Brightspire Capital Intrinsic Value Calculator – Strs Ohio Trims Its Investment in BrightSpire Capital, by 10.4% in 4th Quarter

April 25, 2023

Trending News 🌥️

BRIGHTSPIRE ($NYSE:BRSP): BrightSpire Capital, Inc. is a publicly traded company that provides specialized services to aid entrepreneurs in the middle market. The company offers capital, consulting, and management services to businesses in the healthcare, technology, and consumer products industries. Strs Ohio is an Ohio-based public pension fund that recently filed documents indicating that it had reduced its stake in BrightSpire Capital, Inc. by 10.4% during the fourth quarter. It is unclear why Strs Ohio has decided to trim its investment in the company, but the move marks a significant decrease in the pension fund’s stake.

It remains to be seen how this move will affect BrightSpire Capital’s performance, but the company has continued to report strong financial results over the past year despite the decrease in Strs Ohio’s investment. Investors will continue to monitor the situation in order to see if the decrease in Strs Ohio’s stake will have any long-term effects on BrightSpire’s stock price.

Stock Price

On Monday, BRIGHTSPIRE CAPITAL, Inc. experienced a slight dip in share price as the stock opened at $5.8 and closed at $5.7, representing a decrease of 1.2% from its previous closing price of $5.8. This decrease could be attributed to the recent news that STR Ohio, one of BrightSpire’s major shareholders, had reduced its ownership stake in the company by 10.4% during the 4th quarter. The move marks a significant departure from the long-term investment strategy of STR Ohio, which has historically sought to build up its portfolios with long-term investments. It is unclear what type of impact this move will have on BrightSpire’s growth prospects in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Brightspire Capital. More…

| Total Revenues | Net Income | Net Margin |

| 358.54 | 45.79 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Brightspire Capital. More…

| Operations | Investing | Financing |

| 125.28 | 89.34 | -161.45 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Brightspire Capital. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.75k | 3.36k | 10.77 |

Key Ratios Snapshot

Some of the financial key ratios for Brightspire Capital are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 12.1% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis – Brightspire Capital Intrinsic Value Calculator

