Ast Spacemobile Intrinsic Stock Value – “AST SpaceMobile On Track to Provide Satellite Phone Service”.

May 17, 2023

Trending News 🌥️

AST ($NASDAQ:ASTS) SpaceMobile is a revolutionary satellite communications company that is making waves in the telecommunications market. Recently, their update has revealed that their satellite phone service is progressing as planned, propelling their stock to new heights. AST SpaceMobile’s ambition of providing satellite phone service is on track and the company is well-positioned to capitalize on the current market demand. AST SpaceMobile has been steadily increasing their presence in the telecommunications market. They have developed a unique mobile network that provides a reliable and cost-effective solution for customers. With this new service, AST SpaceMobile is able to provide satellite phone service to both consumers and businesses alike. The company is also focused on creating a seamless user experience for customers, which includes low latency and high speed coverage. The potential of AST SpaceMobile’s satellite phone service is tremendous.

By utilizing their existing infrastructure, the company is well-positioned to meet the growing demand from both residential and commercial customers. Already, the company has made great strides in the industry by signing deals with major providers and launching services in multiple countries. In conclusion, AST SpaceMobile’s update reveals that their satellite phone service is progressing as planned, elevating the company’s status and position in the telecommunications sector. As a result, their stock has seen an impressive increase, further solidifying the company’s place as a leader in this market. With its innovative technology and strong partnerships, AST SpaceMobile is well-equipped to provide reliable and cost-effective satellite phone services to both consumers and businesses.

Stock Price

On Monday, AST SPACEMOBILE stock opened at $5.2 and closed at $5.0, down by 3.3% from prior closing price of 5.1. Despite this small drop, AST SPACEMOBILE is still on track to provide satellite phone service to its customers. The company has been making strides in the industry since its launch, introducing innovative solutions and technologies to enhance the customer experience. Recently, AST SPACEMOBILE announced plans to launch a new satellite network that will provide satellite phone service to even more customers across the globe. This will help boost their customer base and give them an edge in the market.

Additionally, they have also unveiled plans to develop a low-cost satellite phone service designed to make satellite phone service more affordable for those who cannot afford traditional cell phone plans. AST SPACEMOBILE has earned a reputation for providing reliable and innovative services, and their commitment to delivering quality customer experience has been reflected in the success of their stock performance. On Monday, despite the dip in stock prices, AST SPACEMOBILE remains on track to provide satellite phone service to its customers and continues to be a leader in the industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ast Spacemobile. More…

| Total Revenues | Net Income | Net Margin |

| 13.82 | -31.64 | -311.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ast Spacemobile. More…

| Operations | Investing | Financing |

| -156.46 | -31.35 | 102.34 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ast Spacemobile. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 438.37 | 78.55 | 1.86 |

Key Ratios Snapshot

Some of the financial key ratios for Ast Spacemobile are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -1054.4% |

