American Tower Intrinsic Stock Value – American Tower Poised to Overcome Current Challenges

April 22, 2023

Trending News ☀️

American Tower ($NYSE:AMT) is a real estate investment trust (REIT) that owns, operates, and develops wireless and broadcast communications sites. The company has experienced some headwinds as of late, but remains a solid company poised to overcome current challenges. American Tower specializes in leasing space on its multi-tenant communications sites to various wireless service providers, radio and television broadcasters, government agencies and municipalities, and other customers. It also offers services such as site development and deployment of wireless equipment for its customers.

However, the company has been able to rely on its long-term contracts and diversified portfolio of customers to mitigate these losses.

In addition, American Tower has been able to stay ahead of the curve in terms of technological innovation, enabling it to remain competitive in an ever-changing industry. Going forward, American Tower is poised to overcome the current challenges it is facing and continue to be a leader in the communications infrastructure industry. Its robust portfolio of sites combined with its diversified customer base and technological capabilities will ensure that the company remains well-positioned for future growth.

Stock Price

American Tower has faced a difficult market in recent weeks, as evidenced by its stock price on Friday. It opened at $206.6 and closed at $204.1, a drop of 0.7% from the prior closing price of 205.6.

However, despite this minor dip, the company’s future looks bright. Their large portfolio coupled with their strong financial position gives them an advantageous position to weather any market headwinds. The company is continuing to make strategic investments, such as the acquisition of XRadio Wireless, to help drive growth.

In addition, American Tower has also been focusing on expanding its geographic footprint and increasing its portfolio of telecom services and products, positioning it to take advantage of any potential new opportunities in the market. With its strong presence in the U.S., its strategic investments, and its focus on geographic expansion, it is poised for continued success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for American Tower. More…

| Total Revenues | Net Income | Net Margin |

| 10.71k | 1.77k | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for American Tower. More…

| Operations | Investing | Financing |

| 3.7k | -2.36k | -1.42k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for American Tower. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 67.19k | 54.79k | 11.97 |

Key Ratios Snapshot

Some of the financial key ratios for American Tower are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 28.4% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis – American Tower Intrinsic Stock Value

