Aemetis Stock Intrinsic Value – Aemetis RNG Plant Approved by EPA for D3 RIN Generation

May 19, 2023

Trending News ☀️

The Environmental Protection Agency (EPA) has granted approval to Aemetis ($NASDAQ:AMTX) for their renewable natural gas (RNG) production plant, allowing them to generate D3 RINs. This is a major milestone in Aemetis’ efforts to expand production of clean energy and reduce carbon emissions. It produces and sells biofuels, including ethanol, biodiesel and renewable diesel, and specialty chemicals. The company’s mission is to expand its renewable product lines to replace traditional petroleum-based fuels and industrial chemicals.

The approval of their RNG production plant will help Aemetis meet its goal of reducing carbon emissions, while also generating income through the sale of D3 RINs. This move further aligns Aemetis with the EPA’s clean air standards, demonstrating the company’s commitment to sustainable energy practices.

Price History

On Thursday, the stock price of AEMETIS opened at $2.2 and closed at $2.4, soaring by a whopping 17.3% from its last closing price of $2.1. This surge came after the Environmental Protection Agency (EPA) approved Aemetis’ renewable natural gas (RNG) plant in California to generate D3 RINs, which stand for Renewable Identification Numbers. These RINs act as credits, which are sold to other companies that require them to meet their own Renewable Fuel Standard obligations.

The approval of Aemetis’ RNG plant will not only generate additional revenue from the sales of credits but also help the company in achieving its ultimate goal of becoming a zero-carbon fuels producer. This move is a major step forward in Aemetis’ efforts to become a leader in renewable fuels and is expected to fuel further stock price growth of the company in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Aemetis. More…

| Total Revenues | Net Income | Net Margin |

| 206.62 | -115.87 | -42.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Aemetis. More…

| Operations | Investing | Financing |

| -22.87 | -31.31 | 53.63 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Aemetis. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 210.38 | 432.8 | -6.07 |

Key Ratios Snapshot

Some of the financial key ratios for Aemetis are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.2% | – | -37.4% |

