Amcor Plc Stock Fair Value – Teacher Retirement System of Texas Trims Amcor plc Holdings By 37.8% in 4Q

June 12, 2023

🌧️Trending News

Amcor ($NYSE:AMCR) plc is a global leader in providing responsible packaging solutions. They are dedicated to designing, creating, and delivering innovative packaging solutions that are safe, efficient, and sustainable. This change was noted in their most recent 13F filing. This is an indication that the retirement system is choosing to reduce its exposure to the company’s stock at this time.

The news of this reduction in holdings has caused a decline in Amcor plc‘s stock price, as investors have become wary of their potential decreased returns. Despite this, many analysts remain optimistic about the company’s future prospects and long-term investments. It remains to be seen how this news will affect the company’s stock price in the future.

Analysis – Amcor Plc Stock Fair Value

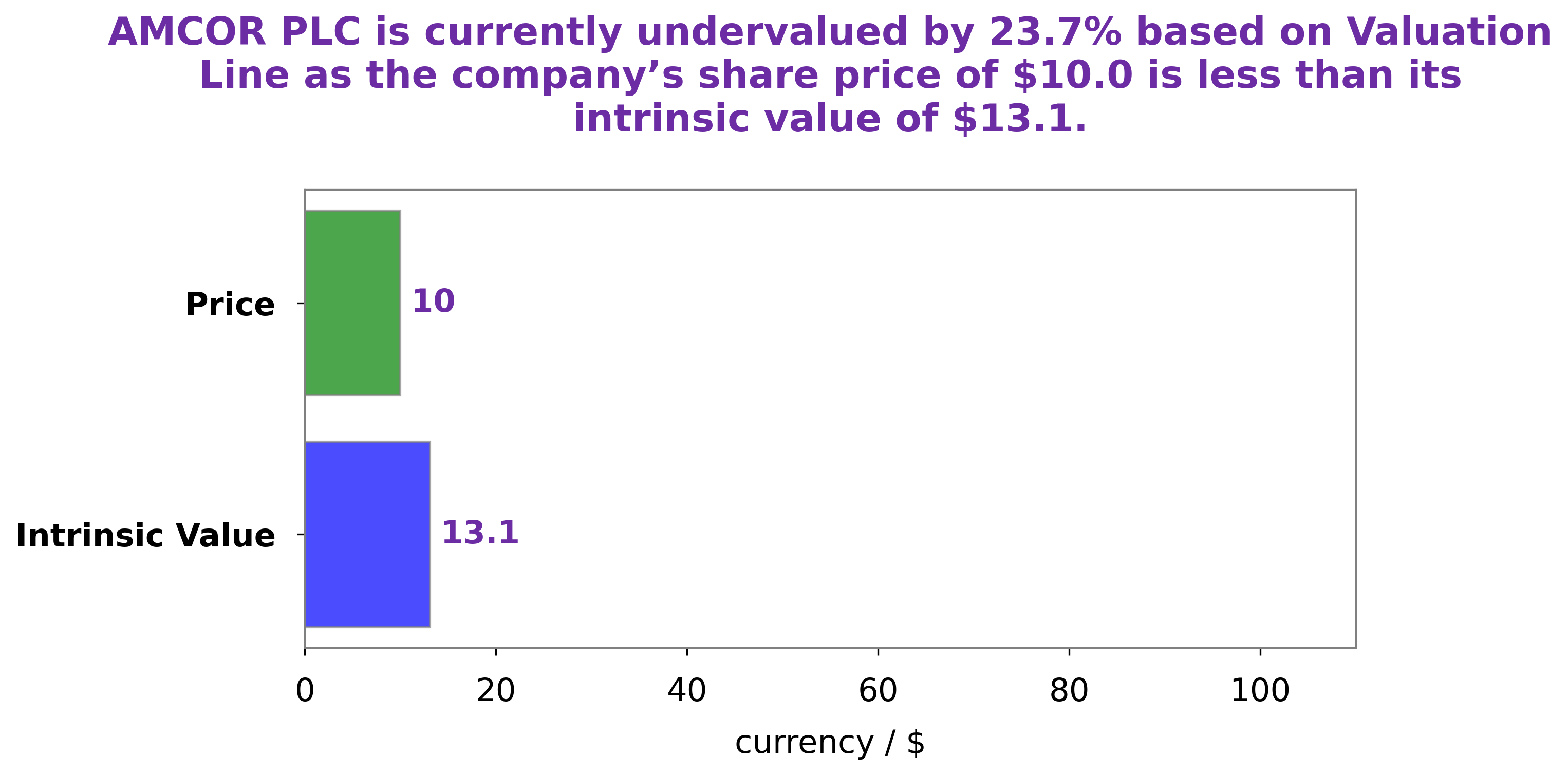

At GoodWhale, we have conducted a detailed analysis of AMCOR PLC‘s financials. Our proprietary Valuation Line indicates that the intrinsic value of AMCOR PLC’s stock is approximately $13.1. However, the stock is currently trading at $10.0, which means that it is undervalued by 23.7%. This presents an attractive investing opportunity for those looking to capitalize on an undervalued stock. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Amcor Plc. More…

| Total Revenues | Net Income | Net Margin |

| 14.93k | 970 | 6.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Amcor Plc. More…

| Operations | Investing | Financing |

| 1.27k | -293 | -1.31k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Amcor Plc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.28k | 12.97k | 2.93 |

Key Ratios Snapshot

Some of the financial key ratios for Amcor Plc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.8% | 12.9% | 9.9% |

| FCF Margin | ROE | ROA |

| 4.9% | 21.6% | 5.4% |

Peers

The company’s primary competitors are Huhtamäki Oyj, Robinson PLC, and Southern Packaging Group Ltd. All three companies are global leaders in the packaging industry with a strong presence in Europe and North America.

– Huhtamäki Oyj ($LTS:0K9W)

Huitamäki is a Finnish packaging company with a focus on sustainable food packaging solutions. The company has a strong focus on reducing its environmental impact, and has set a goal to be carbon neutral by 2040. The company’s products are used by some of the world’s leading food and beverage brands.

– Robinson PLC ($LSE:RBN)

Robinson PLC is a British company that manufactures and sells office products. It has a market cap of 14.24 million as of 2022 and a return on equity of 9.8%. The company was founded in 1887 and is headquartered in London, England. Robinson PLC’s products include office furniture, stationery, and office supplies. The company sells its products through a network of retailers in the United Kingdom and Europe.

– Southern Packaging Group Ltd ($SGX:BQP)

Southern Packaging Group Ltd is a packaging company that operates in Australia and New Zealand. The company has a market cap of 29.89M as of 2022 and a return on equity of 1.31%. Southern Packaging Group Ltd provides packaging solutions for a wide range of industries including food and beverage, pharmaceutical, and cosmetic. The company offers a variety of packaging products such as corrugated boxes, plastic containers, and glass bottles. Southern Packaging Group Ltd is a publicly traded company listed on the Australian Securities Exchange.

Summary

Amcor PLC is a leading global supplier of flexible and rigid packaging solutions. This is a significant move indicating that the fund may be concerned about the company’s performance. Investors should take note and conduct further research on Amcor PLC prior to investing in the company. They should review its financial statements, competitive landscape, management team, and growth prospects to determine if it is a good fit for their portfolio.

Additionally, investors should consider factors such as market volatility, liquidity, and risk tolerance before committing capital to Amcor PLC.

Recent Posts