CTOS Intrinsic Value – Oppenheimer Reiterates Outperform Rating for Custom Truck One Source on May 15, 2023.

May 20, 2023

Trending News 🌥️

On May 15, 2023, Oppenheimer reaffirmed their Outperform rating on Custom Truck One ($NYSE:CTOS) Source (CTOS) according to Fintel. CTOS is a leading provider of comprehensive trucking solutions and services to the heavy-duty trucking industry. CTOS has been able to build a strong reputation in the heavy-duty trucking industry for delivering the best customer service and highest quality products with a focus on safety and environmental responsibility. The company is dedicated to providing innovative solutions and exceptional customer service, which has contributed to its strong financial position and its continued success in the industry.

Price History

On Tuesday, May 15th, 2023, Oppenheimer reiterated its Outperform rating for Custom Truck One Source, following the stock’s opening at a price of $6.4 and closing at $6.4, a 1.7% drop from its previous closing price of $6.5. Despite this decrease, analysts at Oppenheimer remain confident in Custom Truck One Source’s potential and believe the company’s stock price will continue to outperform in the long-term. Oppenheimer has noted Custom Truck One Source’s strong competitive strengths, as well as its strategic approach to operational excellence and cost-effectiveness, as key reasons for their optimism. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for CTOS. More…

| Total Revenues | Net Income | Net Margin |

| 1.66k | 55.98 | 4.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for CTOS. More…

| Operations | Investing | Financing |

| 79.64 | -210.43 | 141.61 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for CTOS. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.07k | 2.16k | 3.64 |

Key Ratios Snapshot

Some of the financial key ratios for CTOS are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 68.7% | 44.6% | 9.7% |

