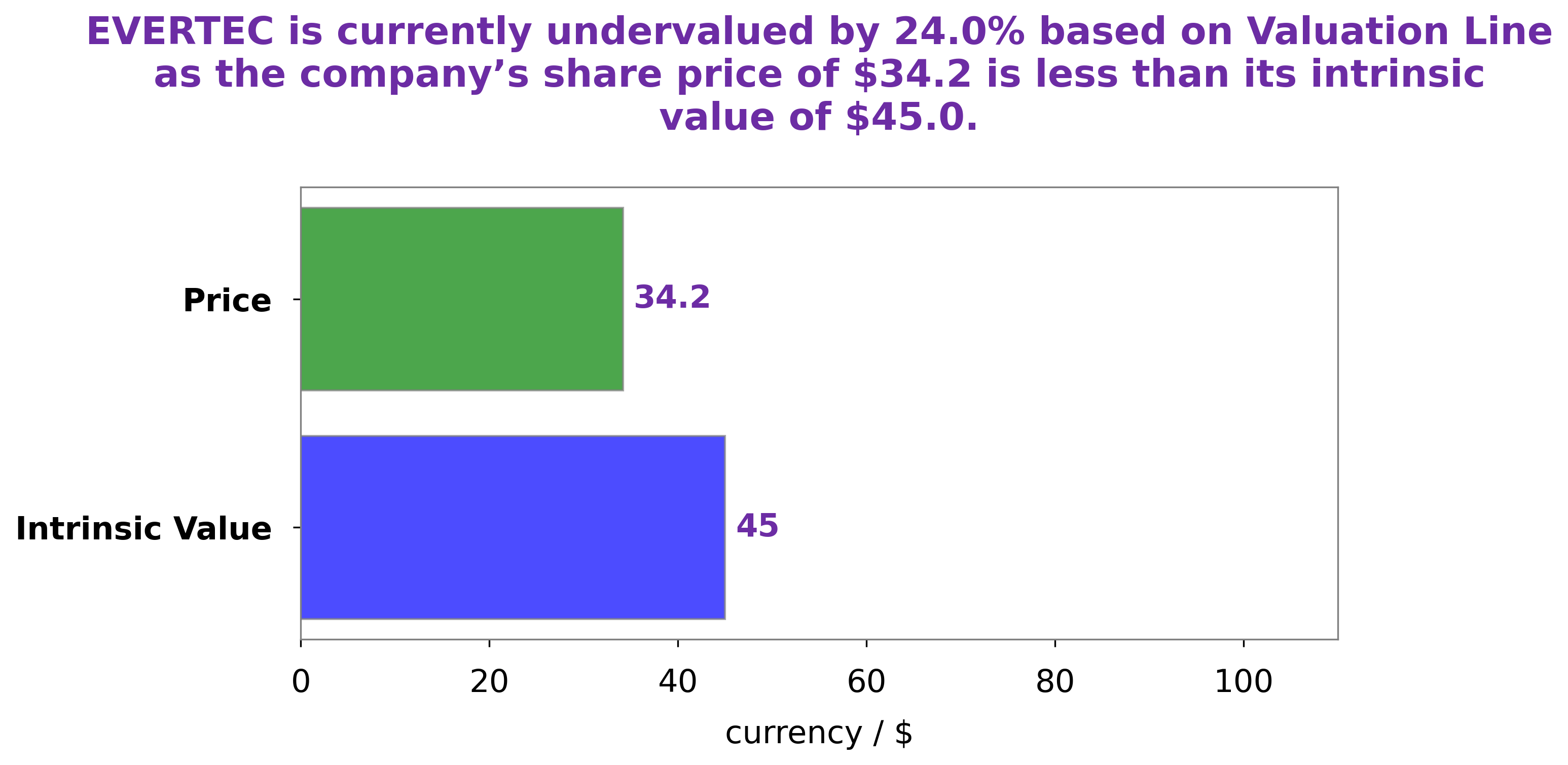

At GoodWhale, we recently conducted an evaluation of EVERTEC‘s fundamentals. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Evertec. EVERTEC_by_28.4_in_4th_Quarter”>More…

| Total Revenues | Net Income | Net Margin |

| 627.98 | 230.16 | 19.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Evertec. EVERTEC_by_28.4_in_4th_Quarter”>More…

| Operations | Investing | Financing |

| 207.52 | -155.67 | -161.18 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Evertec. EVERTEC_by_28.4_in_4th_Quarter”>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.14k | 626.05 | 7.8 |

Key Ratios Snapshot

Some of the financial key ratios for Evertec are shown below. EVERTEC_by_28.4_in_4th_Quarter”>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.6% | 2.7% | 44.7% |

| FCF Margin | ROE | ROA |

| 20.1% | 35.8% | 15.4% |

Peers

The company offers a wide range of products and services that enable businesses to accept and process electronic payments. Evertec Inc’s competitors include Euronet Worldwide Inc, EVO Payments Inc, and DLocal Ltd.

– Euronet Worldwide Inc ($NASDAQ:EEFT)

Euronet Worldwide is a leading global provider of electronic transaction processing solutions for the financial and retail industries. The company has a market cap of 4.5 billion and a return on equity of 18.5%. Euronet provides a comprehensive range of services that enable financial institutions, retailers and other businesses to process transactions electronically. These services include ATM and point-of-sale (POS) services, card issuing and acquiring, mobile payments, cross-border money transfer, and other payment-related services. Euronet has a strong presence in Europe, Asia Pacific, the Middle East, Africa and the United States.

– EVO Payments Inc ($NASDAQ:EVOP)

Evo Payments, Inc. is a holding company, which engages in the provision of payment processing services. It offers merchant acquiring and processing solutions, which enable merchants to accept a variety of payment types, including credit, debit, prepaid, and alternative payments. The company was founded in 1989 and is headquartered in Atlanta, GA.

– DLocal Ltd ($NASDAQ:DLO)

DLocal is a leading cross-border payments platform that enables businesses to make and receive payments in local currencies across Africa, Asia, Latin America, and the Middle East. The company has a market cap of 4.11B as of 2022 and a return on equity of 23.96%. DLocal is headquartered in London, UK.

Summary

This indicates that UBS is confident in the growth potential of the company and sees value in its stock. The investment may be a sign of further bullish sentiment for EVERTEC from other institutional investors, as well as a signal to potential individual investors looking to capitalize on strong returns. Analysts are likely to keep a close eye on the market performance of EVERTEC’s stock to determine if further investments will be made in the future.

Recent Posts