Allot Ltd Stock Intrinsic Value – totalling 8,100 shares, a decline of 45.5% from the March 15th total of 14,900 shares.

April 19, 2023

Trending News ☀️

Allot Communications Ltd, a provider of innovative network intelligence and security solutions, experienced a significant decrease in short interest in March. ALLOT LTD ($NASDAQ:ALLT) is a publicly traded company on the Nasdaq Global Select Market under the ticker symbol ALLT. Its solutions enable service providers and enterprises to optimize and secure their networks to deliver an enhanced quality of experience for users and customers. It will be interesting to see if this trend continues as Allot Communications seeks to reach its potential and make profits for investors.

Price History

This news followed Monday’s opening of ALLOT LTD stock at $2.8 and closing at $2.8, up by 1.4% from prior closing price of 2.8. The decrease in short interest signals a shift in sentiment among investors, as fewer traders are betting against the stock with short positions. While the reason for the decreased short interest remains unclear, this may be a sign that investors have more confidence in the stock over the long-term. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Allot Ltd. More…

| Total Revenues | Net Income | Net Margin |

| 122.74 | -32.03 | -26.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Allot Ltd. More…

| Operations | Investing | Financing |

| -32.56 | -6.51 | 39.66 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Allot Ltd. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 212.95 | 110.98 | 3.39 |

Key Ratios Snapshot

Some of the financial key ratios for Allot Ltd are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.7% | – | -26.3% |

