Commercial Metals Stock Intrinsic Value – Commercial Metals Co. Breaks Above 200-Day Moving Average, Signaling Bullish Market Outlook for CMC

June 9, 2023

🌥️Trending News

On Wednesday, shares of Commercial Metals ($NYSE:CMC) Co. (CMC) crossed a significant milestone, surpassing their 200 day moving average of $46.69. This is seen as a bullish sign for CMC, with the stock trading as high as ___, and signaling a brighter outlook for the company. Commercial Metals Co. is a global leader in the metals industry with operations and investments in numerous countries around the world. Their core businesses consist of manufacturing, recycling, and marketing of steel, aluminum, and other metal-related products and services. The company has a strong presence in the U.S., Europe, and Asia, and their products are used in a variety of applications, including construction, automotive, consumer electronics, aerospace, and more. The stock’s break above its 200 day moving average is a positive sign for CMC and a potential indicator of future growth. Analysts expect that the company will benefit from strong commodity prices and an uptick in demand for its products from industrial customers.

Additionally, CMC’s electronic recycling operations are expected to drive further growth in the coming years. Overall, CMC’s break above its 200 day moving average is seen as a bullish market signal for the company and its stock. Investors are hopeful that this move will be reflective of improved performance in the future and lead to increased returns for shareholders.

Market Price

On Thursday, Commercial Metals Co. (CMC) broke above the 200-day moving average, closing at $47.0. This is 0.1% lower than the prior closing price of $47.0. Although the stock saw a small drop in its value on Thursday, its break above the 200-day moving average is a positive sign for the company’s long-term growth. Analysts have noted that when stocks break above such a key metric, it often indicates a stock is in an upward trend and will continue to grow in the coming weeks and months.

As such, investors may wish to consider adding CMC to their portfolios in order to take advantage of this trend. With a consistent record of breaking above key benchmarks, CMC has proven to be an attractive option for those looking to benefit from stocks that are likely to continue to rise. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Commercial Metals. More…

| Total Revenues | Net Income | Net Margin |

| 9.17k | 1.04k | 11.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Commercial Metals. More…

| Operations | Investing | Financing |

| 1.2k | -1.16k | -442.77 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Commercial Metals. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.48k | 2.7k | 32.28 |

Key Ratios Snapshot

Some of the financial key ratios for Commercial Metals are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.0% | 42.3% | 14.9% |

