Consol Energy Intrinsic Stock Value – value.

April 11, 2023

Trending News ☀️

CONSOL ($NYSE:CEIX) Energy Inc. is a leading integrated energy company engaged in coal, natural gas, and oil production and power generation. On Thursday, April 06, the company’s stock value fell by 1.31% due to a data-driven analysis conducted by investors that led to a decrease in its value. The data-driven analysis highlighted the differences between CONSOL Energy’s performance and that of its peers in the energy sector. Investors noted that although the company has a strong presence in all three energy sources, its reliance on coal was seen as a weakness when compared to other companies in the industry. This, coupled with rising global demand for natural gas and oil, has caused investors to consider other options.

Additionally, investors highlighted the fact that the company’s stock has not been performing as strongly as its peers in recent months. This, combined with the data-driven analysis, has caused investors to lose confidence in CONSOL Energy and its future prospects. In particular, the company’s lack of diversification in its portfolio and its reliance on coal for revenue have led to further concern. All in all, CONSOL Energy Inc. lost ground following a data-driven analysis which caused its stock value to decrease. The company’s reliance on coal and lack of diversification were two key points highlighted in the analysis that led to investors losing confidence in the stock. Moving forward, it will be important for CONSOL Energy to address these issues and focus on diversification if it hopes to regain investor confidence and boost its stock value.

Price History

On Monday, CONSOL Energy Inc. lost ground after a data-driven analysis suggested that the stock may not be a wise investment. The stock opened at $59.7 and closed at $59.6, representing a 0.6% increase from its previous closing price of 59.3. The drop in share value is due to a few analysts and market watchers expressing their hesitancy in investing in CONSOL Energy Inc., citing a lack of long-term value. While it may be true that the stock may be volatile in the short term, the company has long-term potential investments that could benefit its shareholders over the long run. With its diverse portfolio of natural gas and coal operations, the company is well positioned to capitalize on growth opportunities across multiple industries.

For now, it may be wise for investors to cautiously monitor CONSOL Energy Inc.’s performance as it moves forward. While the data-driven analysis may have caused a stir in the markets, it is important to remember that the company still has many potential opportunities to create value for shareholders. It is up to investors to decide whether or not they wish to take the risk of investing in CONSOL Energy Inc., but they should take the time to research and understand the potential opportunities before making a decision. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Consol Energy. More…

| Total Revenues | Net Income | Net Margin |

| 2.28k | 466.98 | 28.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Consol Energy. More…

| Operations | Investing | Financing |

| 650.99 | -142.18 | -380.07 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Consol Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.7k | 1.54k | 33.55 |

Key Ratios Snapshot

Some of the financial key ratios for Consol Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 18.3% | 77.6% | 27.2% |