| FCF Margin | ROE | ROA |

| -30.0% | 22.7% | -22.9% |

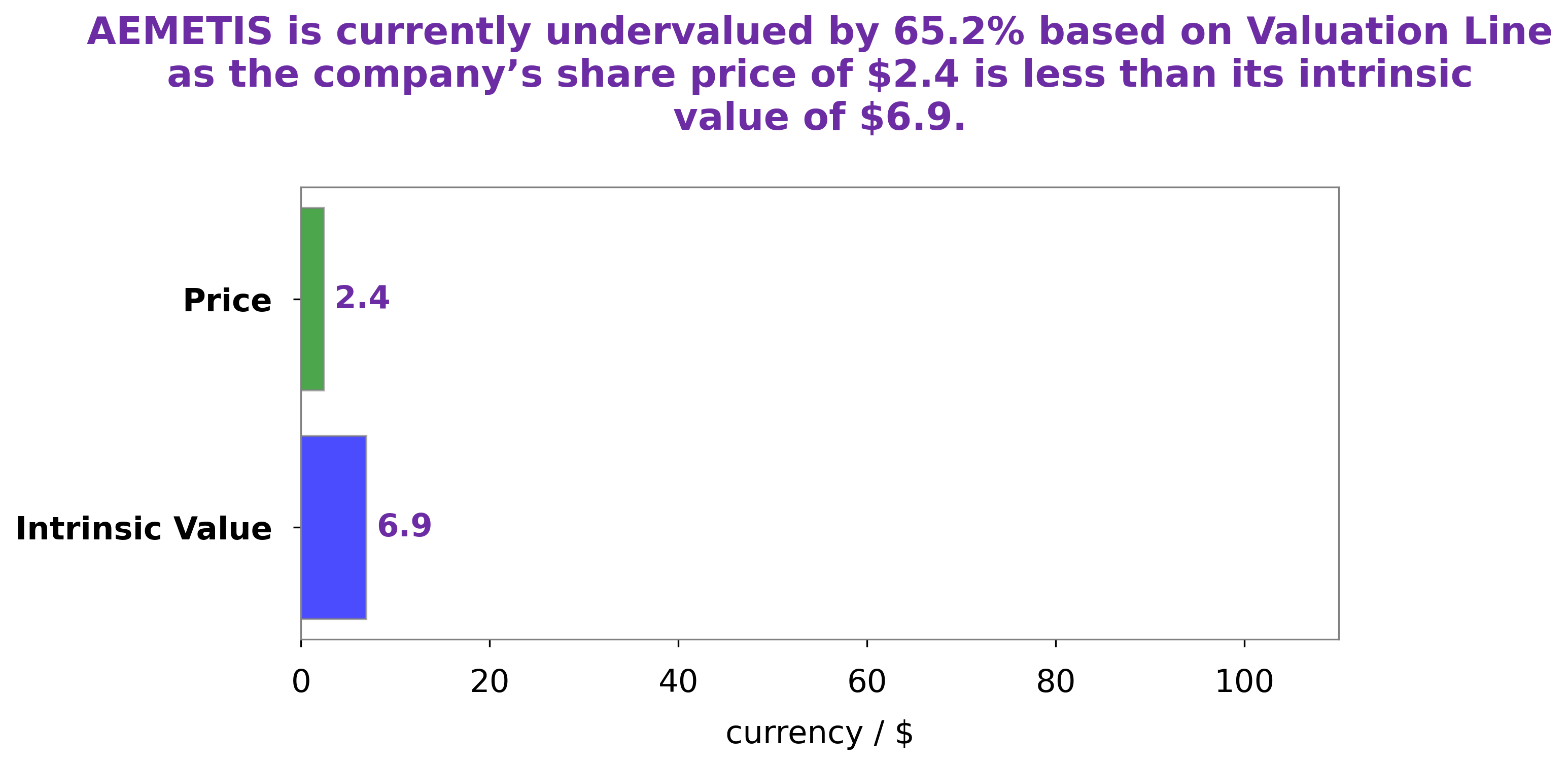

Analysis – Aemetis Stock Intrinsic Value

At GoodWhale, we recently ran an analysis of AEMETIS’s wellbeing. After considering several factors, including the company’s financial position and outlook, our proprietary Valuation Line came up with a fair value of AEMETIS’s share of around $6.9. However, AEMETIS stock is currently trading at $2.4, which is an astonishing 65.3% below its fair value. Thus, we believe AEMETIS stock to be significantly undervalued at this point in time. Aemetis_RNG_Plant_Approved_by_EPA_for_D3_RIN_Generation”>More…

Peers

Headquartered in Cupertino, California, Aemetis operates an integrated production facility in India and a 50,000 gallon per day demonstration and small-scale production facility in Riverbank, California. The company has a joint venture and technology license agreement with a major Indian sugar producer for a large-scale integrated production facility in India. Aemetis owns and operates a 50 million gallon per year ethanol plant in Keyes, California. The company also owns and operates a distillation facility to produce high purity alcohols from renewable feedstocks. Aemetis has developed and patented technology to produce second-generation renewable fuels and chemicals from non-food biomass.

– Bangchak Corp PCL ($SET:BCP)

Bangchak Corporation Public Company Limited is a Thailand-based company engaged in the oil business. The Company operates in five business segments. The Refining and Marketing segment is engaged in the refining of crude oil into petroleum products and the marketing of petroleum products. The Petroleum Retail segment retails gasoline, diesel oil and lubricants under the BP brand. The Power Generation segment is involved in the generation of electricity. The Engineering and Construction segment provides engineering and construction services. The Solar Farm segment provides solar farms services. The Company operates its business through its subsidiaries.

– Thai Oil PCL ($SET:TOP)

Thai Oil PCL is a leading oil and gas company in Thailand with a market cap of 118.31B as of 2022. The company has a strong return on equity of 24.7%. Thai Oil PCL is involved in the exploration, production, refining, and marketing of oil and gas products. The company has a strong presence in Thailand and Southeast Asia.

– Elinoil Hellenic Petroleum Co SA ($LTS:0NTV)

Elinoil Hellenic Petroleum Co SA is a Greece-based company engaged in the refining, marketing and supply of petroleum products, as well as the operation of a network of petrol stations. The Company’s activities are divided into three main segments: Refining, which includes the operation of a refinery in Aspropyrgos; Marketing, which deals with the marketing and sale of petroleum products; and Supply, which includes the supply of crude oil to the refinery. As of December 31, 2011, the Company operated a network of 438 petrol stations.

Summary

Aemetis Inc. recently received approval from the Environmental Protection Agency (EPA) to produce Renewable Natural Gas (RNG) from its production plant, resulting in the generation of D3 Renewable Identification Numbers (RINs). This approval had an immediate effect on Aemetis’ stock; the stock price rose significantly by the end of the day. Investors interested in Aemetis may be attracted to the potential of financial growth and increased profitability as the company expands its RNG production.

Additionally, the company can now benefit from tax incentives and improved marketability due to its association with renewable energy. Given the potential of RNG production, the stock could be a good investment for those looking for a long-term gain.

Recent Posts