Charge Enterprises Intrinsic Value Calculation – stock’s value to $6.31

April 14, 2023

Trending News ☀️

Charge Enterprises ($NASDAQ:CRGE) Inc., a technology and fabrication company based in South Carolina, has seen its stock price jump to 6.31% on Thursday, April 06. This is a significant increase from the previous day’s closing price, and could point to a potential uptick in market demand for the company’s products and services. As such, investors should remain vigilant and act cautiously when considering any potential investments in the company. The sudden increase in stock value may be attributed to increased activity in the market, as well as the company’s recent financial results. This strong performance is expected to continue, as the company recently announced plans to expand its production capabilities and hire additional personnel. The company is also looking to capitalize on new opportunities in the emerging tech space. Charge Enterprises Inc. has recently acquired several new patents and is investing heavily in product development to stay competitive in an ever-changing market. This could lead to further stock appreciation in the future.

However, investors should be aware that volatility can quickly reverse course and cause stock prices to crash. Therefore, it would be wise to keep an eye on the company’s performance and use caution when making any decisions regarding investments in Charge Enterprises Inc.’s stock.

Share Price

In a volatile market, Charge Enterprises Inc. has seen its stock reach a closing price of 6.31 on Monday. This marks a 1.9% increase from the prior closing price of 1.1, bringing the stock to its highest level in months. Despite the recent surge, investors are urged to remain cautious as the stock remains susceptible to fluctuations in the market. Investors looking to capitalize on the recent movement may be wise to exercise caution and consider their options carefully.

The market is unpredictable and any investment should be made with a plan in place for both the short and long term. Given the current state of the market, investors should take a close look at the stock’s performance in order to accurately predict its future value. While the stock may appear to be an attractive investment opportunity, there is no guarantee that it will remain at its current value in the coming days or weeks. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Charge Enterprises. More…

| Total Revenues | Net Income | Net Margin |

| 697.83 | -68.39 | -7.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Charge Enterprises. More…

| Operations | Investing | Financing |

| -11.37 | -2.01 | 22.99 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Charge Enterprises. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 168.45 | 127.63 | 0.2 |

Key Ratios Snapshot

Some of the financial key ratios for Charge Enterprises are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -2.6% |