| FCF Margin | ROE | ROA |

| 21.0% | 37.3% | 14.4% |

Analysis – Consol Energy Intrinsic Stock Value

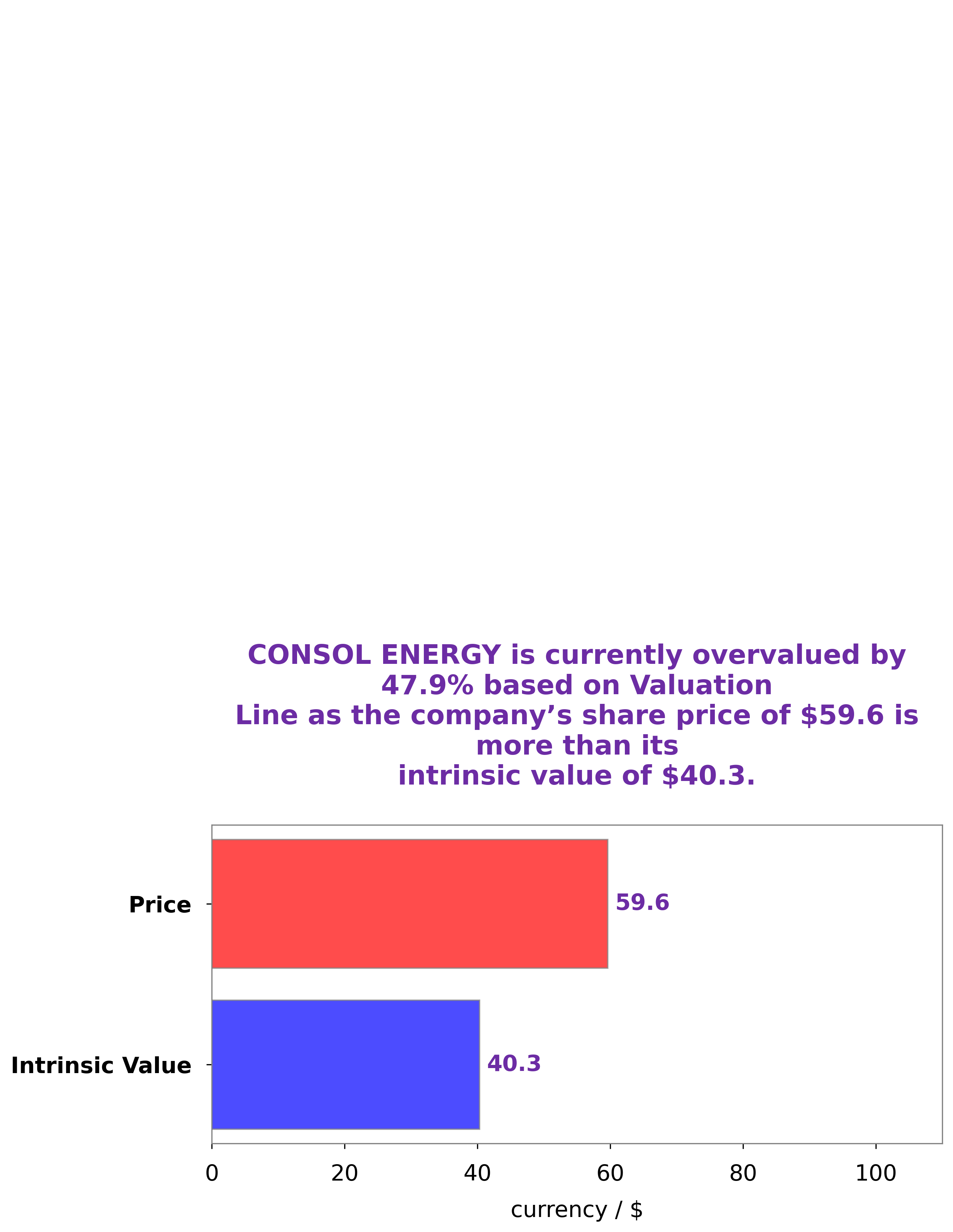

GoodWhale has conducted an analysis of CONSOL ENERGY‘s finances, and according to our proprietary Valuation Line, the fair value of CONSOL ENERGY share is around $40.3. At the time of writing, CONSOL ENERGY stock is traded at $59.6, which is significantly overvalued by 47.9%. This presents a potential buying opportunity for savvy investors who are willing to take advantage of the current discrepancy between market price and fair value. More…

Peers

The company’s competitors include PT Prima Andalan Mandiri Tbk, NACCO Industries Inc, and PT Delta Dunia Makmur Tbk.

– PT Prima Andalan Mandiri Tbk ($IDX:MCOL)

In 2022, PT Prima Andalan Mandiri Tbk had a market capitalization of 25.6 trillion rupiah and a return on equity of 66.4%. The company is a leading Indonesian provider of integrated logistics solutions. It offers a wide range of services, including transportation, warehousing, and distribution. The company has a strong focus on customer service and has a reputation for reliability and efficiency.

– NACCO Industries Inc ($NYSE:NC)

NACCO Industries, Inc. is a holding company, which engages in the mining, and consumer and industrial products businesses. It operates through the following segments: Mining, Consumer Products, and Industrial Products. The Mining segment comprises of coal mining operations. The Consumer Products segment consists of small appliances, specialty housewares, and gourmet cookware. The Industrial Products segment covers material handling products and other industrial equipment. The company was founded by Sherman Conger in 1919 and is headquartered in Cleveland, OH.

– PT Delta Dunia Makmur Tbk ($IDX:DOID)

Delta Dunia Makmur Tbk has a market cap of 3.18T as of 2022, a Return on Equity of 26.49%. The company is a leading provider of coal mining services in Indonesia. It is the largest producer of thermal coal in Indonesia and supplies coal to power plants and industrial customers in Indonesia and abroad.

Summary

Investors should keep an eye on CONSOL Energy Inc., as its stock price has fallen 1.31% below its previous day’s close. This is an indication of a downside momentum, meaning buyers are less likely to invest in the company. Investors should analyze the market trend, current events, and financials of CONSOL Energy before investing in order to reduce risk and maximize returns. Fundamental analysis should include reviewing financial statements, researching the industry, assessing management, and considering the risks.

Investors should also consider the company’s long-term strategy, such as potential for organic growth and innovation. Finally, investors should be aware of their own risk tolerance when making any investment decisions.

Recent Posts