Aes Corporation Intrinsic Stock Value – AES Corporation Launches Phase One of Arizona’s Largest Wind Farm

June 2, 2023

🌥️Trending News

AES ($NYSE:AES) Corporation is committed to transitioning to clean energy sources and has invested billions of dollars into renewable energy projects in the U.S. and across the world. In Arizona, the company has also invested in solar projects and battery storage solutions. The renewable energy generated by the facility will not only help reduce Arizona’s carbon footprint but will also create jobs and provide economic benefits to the local community. As AES Corporation continues to invest in innovative energy solutions, Arizona and the rest of the world will benefit from a cleaner, more sustainable future.

Price History

On Thursday, AES Corporation made a major step towards achieving its renewable energy goals, launching the first phase of Arizona’s largest wind farm. The news of the launch was met with enthusiasm from investors, as AES Corporation stock opened at $19.9 and closed at the same price, with an increase of 0.7% from the previous day’s closing price of 19.7. This positive response reflects the market’s growing interest in renewable energy solutions and confidence in AES Corporation’s ability to deliver on its promises. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Aes Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 13k | -510 | 3.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Aes Corporation. More…

| Operations | Investing | Financing |

| 2.88k | -6.31k | 3.96k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Aes Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 39.36k | 34.89k | 3.53 |

Key Ratios Snapshot

Some of the financial key ratios for Aes Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.6% | 4.9% | 7.9% |