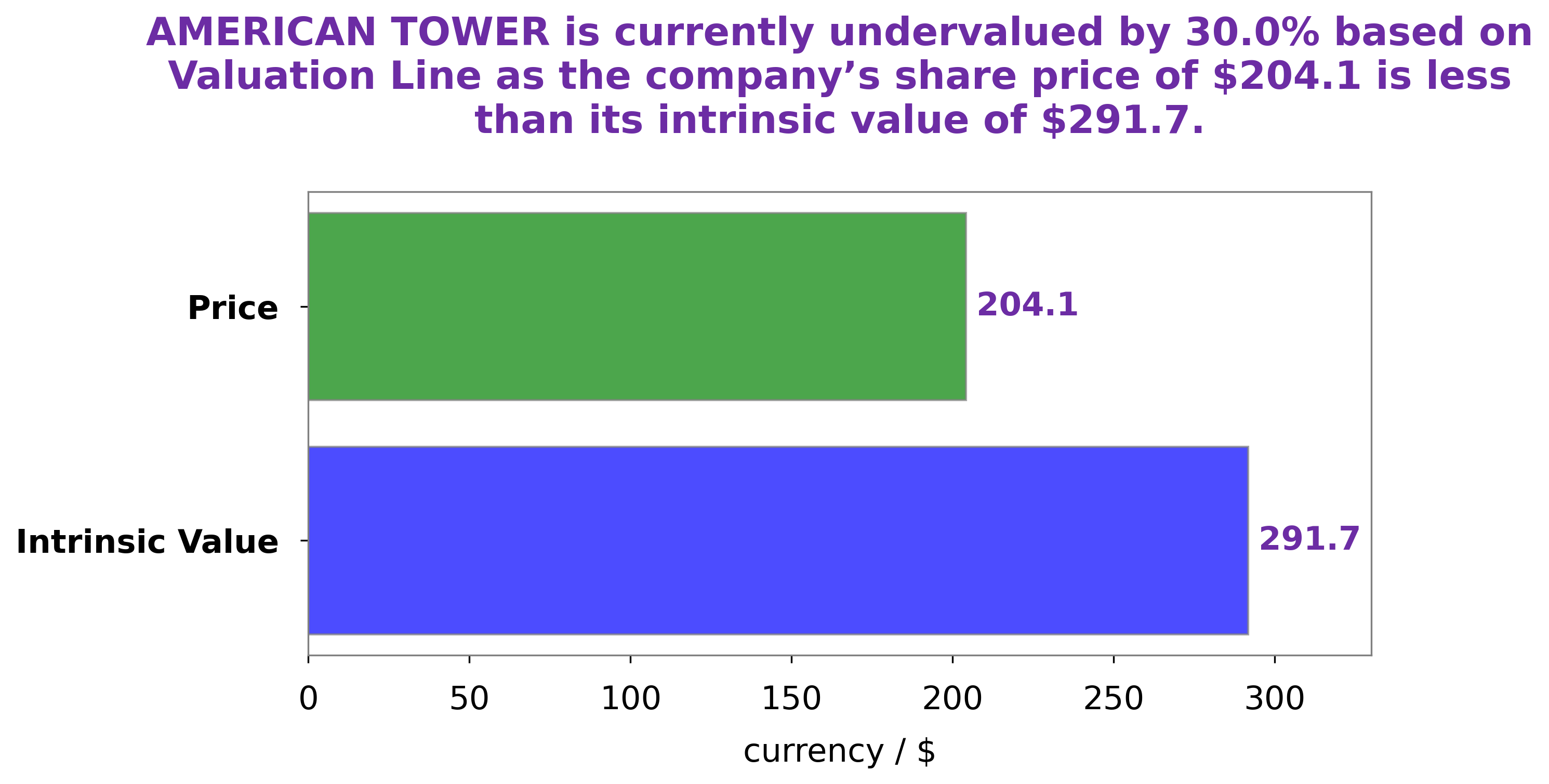

At GoodWhale, we have conducted an analysis of AMERICAN TOWER‘s financials, and find that the stock is currently undervalued. Our proprietary Valuation Line has determined that the fair value of a share of AMERICAN TOWER is around $291.7. This means that the stock is currently trading at $204.1, which is 30.0% below its fair value. This presents an attractive investment opportunity for those looking to capitalize on a potential upside return. More…

Peers

The company owns and operates more than 40,000 wireless communication sites across the country. American Tower Corp’s main competitors are SBA Communications Corp, CyrusOne Inc, and Equinix Inc.

– SBA Communications Corp ($NASDAQ:SBAC)

SBA Communications Corporation is a holding company that operates as a real estate investment trust (REIT), which is engaged in the ownership and leasing of wireless communications infrastructure, including antenna sites, towers, other structures, and supporting assets.

As of December 31, 2020, the Company owned or operated approximately 40,000 communication sites in the United States, Brazil, Canada, Chile, Colombia, Germany, Guatemala, India, Mexico, Peru, South Africa, and Spain.

– CyrusOne Inc ($NASDAQ:EQIX)

Equinix is a company that provides data center and interconnection services to a variety of customers. Its market cap as of 2022 is 47.86B. The company has a variety of products and services that it offers to its customers, which include data center services, interconnection services, and a variety of other services.

Summary

American Tower is a global real estate investment trust that owns, operates, and develops tens of thousands of communication sites across the world. With a track record of growth and profitability, the company has been a reliable investment for years, but it has recently seen some headwinds due to industry challenges such as increasing competition, pricing pressure, and the potential for a slowdown in capital expenditure from mobile operators. Despite these risks, the company remains well-positioned to capitalize on the global growth in demand for network infrastructure, and its strong balance sheet provides a solid foundation on which to deliver long-term value for investors.

Recent Posts