CHH Stock Intrinsic Value – Earn Big Rewards with the Choice Privileges Select Mastercard from Choice Hotels International – USA TODAY Blueprint Review

June 12, 2023

☀️Trending News

They are now offering their guests the opportunity to make their stay even more rewarding with the Choice Privileges Select Mastercard from Choice Hotels International ($NYSE:CHH). USA TODAY has recently reviewed this card and found it to be an excellent way for those who frequent Choice Hotels to get bigger rewards for their loyalty. This provides cardholders with a great opportunity to get more rewards for staying at Choice Hotels locations. This can provide customers with a great opportunity to save money while still being rewarded for their loyalty to Choice Hotels International.

Share Price

On Tuesday, the stock of CHOICE HOTELS INTERNATIONAL opened at $113.5 and closed at $116.7, up by 2.7% from prior closing price of $113.6. The Choice Privileges Select Mastercard comes with multiple benefits, including an array of travel rewards that can be used on stays at Choice Hotels. These points can then be redeemed for free nights, airline miles, gift cards, and more. The publication praises the card for its low APR and generous rewards program.

Furthermore, it is an ideal choice for travelers who are looking to maximize their rewards while minimizing their costs. With its low APR and generous rewards, it is one of the best travel credit cards available. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for CHH. More…

| Total Revenues | Net Income | Net Margin |

| 1.48k | 315.75 | 20.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for CHH. More…

| Operations | Investing | Financing |

| 315.17 | -449.43 | -360.92 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for CHH. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.11k | 2.06k | 0.92 |

Key Ratios Snapshot

Some of the financial key ratios for CHH are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.8% | 10.7% | 31.3% |