| FCF Margin | ROE | ROA |

| -18.9% | 26.6% | 1.6% |

Analysis – Aes Corporation Intrinsic Stock Value

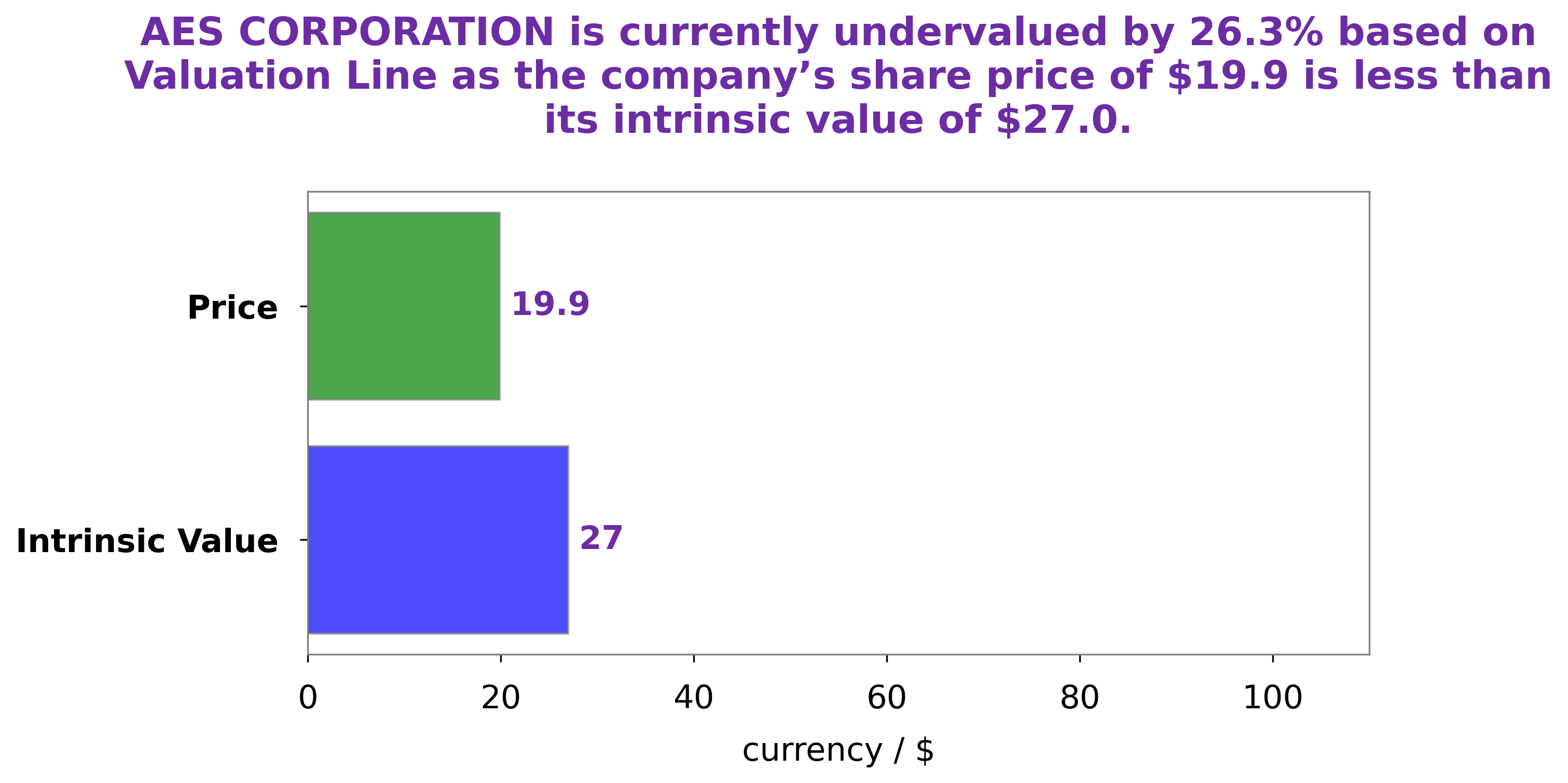

At GoodWhale, we have conducted an in-depth analysis of AES Corporation‘s fundamentals and have determined its intrinsic value to be around $27.0 per share. Our proprietary Valuation Line tool was used to arrive at this conclusion. Currently, AES Corporation stock is being traded at around $19.9 – this is 26.4% lower than its intrinsic value, making it a potentially good investment opportunity for those looking to add it to their portfolio. More…

Peers

The company’s main competitors are Iberdrola SA, Portland General Electric Co, and ALLETE Inc.

– Iberdrola SA ($LTS:0HIT)

Iberdrola SA is a Spanish electric utility company. It is the largest producer of wind power in the world and a major player in the Spanish electricity market. Iberdrola also has a strong presence in the United Kingdom, Mexico, and the United States. The company has a market capitalization of 58.35 billion as of 2022 and a return on equity of 11.07%. Iberdrola is a vertically integrated utility, meaning it is involved in all aspects of the electricity business, from generation to distribution to retail sales. The company has a diversified generation portfolio that includes nuclear, hydro, renewable, and thermal power plants. Iberdrola is also one of the largest distributors of electricity in Spain and the United Kingdom.

– Portland General Electric Co ($NYSE:POR)

The company’s market cap is 3.82B as of 2022. The company’s ROE is 9.64%. The company is a diversified electric utility with operations in Oregon, Washington and Idaho. The company’s primary business is the generation, transmission and distribution of electricity. The company also owns and operates a coal-fired power plant and a natural gas-fired power plant.

– ALLETE Inc ($NYSE:ALE)

Pall Corporation is a global leader in providing filtration, separation and purification solutions to meet the critical fluid management needs of customers across the broad spectrum of life sciences and industry. Pall’s products are key to the success of customers in the medical, biopharmaceutical, semiconductor, water purification, aerospace, and energy markets. The company’s products are used every day by people around the world, in a wide range of applications and industries. Pall Corporation has a market cap of 2.89B as of 2022 and a Return on Equity of 4.57%.

Summary

AES Corporation is a global leader in energy production and services, with investments in clean and renewable energy sources. The company recently announced the commencement of the first phase of its largest wind farm in Arizona. AES has made several investments in renewable energy sources, such as solar, wind, and hydroelectric power.

Additionally, the company has increased its focus on developing energy storage solutions, which could reduce grid demand during peak periods. AES Corporation’s investments in renewable energy sources and energy storage solutions provide investors with a great opportunity for profitable returns.

Recent Posts