Amcor Plc Intrinsic Value Calculator – Amcor plc Sees Recent Price Increase, But Uncertainty Lingers.

April 20, 2023

Trending News 🌧️

Amcor ($NYSE:AMCR) plc, a global packaging leader, saw an uptick in its share price on Tuesday, April 18, when it traded at $11.14, representing a 0.32% increase from the previous day. Despite this encouraging development, potential trouble may still lie ahead for the company; analysts remain split on the stock’s future trajectory. Moving forward, Amcor will need to continue to innovate and adapt to changing market conditions if it wants to maintain its position as a leading player in the industry.

Stock Price

Amcor plc saw a slight uptick in its share price on Wednesday, opening at $11.2 and closing at $11.1, up slightly from its previous closing price of 11.2.

However, uncertainty continues to linger around the stock, as investors remain uncertain about the future growth potential of the company. Amcor plc has seen a mixed performance in the stock market, with some days showing positive gains and other days seeing a decrease in share prices. As such, investors are wary of investing in Amcor plc stock until more clarity is provided regarding its future performance. Despite the recent price increase, investors are still uncertain about the company’s long-term prospects and have yet to commit to any significant investment in Amcor plc. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Amcor Plc. More…

| Total Revenues | Net Income | Net Margin |

| 14.97k | 1.06k | 7.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Amcor Plc. More…

| Operations | Investing | Financing |

| 1.35k | -238 | -746 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Amcor Plc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.48k | 13.06k | 2.93 |

Key Ratios Snapshot

Some of the financial key ratios for Amcor Plc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.5% | 18.1% | 10.4% |

