Dutch Bros Stock Fair Value – Dutch Bros: Winning the Coffee Game with Their Proven Strategy

April 13, 2023

Trending News ☀️

Dutch Bros ($NYSE:BROS) is a rapidly growing coffee company that has taken the world by storm. Their unique approach to the coffee game has won them many fans and customers, who love their signature drinks as well as their commitment to great customer service. To remain successful, Dutch Bros must adhere to the playbook that has made them successful in the first place: a focus on quality products, excellent customer service, and innovative marketing techniques. By following this playbook, Dutch Bros can continue to delight its customers and win over new ones. At the same time, Dutch Bros is committed to staying true to its core values of hard work, integrity, and respect.

This commitment shines through with their employees, who are treated like family and given the resources they need to excel. As a result of these strategies, Dutch Bros continues to remain on top of the coffee game. With a proven strategy that focuses on quality, customer service, and innovation, Dutch Bros is sure to remain a leader in the coffee industry for many years to come.

Share Price

Dutch Bros, the Oregon-born coffee company, recently experienced a dip in their stock price when on Wednesday it opened at $33.8 and closed at $32.5, down by 2.1% from the previous closing price of 33.2. Despite this small setback, Dutch Bros has established itself as a leader in the coffee game with its proven strategy and commitment to quality. With its signature drinks like the Freeze, Dutch Bros has managed to stay at the top of the coffee industry with a slew of unique offerings that bring something new to the table. Dutch Bros is continuing to prove its ability to stay ahead of the curve.

With its commitment to quality and customer service, the company is focused on continuing to provide the best experience for coffee lovers everywhere. The company’s success is a testament to its strategy and dedication to providing the best product possible. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Dutch Bros. More…

| Total Revenues | Net Income | Net Margin |

| 739.01 | -4.75 | -0.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Dutch Bros. More…

| Operations | Investing | Financing |

| 59.88 | -192.57 | 134.36 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Dutch Bros. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.19k | 934.38 | 2.23 |

Key Ratios Snapshot

Some of the financial key ratios for Dutch Bros are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 45.8% | – | 0.2% |

