Atour Lifestyle Intrinsic Stock Value – Atour Lifestyle Unveils Bold Plan to Tap Into ‘Revenge Travel’ Market

April 8, 2023

Trending News 🌧️

Atour Lifestyle ($NASDAQ:ATAT), a leading tourism company, has announced a bold plan to capitalize on the growing “Revenge Travel” market. The company aims to tap into the growing trend of travelers who are eager to make up for lost time and explore the world after the pandemic subsides. To achieve this goal, Atour is launching a major expansion plan that includes major investments in travel technology, marketing, and staff training. The company’s aim is to create an online platform that allows people to book flights, hotels, rental cars, and other travel services in one place. It’s also developing a mobile app to make booking even simpler. The company also plans to invest in marketing campaigns that target the Revenge Travel market.

Its goal is to provide attractive incentives and discounts to encourage travelers to make their post-pandemic dreams come true. Finally, Atour is focusing on staff training to ensure its team is well-prepared to meet the changing demands of Revenge Travelers. The company plans to train its staff in the latest trends and technologies to make travel easier for customers. Atour Lifestyle’s ambitious plan to tap into the Revenge Travel market has the potential to revolutionize the tourism industry. If successful, it could pave the way for a new era of travel that offers travelers greater convenience and cost savings.

Price History

Atour Lifestyle’s plans include targeting pent-up demand from travelers that have been forced to stay at home for the past year, offering customers greater flexibility when booking trips and increasing its presence in emerging markets. It also aims to expand its services such as lifestyle experiences, destination-based activities, and other unique offerings. The company’s plans were met with enthusiasm in the stock market, where ATOUR LIFESTYLE stock opened at $26.0 and closed at $26.6, up by 1.6% from last closing price of 26.2. With the strong performance of the stock and its strategic plans, Atour Lifestyle is well-positioned to make the most of the growing ‘Revenge Travel’ market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Atour Lifestyle. More…

| Total Revenues | Net Income | Net Margin |

| 2.26k | 98.1 | 4.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Atour Lifestyle. More…

| Operations | Investing | Financing |

| 283.68 | -192.22 | 456.31 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Atour Lifestyle. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.76k | 3.57k | – |

Key Ratios Snapshot

Some of the financial key ratios for Atour Lifestyle are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.0% | 21.8% | 8.3% |