| FCF Margin | ROE | ROA |

| 5.5% | 23.6% | 5.6% |

Analysis – Amcor Plc Intrinsic Value Calculator

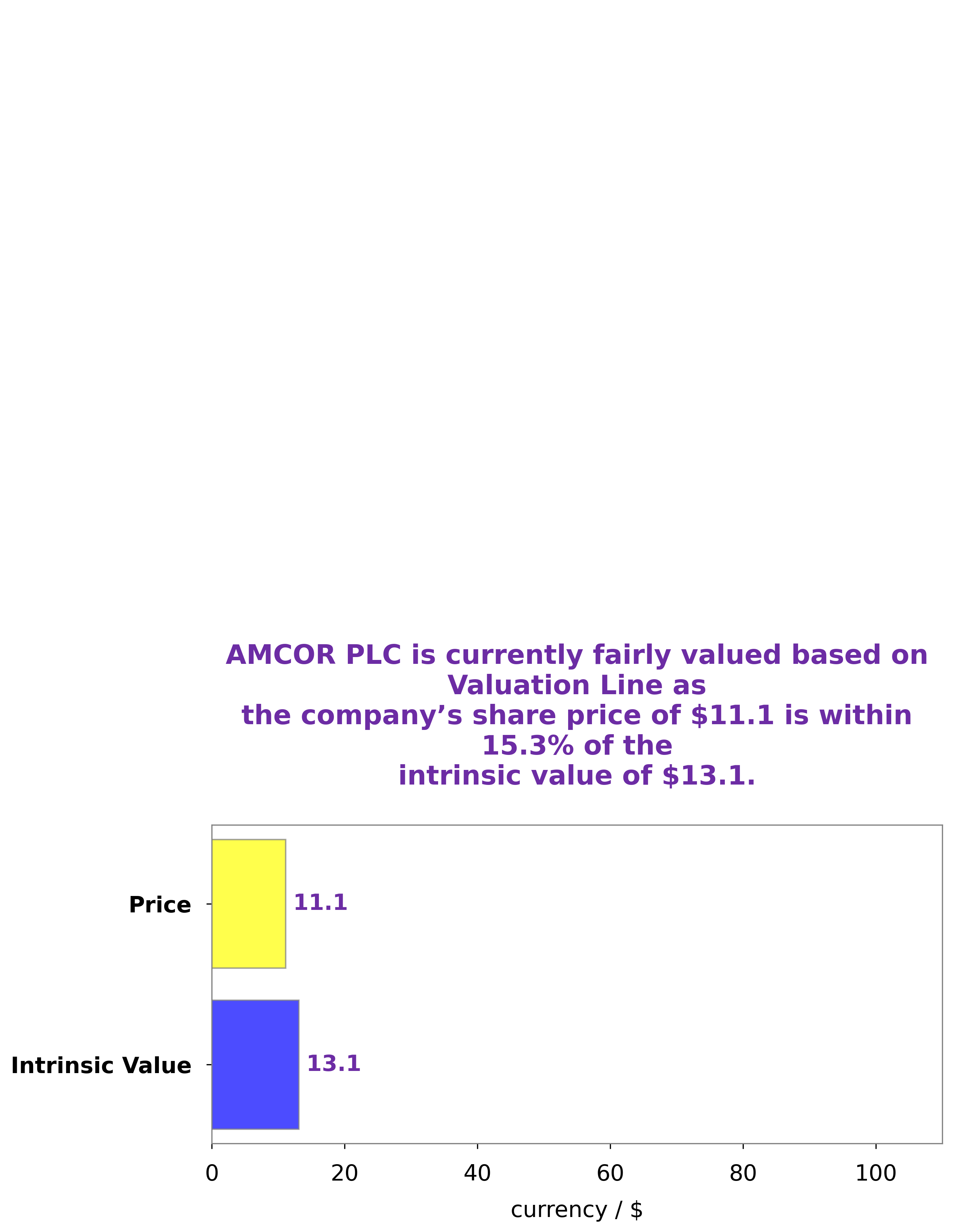

At GoodWhale, we have conducted an assessment of AMCOR PLC‘s fundamentals. After careful evaluation, our proprietary Valuation Line has determined that the intrinsic value of AMCOR PLC’s share is approximately $13.1. Currently, AMCOR PLC stock is trading at $11.1, leaving it undervalued by 15.2%. More…

Peers

The company’s primary competitors are Huhtamäki Oyj, Robinson PLC, and Southern Packaging Group Ltd. All three companies are global leaders in the packaging industry with a strong presence in Europe and North America.

– Huhtamäki Oyj ($LTS:0K9W)

Huitamäki is a Finnish packaging company with a focus on sustainable food packaging solutions. The company has a strong focus on reducing its environmental impact, and has set a goal to be carbon neutral by 2040. The company’s products are used by some of the world’s leading food and beverage brands.

– Robinson PLC ($LSE:RBN)

Robinson PLC is a British company that manufactures and sells office products. It has a market cap of 14.24 million as of 2022 and a return on equity of 9.8%. The company was founded in 1887 and is headquartered in London, England. Robinson PLC’s products include office furniture, stationery, and office supplies. The company sells its products through a network of retailers in the United Kingdom and Europe.

– Southern Packaging Group Ltd ($SGX:BQP)

Southern Packaging Group Ltd is a packaging company that operates in Australia and New Zealand. The company has a market cap of 29.89M as of 2022 and a return on equity of 1.31%. Southern Packaging Group Ltd provides packaging solutions for a wide range of industries including food and beverage, pharmaceutical, and cosmetic. The company offers a variety of packaging products such as corrugated boxes, plastic containers, and glass bottles. Southern Packaging Group Ltd is a publicly traded company listed on the Australian Securities Exchange.

Summary

Investors should take a closer look at Amcor PLC, as its share price has recently risen. At last check on April 18, the stock was trading at $11.14, representing an increase of 0.32% from the previous day. Despite the recent gains, there may still be potential risks and challenges ahead for the company. Investors should assess the company’s current financial reports and performance, as well as its strengths and weaknesses, to identify investment opportunities and potential risks.

Additionally, investors should consider the company’s industry, competitors, and macroeconomic trends, to determine whether Amcor PLC is a sound investment.

Recent Posts