| FCF Margin | ROE | ROA |

| -1.7% | -26.2% | -6.7% |

Analysis – Charge Enterprises Intrinsic Value Calculation

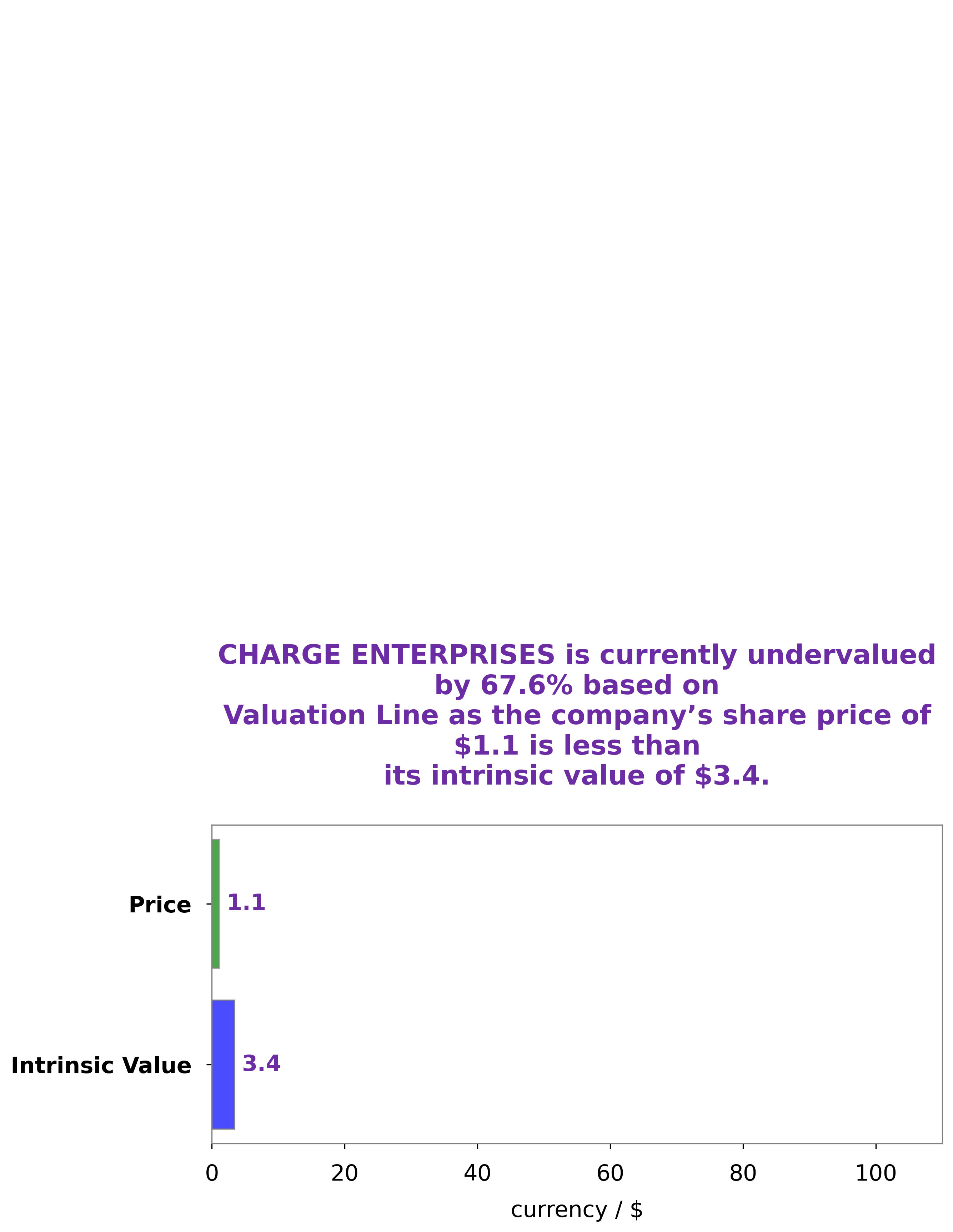

At GoodWhale, we have conducted an extensive analysis of CHARGE ENTERPRISES fundamentals. After thorough examination, we have come up with a fair value of the stock at around $3.4, using our proprietary Valuation Line. Currently, CHARGE ENTERPRISES stock is being traded at only $1.1, which represents a huge 68.1% discount to its fair value. Therefore, CHARGE ENTERPRISES stock is undervalued and may present an attractive investment opportunity to potential investors. More…

Peers

The Company is engaged in the business of providing technology and marketing solutions for the electric vehicle industry. Charge Enterprises Inc has a strategic alliance with Ascentech KK, Quest Co Ltd, and Ntegrator International Ltd.

– Ascentech KK ($TSE:3565)

Ascentech KK is a Japanese company with a market cap of 6.79B as of 2022. The company has a return on equity of 17.08%. Ascentech KK is involved in the manufacturing of semiconductor devices and other electronic components.

– Quest Co Ltd ($TSE:2332)

Since its establishment in 2001, Quest has been a leading provider of end-to-end enterprise software solutions. The company has a market cap of 6.02B as of 2022 and a ROE of 11.79%. Quest provides a comprehensive suite of solutions that helps organizations automate their business processes, improve their operational efficiency, and optimize their customer experience. The company’s products and services are used by more than 10,000 customers in over 100 countries.

Summary

Charge Enterprises Inc.’s stock price has experienced significant volatility recently, reaching 6.31% on Thursday April 06. The stock rose by 1.92% from the previous day’s close, indicating strong buying momentum. Investors should keep an eye on the stock and its future performance, as the company undergoes changes in the market that may affect the stock price.

Additionally, analysts predict that the company will report earnings in the near future, and investors should consider this when evaluating their investments in the stock. Overall, investors should take caution when investing in Charge Enterprises Inc. and monitor the situation closely before making an investment decision.

Recent Posts