| FCF Margin | ROE | ROA |

| 10.8% | 12.6% | 2.5% |

Analysis – Atour Lifestyle Intrinsic Stock Value

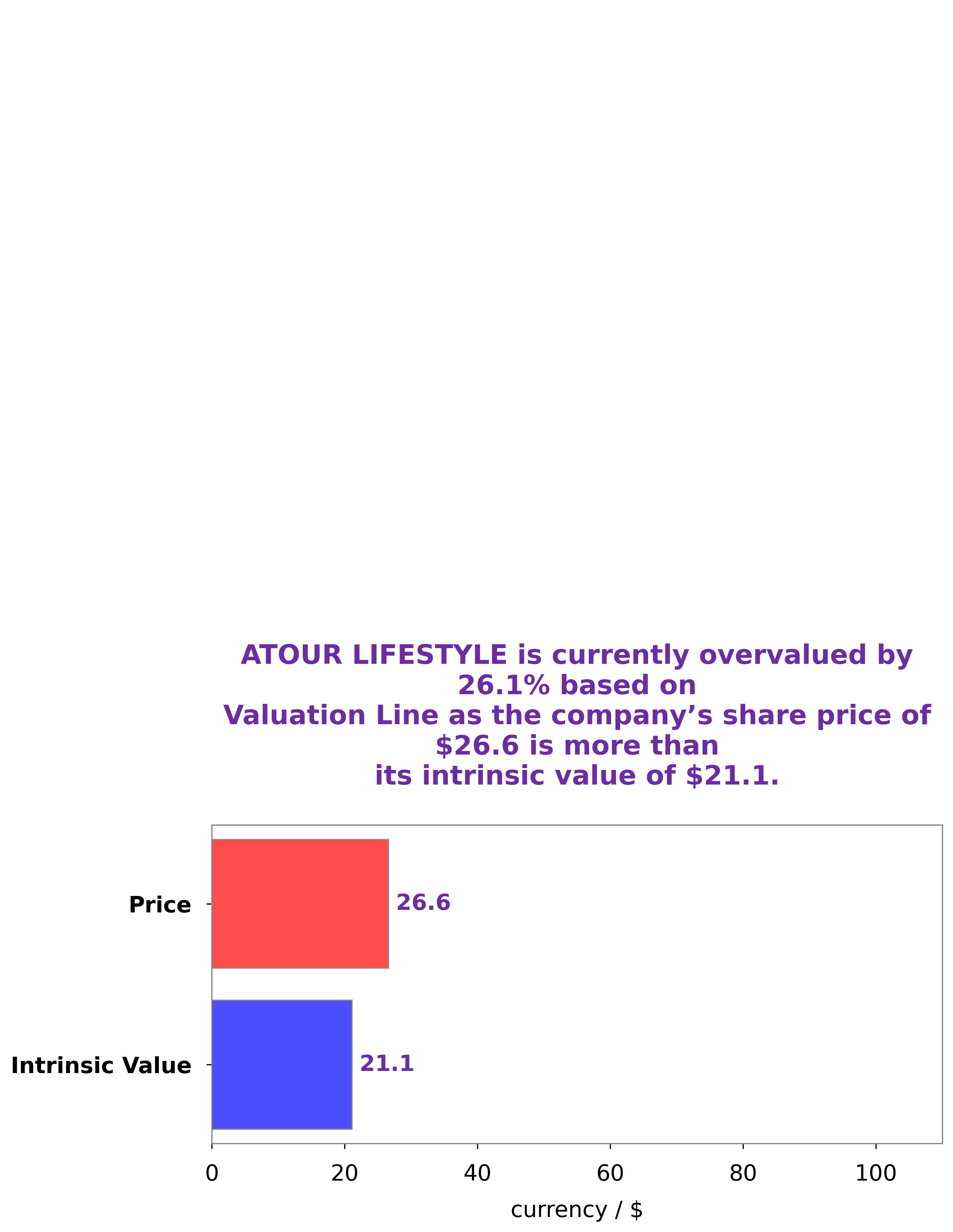

GoodWhale has conducted a study of the fundamentals of ATOUR LIFESTYLE, and our proprietary Valuation Line has given us a fair value of around $21.1 per share. However, the stock is currently trading at $26.6, indicating an overvaluation of 26.3%. Our analysis shows that ATOUR LIFESTYLE is currently significantly overpriced and is due for a correction in the near future. We recommend investors take caution when investing in ATOUR LIFESTYLE shares and consider taking profits off the table if they are currently holding the stock. More…

Peers

It is one of the few companies that provides comprehensive services in the hospitality sector, such as hotel management, catering, travel services, and more. It is a major player in the industry and competes with other leading companies like Gujarat Hotels Ltd, Benares Hotels Ltd, and Hotel Royal Chihpen Spa Co Ltd. These companies all strive to provide high-quality service and products to their customers, ensuring that they have an enjoyable and profitable experience.

– Gujarat Hotels Ltd ($BSE:507960)

Gujarat Hotels Ltd is a hospitality company based in India that engages in the ownership and management of hotels, resorts, and restaurants. As of 2023, the company has a market cap of 504.88M and a Return on Equity (ROE) of 4.42%. The market cap is a measure of the company’s total value and is calculated by multiplying the price of one share of stock by the total number of outstanding shares. The ROE measures the efficiency of management at generating profits with shareholders’ money, indicating the rate of return on the ownership investment. Gujarat Hotels Ltd’s ROE indicates that it is able to generate a healthy return for its investors.

– Benares Hotels Ltd ($BSE:509438)

Benares Hotels Ltd is a hospitality company that operates hotels and resorts throughout India. The company is well-regarded for its quality service, luxury accommodations, and unique experiences. As of 2023, the company has a market cap of 4.24B, reflecting its impressive growth over the past few years. Furthermore, it has an excellent Return on Equity (ROE) of 19.1%, indicating that the company is quite efficient at utilizing its equity to generate profits.

– Hotel Royal Chihpen Spa Co Ltd ($TPEX:5704)

Hotel Royal Chihpen Spa Co Ltd is a hospitality and spa company that provides luxurious accommodations and spa services in Taiwan. The company has a market capitalisation of 2.27 billion US dollars as of 2023, making it one of the largest hospitality and spa companies in the region. The Return on Equity (ROE) of 13.75% indicates that the company is able to generate a substantial amount of profit from the money invested by shareholders. With its strong financial performance and unique offerings, Hotel Royal Chihpen Spa Co Ltd is well-positioned to capture a larger share of the hospitality and spa industry.

Summary

ATOUR LIFESTYLE has recently announced a major expansion plan, as it looks to capitalize on the current trend of “revenge travel” in the wake of the pandemic. The plan includes investments in its existing product lineup and new technology, as well as a focus on expanding into new markets and customer segments. Company executives anticipate that the investments made will yield higher profits in the long-term and increase their market share.

The company also plans to leverage its online platforms to attract new customers and reach out to existing ones. ATOUR LIFESTYLE aims to be an industry leader in the “revenge travel” market, as well as a top competitor in the overall travel industry.

Recent Posts