| FCF Margin | ROE | ROA |

| -20.0% | 11.2% | 3.3% |

Analysis – CTOS Intrinsic Value

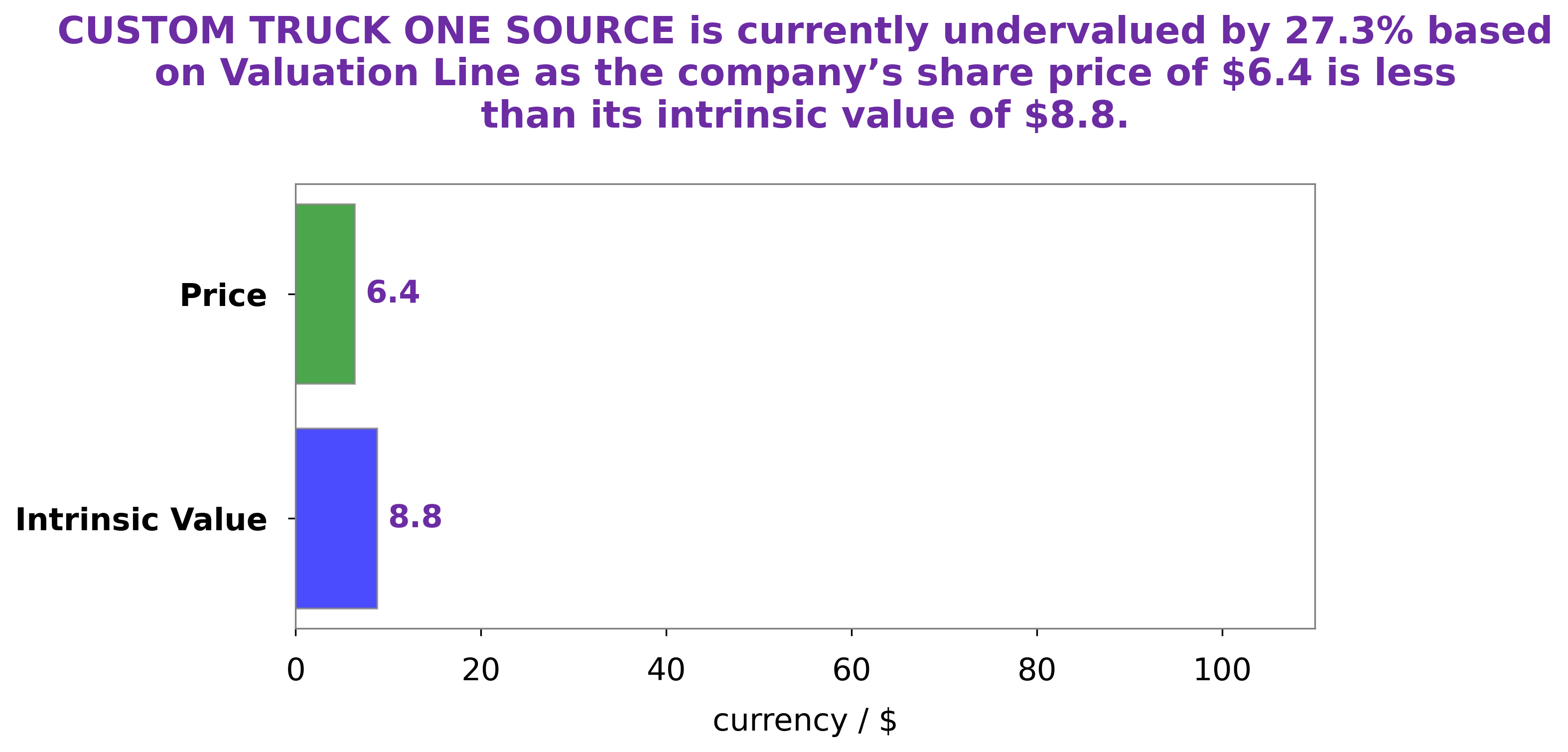

GoodWhale has conducted an evaluation of CUSTOM TRUCK ONE SOURCE’s fundamentals and derived a fair value of $8.8 per share. Our proprietary Valuation Line was used to calculate this figure. Currently, CUSTOM TRUCK ONE SOURCE shares are trading at $6.4, representing a 27.6% discount to fair value. This presents an opportunity for investors to purchase an undervalued stock. More…

Peers

The company has a strong competitive position in the market, with a wide range of products and services. Custom Truck One Source Inc is a publicly traded company on the New York Stock Exchange under the ticker symbol CUST.

– H&E Equipment Services Inc ($NASDAQ:HEES)

H&E Equipment Services is a leading provider of equipment services and solutions for a wide range of industries, including construction, mining, oil and gas, government, and power generation. The company has a market cap of 1.49B as of 2022 and a return on equity of 35.46%. H&E Equipment Services provides a wide range of services, including equipment rental, sales, and maintenance, to its customers. The company has a strong focus on customer service and provides a wide range of support services to its customers.

– Babylon Pump & Power Ltd ($ASX:BPP)

Babylon Pump & Power Ltd is a market leader in providing pump and power solutions. The company has a strong focus on customer service and providing high quality products. The company has a market capitalization of 12.29M as of 2022 and a return on equity of -43.24%. The company’s products are used in a wide range of industries, including mining, construction, agriculture, and manufacturing.

– Triton International Ltd ($NYSE:TRTN)

Triton International Ltd is a leading provider of containers and related services. The company has a market cap of 3.83B as of 2022 and a return on equity of 15.89%. Triton International Ltd is a publicly traded company listed on the New York Stock Exchange. The company was founded in 2006 and is headquartered in Hamilton, Bermuda. Triton International Ltd is a leading provider of intermodal transportation equipment and services with a focus on container leasing and sales, depot services, container trucking, and related logistics services.

Summary

Custom Truck One Source is a company that provides new and used heavy-duty trucks, equipment and parts. Oppenheimer recently reiterated their Outperform rating for the company, indicating that it is a good investment. Analysts believe that Custom Truck One Source is well-positioned to continue to grow and provide strong returns for investors. The company has established a strong base of customers and dealers, giving them a competitive edge in the marketplace.

Furthermore, the company has made significant investments in technology and innovation, to provide better service and products for their customers. Overall, Custom Truck One Source is an attractive investment that has potential to generate strong returns for investors over the long term.

Recent Posts