| FCF Margin | ROE | ROA |

| 7.2% | 23.2% | 13.2% |

Analysis – Commercial Metals Stock Intrinsic Value

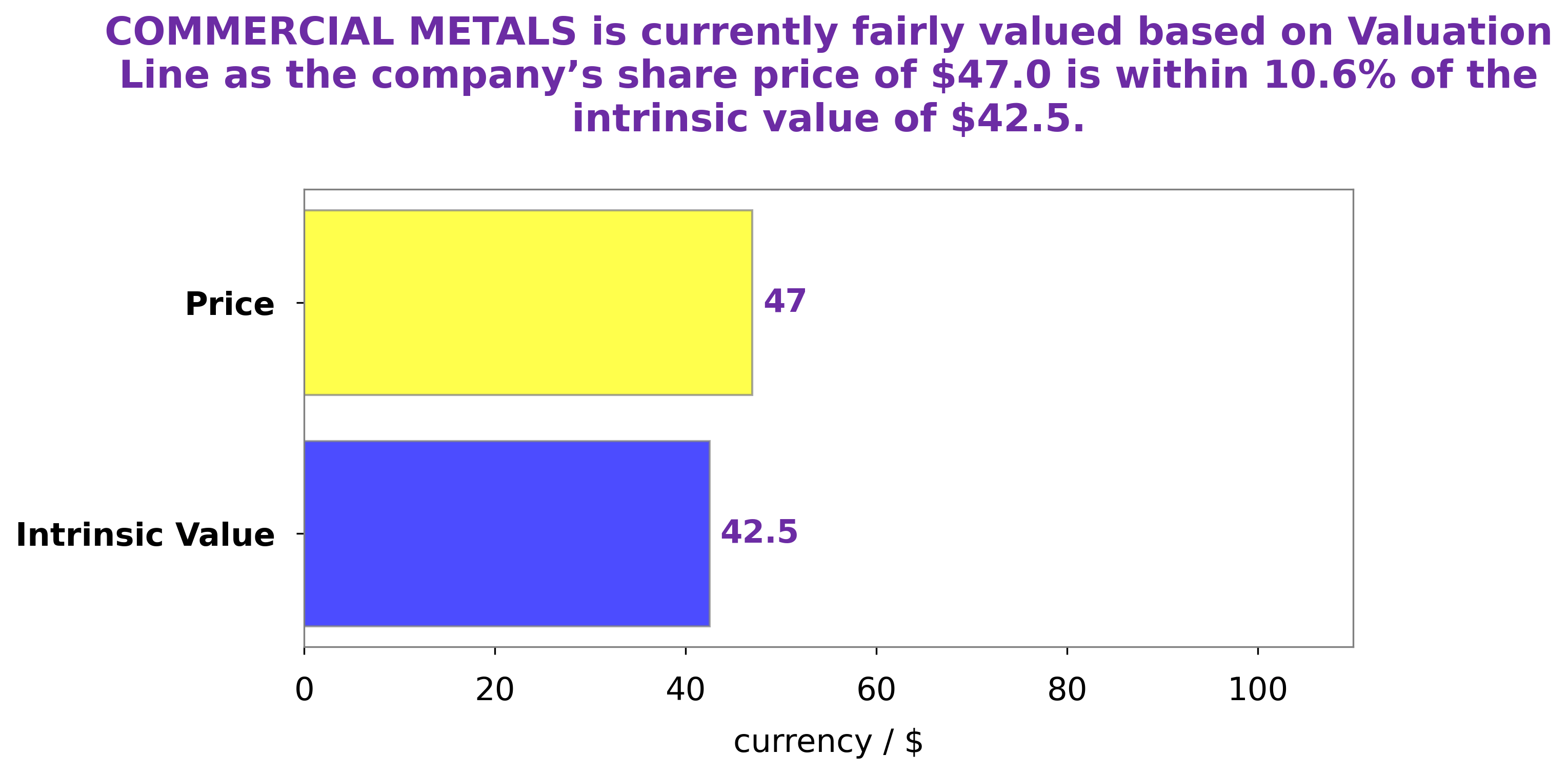

At GoodWhale, we’ve taken a look at COMMERCIAL METALS‘s fundamentals and we’ve found that the intrinsic value of their share is around $42.5, which we’ve calculated using our proprietary Valuation Line. This implies that the current price of $47.0 is overvalued by 10.5%. So, for those looking to invest in COMMERCIAL METALS, it’s worth doing your own research to determine if the stock is still worth investing in at this level. More…

Peers

Commercial Metals Co is one of the world’s largest producers and marketers of steel and metal products. The company operates in more than 30 countries and serves a wide range of industries, including construction, transportation, energy, and manufacturing. Commercial Metals Co’s competitors include KG Dongbusteel, Steel Dynamics Inc, Yieh Phui Enterprise Co Ltd, and a number of other large steel and metal producers.

– KG Dongbusteel ($KOSE:016380)

Dongbu Steel is a South Korean steel company. It was founded in 1954 and is headquartered in Seoul. The company has four business units: steel, trading, engineering, and construction. Dongbu Steel is one of the largest steel companies in South Korea, with an annual production capacity of 5 million tons of crude steel. The company supplies steel to major Korean conglomerates such as Hyundai, POSCO, and LG. In addition to its domestic market, Dongbu Steel exports to over 60 countries around the world.

– Steel Dynamics Inc ($NASDAQ:STLD)

Steel Dynamics Inc is an American steel manufacturer. The company produces steel and steel products, including hot and cold rolled, coated, and painted steel products. The company has a market cap of 16.97B as of 2022 and a Return on Equity of 50.1%. Steel Dynamics is one of the largest steel manufacturers in the United States.

– Yieh Phui Enterprise Co Ltd ($TWSE:2023)

Yieh Phui Enterprise Co Ltd is a Taiwanese company that manufactures and sells steel products. The company has a market cap of 28.19B as of 2022 and a Return on Equity of 13.27%. The company’s products include hot and cold rolled steel, steel plates, steel pipes, and more.

Summary

Commercial Metals Company (CMC) shares recently crossed above its 200-day moving average, a typically bullish indicator for investors. This could signal that the stock is ready to move higher in the near-term as long-term investors become more willing to buy the stock. For traders, this could present a buying opportunity as short-term upside potential remains strong.

With strong fundamentals and a diverse product portfolio, CMC could be a smart addition to any portfolio. Investors should do their own due diligence and research on the company before investing.

Recent Posts