| FCF Margin | ROE | ROA |

| -17.3% | 0.7% | 0.1% |

Analysis – Dutch Bros Stock Fair Value

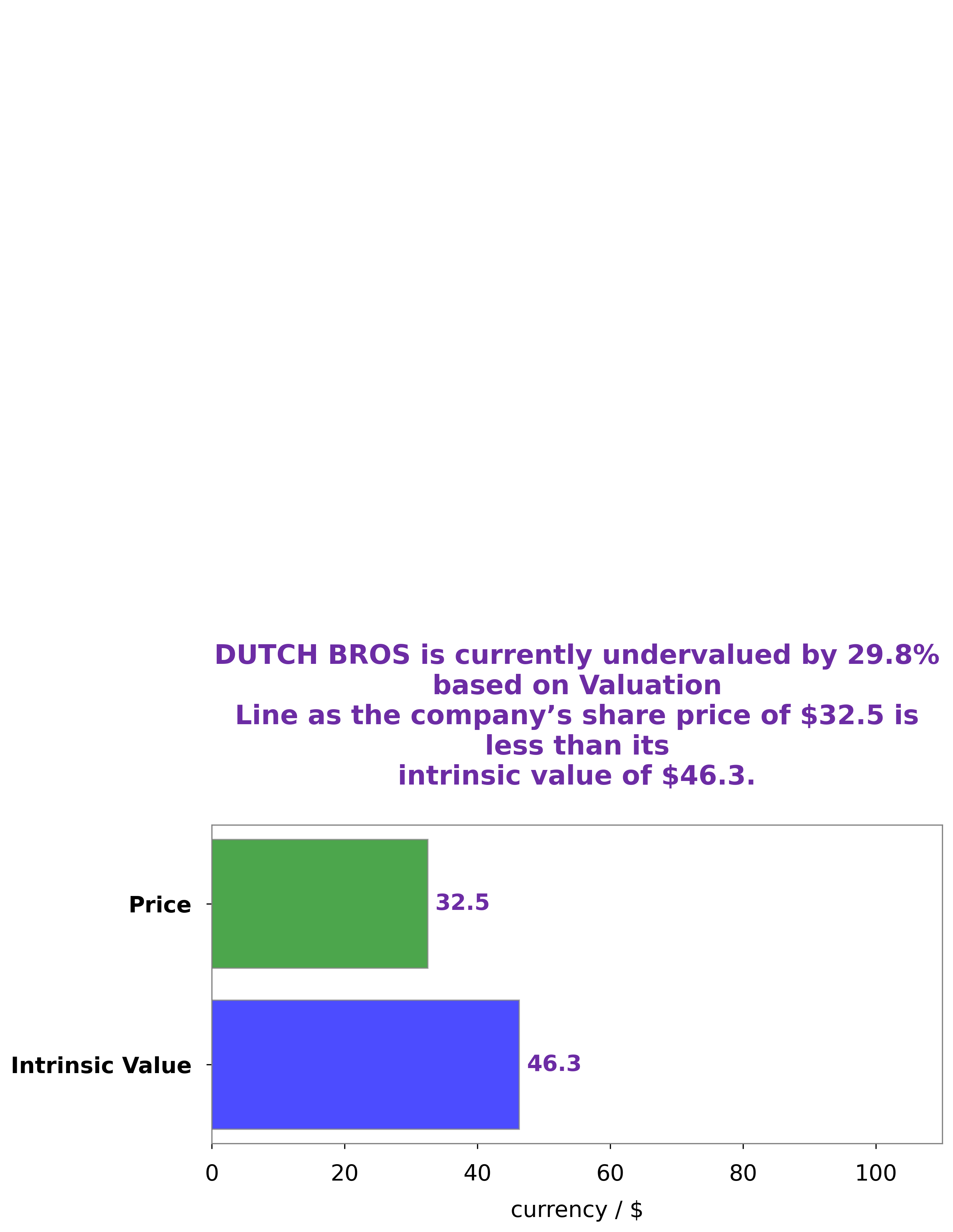

At GoodWhale, we recently conducted an extensive financial analysis of DUTCH BROS. After extensive research, we have determined that the fair value of DUTCH BROS share is around $46.3, calculated by our proprietary Valuation Line. However, the current market price of DUTCH BROS stock is $32.5, representing a 29.8% discount to our estimate of fair value. This discount suggests that the stock is currently undervalued and could provide investors with an attractive buying opportunity. More…

Peers

If you’re in the mood for a delicious milkshake, you may be wondering where to go. Two popular options are Dutch Bros Inc and Shake Shack Inc. Both companies offer a variety of flavors and toppings to choose from.

However, Shake Shack is often pricier than Dutch Bros. Another option is Williston Holding Co, which offers a wider range of food items, including milkshakes. Finally, Doutor Nichires Holdings Co Ltd is a popular choice in Japan for those looking for a delicious milkshake.

– Shake Shack Inc ($NYSE:SHAK)

Founded in 2004, Shake Shack is a modern day “roadside” burger stand serving a classic American menu of burgers, hot dogs, shakes, and more. The company has grown to operate over 200 locations across the globe, including in the United States, United Kingdom, Turkey, Russia, and more. Despite its impressive growth, Shake Shack’s market cap is a relatively modest 1.87 billion as of 2022. This is likely due to the company’s negative return on equity (-3.84%) which indicates that it is not generating enough profit to cover the cost of its equity.

– Williston Holding Co ($OTCPK:WHCA)

Williston Holding Co is a publicly traded company with a market capitalization of 401.76k as of 2022. The company has a return on equity of 7.94%. Williston Holding Co is engaged in the business of oil and gas exploration, production, and development in the Williston Basin in the United States.

– Doutor Nichires Holdings Co Ltd ($TSE:3087)

Doutor Nichires Holdings Co Ltd is a Japanese company that operates in the food and beverage industry. The company has a market capitalization of 72.96 billion as of 2022 and a return on equity of 2.52%. The company’s main operations consist of the production and sale of coffee, tea, and other beverages. The company also operates a chain of coffee shops called Doutor Coffee.

Summary

Analysis of Dutch Bros as an investment focuses on the potential future of the company. Factors such as the current size and scope of the company, its track record of success, the impact of its products and services in the marketplace, and the company’s financial health are all considered.

Additionally, investors will look at the company’s management team and their ability to implement a playbook to achieve success. Due to its growth trajectory, Dutch Bros has been identified as a potential investment opportunity for those interested in a more dynamic return on their capital. As such, the company’s financial stability, strategic positioning, and competitive advantage are all required for successful investment. The future growth of Dutch Bros will require careful planning and assessment, and investors should be comfortable with their risks when considering this company as a viable investment.

Recent Posts