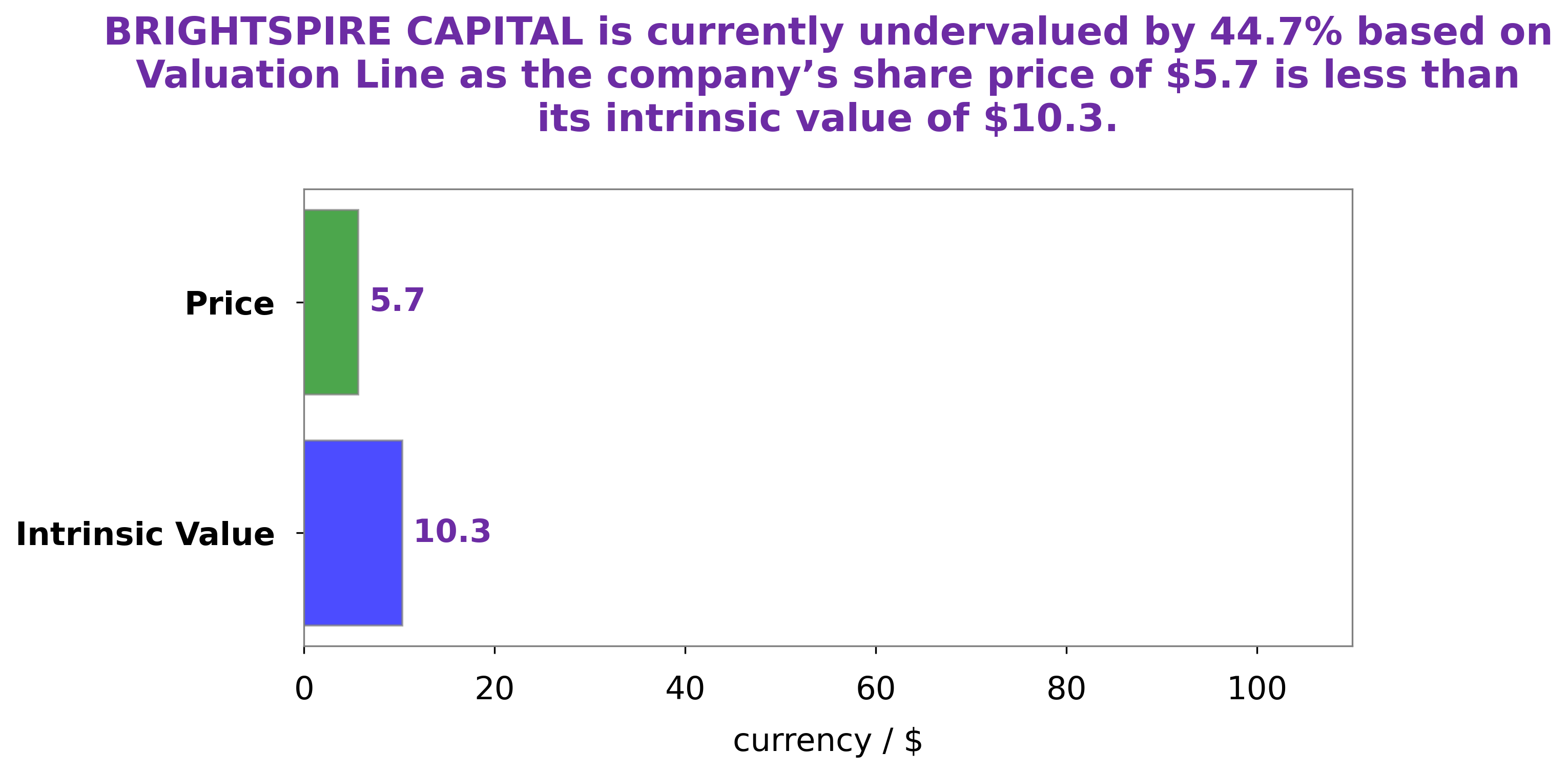

At GoodWhale, we have analyzed the fundamentals of BRIGHTSPIRE CAPITAL and provided our findings. Our proprietary Valuation Line suggests that the fair value of a BRIGHTSPIRE CAPITAL share is around $10.3. However, the current market price of the stock is $5.7, which is 44.5% below the fair value. This suggests that the stock is currently undervalued and may provide an attractive investment opportunity for investors. More…

Peers

The Company offers a broad range of products and services, including equity and debt financing, advisory services, and merchant banking. BrightSpire Capital Inc is a publicly traded company on the Toronto Stock Exchange (TSX: BSC). Modiv Inc is a publicly traded company on the Toronto Stock Exchange (TSX: MDV). 360 Capital REIT is a publicly traded company on the Toronto Stock Exchange (TSX: TSXV: CUR.UN). AREIT Inc is a publicly traded company on the Toronto Stock Exchange (TSX: ARE).

– Modiv Inc ($NYSE:MDV)

Modiv Inc is a publicly traded company with a market cap of 78.07M as of 2022. The company is engaged in the business of providing technology solutions for the retail industry. Modiv Inc’s products and services include retail management software, point-of-sale systems, and mobile commerce solutions. The company serves clients in the United States, Canada, and Europe.

– 360 Capital REIT ($ASX:TOT)

Invesco Mortgage Capital Inc. is a real estate investment trust that focuses on investing in, financing and managing residential and commercial mortgage-backed securities and mortgage loans. The company has a market capitalization of $118.44 million as of 2022. It is headquartered in Atlanta, Georgia, and has offices in New York, Los Angeles, Chicago, Boston, Dallas and San Francisco.

– AREIT Inc ($PSE:AREIT)

REIT, or Real Estate Investment Trust, is a company that owns, operates, or finances income-producing real estate. The market capitalization, or market cap, of a company is the total value of its shares of stock. As of 2022, the market cap of REIT Inc is 48.13 billion dollars. The company owns and operates a variety of income-producing real estate, including office buildings, shopping centers, apartments, and warehouses. REIT Inc is one of the largest real estate investment trusts in the United States.

Summary

BrightSpire Capital, Inc. has seen a significant shift in investor sentiment over the last quarter. In the fourth quarter, Strs Ohio decreased its holdings in BrightSpire Capital, Inc. by 10.4%. This indicates a drop in investor confidence in the company and its potential for growth.

Analysts suggest that investors should monitor BrightSpire Capital, Inc. for any further signs of changes in investor sentiment. It is important for investors to think critically about their investments and weigh the risks and rewards of each opportunity.

Recent Posts