| FCF Margin | ROE | ROA |

| -31.1% | -16.0% | -9.5% |

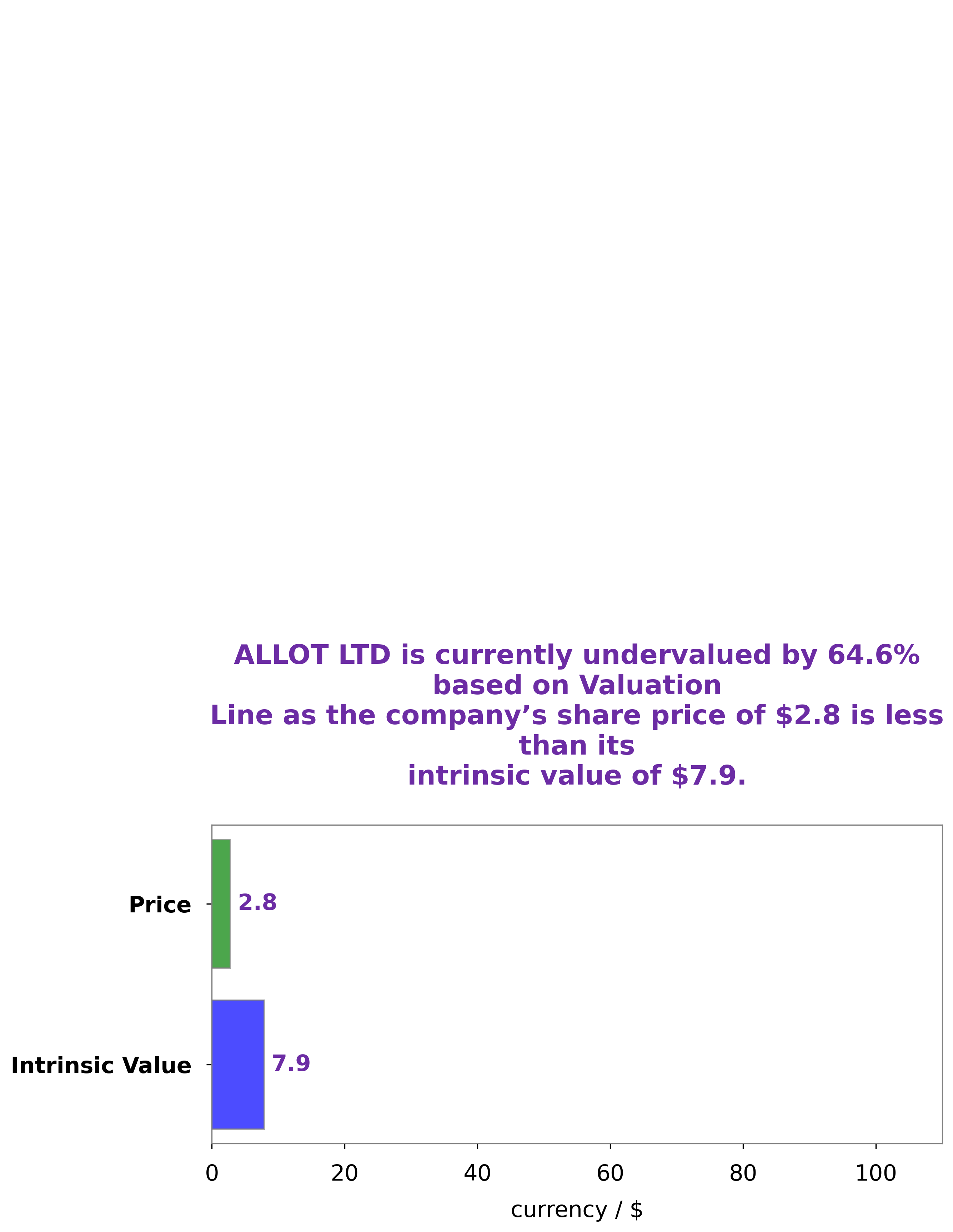

Analysis – Allot Ltd Stock Intrinsic Value

At GoodWhale, we recently conducted an analysis of ALLOT LTD‘s financials. After carefully examining the company’s performance, value drivers, and quality of earnings, our proprietary Valuation Line determined that the fair value of an ALLOT LTD share is around 7.9 USD. While this valuation represents a fair market price for an ALLOT LTD share, its current share price of 2.8 USD indicates that it is trading at a significant discount of 64.5%. We believe that savvy investors should be aware of the potential upside that these discounted shares offer. More…

Peers

In the cyber security market, Allot Ltd competes with Corero Network Security PLC, Hillstone Networks Co Ltd, and Nsfocus Technologies Group Co Ltd. Allot Ltd provides software-based solutions that enable service providers and enterprises to protect and personalize the Internet experience. The company’s solutions are used by over 1,700 customers in more than 80 countries.

– Corero Network Security PLC ($LSE:CNS)

Corero Network Security PLC is a network security company that provides DDoS protection solutions. The company has a market cap of 54.55M as of 2022 and a Return on Equity of 10.96%. Corero Network Security PLC’s DDoS protection solutions help organizations to defend against DDoS attacks and minimize the impact of these attacks.

– Hillstone Networks Co Ltd ($SHSE:688030)

The company’s market cap has grown significantly over the past few years, reaching $3.77 billion by 2022. This is due in part to the company’s strong financial performance, with a return on equity of 3.64%.

Stone Networks is a leading provider of network security solutions. The company’s products are used by some of the largest organizations in the world, including banks, governments, and military organizations.

– Nsfocus Technologies Group Co Ltd ($SZSE:300369)

Nsfocus Technologies Group Co Ltd is a Chinese multinational cybersecurity and anti-virus provider. The company has a market cap of 7.9B as of 2022 and a Return on Equity of 3.03%. Nsfocus provides cybersecurity solutions for enterprise, government, and SMB customers. The company’s products and services include network security, application security, and endpoint security. Nsfocus was founded in 2003 and is headquartered in Beijing, China.

Summary

On March 31st, the number of shares sold short was lower than the previous month and significantly lower than the same period last year. This could indicate a shift in investor sentiment towards Allot Ltd, as fewer investors are betting against the company. Fundamental analysis suggests that Allot Ltd is in a strong financial position and is performing well operationally. The company has shown steady revenue growth in recent quarters and profit margins are healthy.

Furthermore, Allot has a competitive edge in their chosen markets and is well-positioned to capitalize on the upcoming trends in digital transformation. Given the strong financials and bright prospects, investors may want to consider Allot Ltd for their portfolio.

Recent Posts