| FCF Margin | ROE | ROA |

| 15.5% | 287.0% | 13.7% |

Analysis – CHH Stock Intrinsic Value

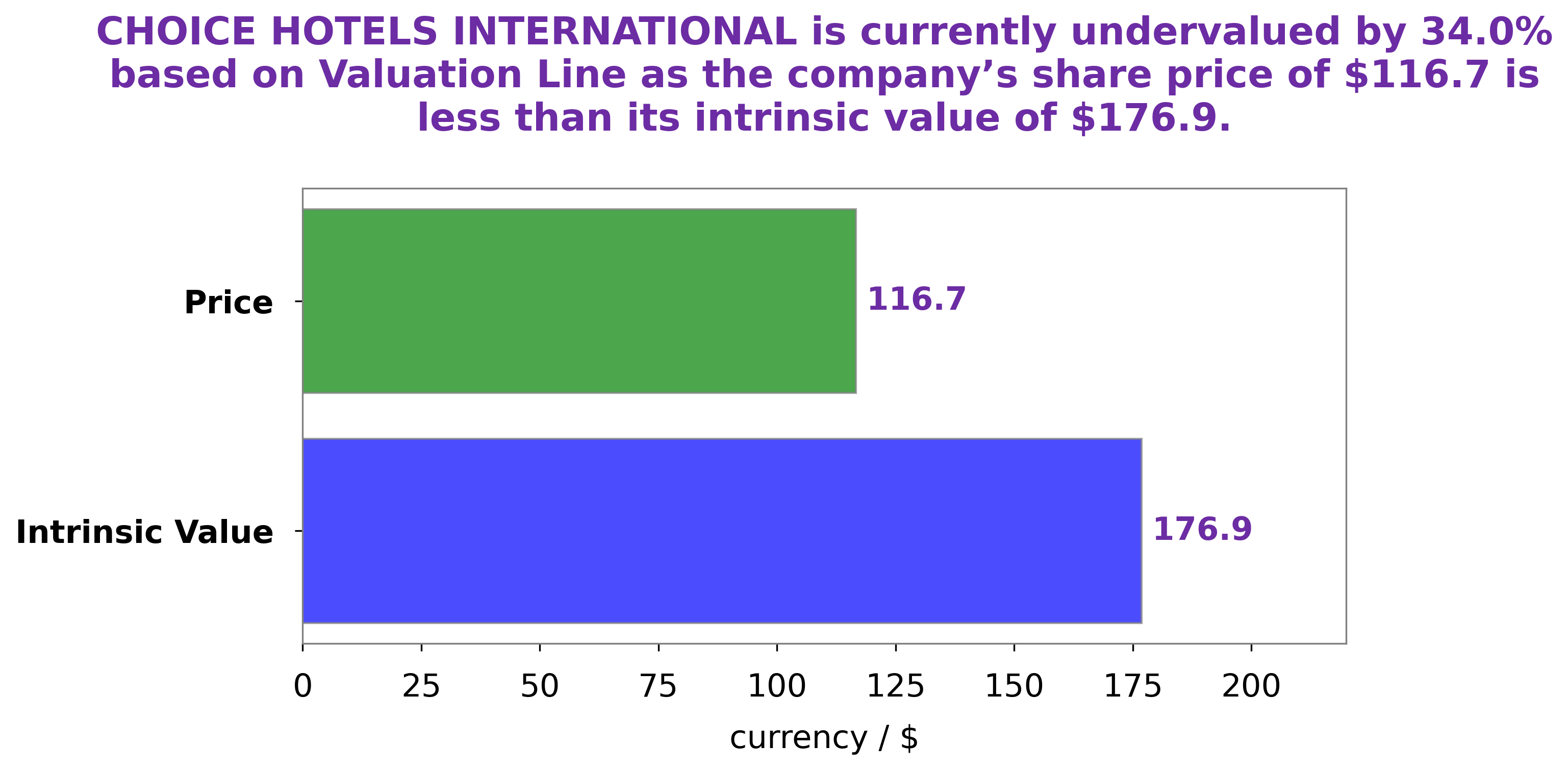

At GoodWhale, we have conducted an analysis of CHOICE HOTELS INTERNATIONAL’s financials and found that the fair value of their share is around $176.9. This was determined through our proprietary Valuation Line. Currently, CHOICE HOTELS INTERNATIONAL stock is trading at $116.7, making it undervalued by 34.0%. This presents investors with a great opportunity to pick up shares at a discounted price. We believe that with proper financial management, CHOICE HOTELS INTERNATIONAL can be a rewarding investment for shareholders. More…

Peers

Choice Hotels International, Inc. is one of the world’s largest hotel companies. With over 6,300 hotels across more than 35 countries and territories, Choice Hotels International offers a wide variety of lodging options to suit any need. Wyndham Hotels & Resorts, Hilton Worldwide Holdings, and Marriott International are all major competitors in the hotel industry.

– Wyndham Hotels & Resorts Inc ($NYSE:WH)

Wyndham Hotels & Resorts Inc is one of the largest hotel companies in the world, with over 7,500 hotels across more than 80 countries. The company offers a wide range of hotel brands, from economy to luxury, and its portfolio includes some of the most well-known hotel brands in the world, such as Wyndham, Ramada, Days Inn, and Super 8. Wyndham Hotels & Resorts is headquartered in Parsippany, New Jersey.

The company’s market cap is 6.2B as of 2022 and its ROE is 30.65%.

– Hilton Worldwide Holdings Inc ($NYSE:HLT)

Hilton Worldwide Holdings Inc. is a hospitality company that owns, leases, manages, develops, and franchises hotels and resorts. The company operates in three segments: Owned and Leased Hotels, Management and Franchise, and Timeshare. As of December 31, 2020, it owned, leased, or managed 2,084 properties with 883,944 rooms. Hilton Worldwide Holdings Inc. was founded in 1919 and is headquartered in McLean, Virginia.

– Marriott International Inc ($NASDAQ:MAR)

Marriott International is one of the world’s largest hotel companies, with more than 6,000 properties in over 120 countries and territories. Marriott operates and franchises hotels and timeshare properties under 30 brands, including Marriott, Ritz-Carlton, Sheraton, and Westin. The company also has a vacation ownership division, Marriott Vacations Worldwide. Marriott was founded in 1927 by J. Willard Marriott and Frank J. Taylor.

Summary

Choice Hotels International is an attractive investment choice for investors seeking long-term growth. Its financials boast strong operating cash flow, solid return on equity, and expanding margins, indicating steady and consistent growth potential. Furthermore, the company has a diversified portfolio of brands, and strong relationships with leading loyalty programs and corporate accounts. Overall, Choice Hotels International is an ideal option for those looking for a reliable and profitable long-term investment.

Recent Posts