| FCF Margin | ROE | ROA |

| -1546.1% | -81.0% | -20.8% |

Analysis – Ast Spacemobile Intrinsic Stock Value

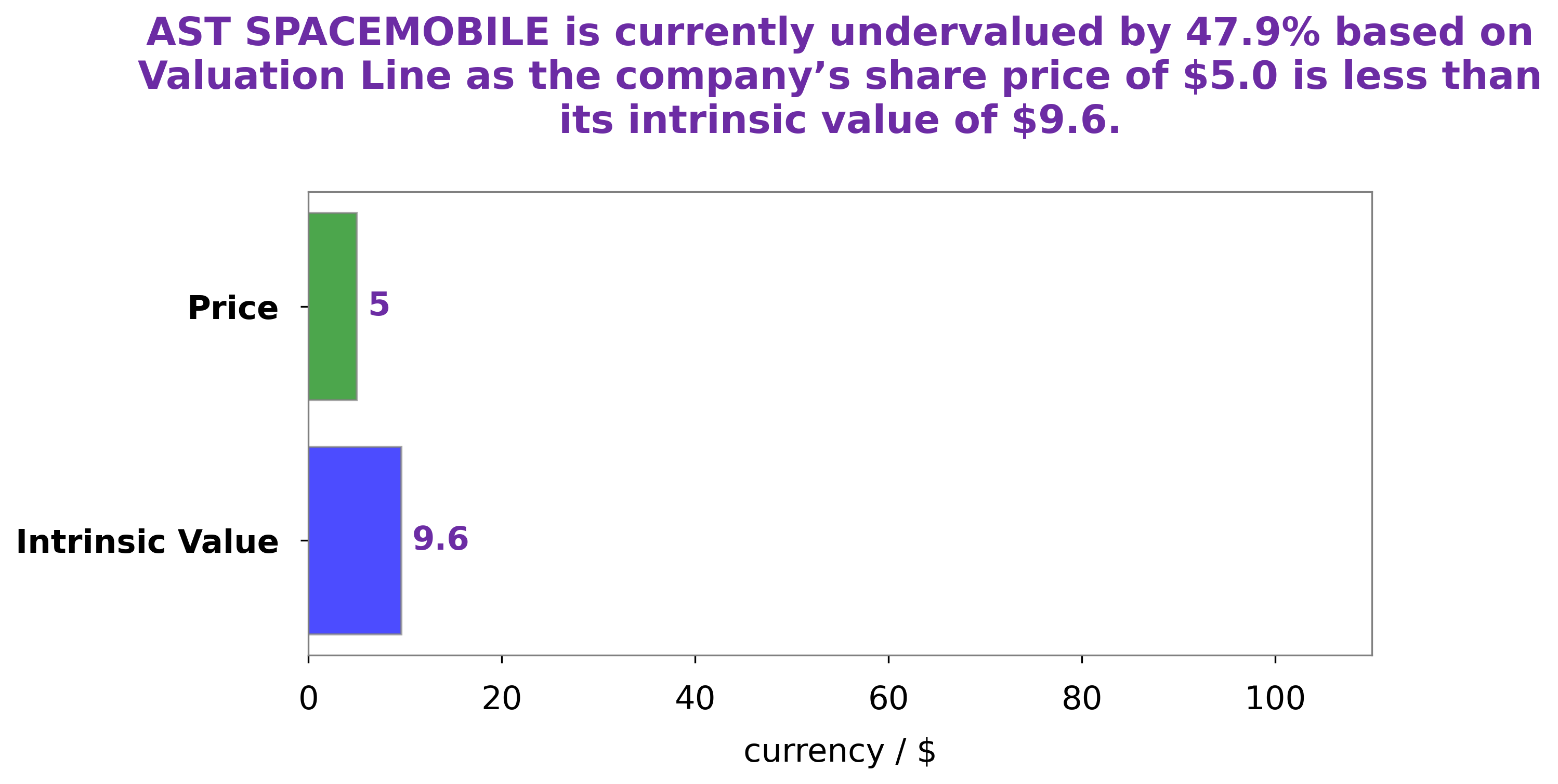

At GoodWhale, we recently analyzed the fundamentals of AST SPACEMOBILE. Our proprietary Valuation Line calculation shows that the company’s intrinsic value is estimated to be around $9.6 per share. Currently, AST SPACEMOBILE’s stock is trading below its intrinsic value, at $5.0 per share. This implies that AST SPACEMOBILE is undervalued by 47.9%. This could be a great opportunity for investors who are looking to buy stocks with potentially high return potential. More…

Peers

The competition in the mobile satellite services market is heating up as AST SpaceMobile Inc enters the fray. The company is up against some big names in the industry such as freenet AG, Japan Communications Inc, and Iliad SA. All these companies are vying for a piece of the pie in this rapidly growing market. The company has developed a new way to provide mobile satellite services that is much more efficient than the traditional methods used by its competitors. This has allowed AST SpaceMobile Inc to offer its services at a much lower price point, which is sure to attract customers. The other companies in the market are not sitting idly by, however. They are all working on their own innovative solutions to the mobile satellite services problem. It is sure to be an interesting battle as these companies fight for market share.

– freenet AG ($OTCPK:FRTAY)

Freenet AG is a German telecommunications company that provides mobile and fixed-line Voice over IP, broadband Internet, and digital television services to residential and business customers. As of 2022, the company had a market capitalization of 2.12 billion euros and a return on equity of 8.63%. Freenet AG is headquartered in Büdelsdorf, Germany.

– Japan Communications Inc ($TSE:9424)

Nippon Telegraph and Telephone Corporation (NTT) is a Japanese telecommunications company headquartered in Tokyo, Japan. NTT is the largest telecommunications company in Japan, and one of the largest telecommunications companies in the world. The company provides a wide range of telecommunications services, including fixed-line and mobile telephone services, Internet services, and data communications services. NTT is a major shareholder in a number of other telecommunications companies, including NTT DoCoMo, NTT Communications, and NTT Data.

– Iliad SA ($OTCPK:ILIAF)

Iliad SA is a French telecommunications company with a market cap of 11.83B as of 2022. The company has a Return on Equity of 18.58%. Iliad SA is a leading provider of fixed and mobile telecommunications services in France. The company offers a wide range of products and services to consumers and businesses, including broadband Internet, fixed and mobile telephony, and TV. Iliad SA is headquartered in Paris, France.

Summary

Investors in AST SpaceMobile may want to take note that the stock price has moved down after an update showing satellite phone service is on track. This suggests that the market is not as optimistic about the company’s prospects as previously thought, so investors should be cautious before jumping in. Short-term investors may want to wait for a better entry point and seek further information on the company’s progress.

Meanwhile, long-term investors may want to look at their risk appetite and consider the company’s fundamentals before investing. Ultimately, investors should remain conscious of their own risk tolerance when assessing whether AST SpaceMobile is a suitable investment.

Recent Posts