Accelerate Diagnostics Stock Intrinsic Value – 38% over the last month.

April 18, 2023

Trending News ☀️

Accelerate Diagnostics ($NASDAQ:AXDX), Inc. is a publicly traded medical technology company which focuses on developing innovative tools to simplify the diagnosis and treatment of infectious diseases. Driven by the success of its products, the company’s revenues have been steadily increasing over the last month, leading market participants to take notice. This has resulted in an impressive 38% spike in the firm’s share prices during this period.

The company’s rapid growth in revenues has clearly caught the attention of market participants, resulting in a substantial surge in its stock price. As the potential of Accelerate Diagnostics, Inc. continues to be recognized by investors, shareholders can expect more gains in the coming months.

Price History

The 13.6% jump from its prior closing price of 0.7 is a clear indication that market participants have taken notice of the company’s increasing revenues. The surge in stock prices shows investors have high hopes for Accelerate Diagnostics, Inc., and believe the company has a bright future ahead of it. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Accelerate Diagnostics. More…

| Total Revenues | Net Income | Net Margin |

| 12.75 | -62.49 | -518.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Accelerate Diagnostics. More…

| Operations | Investing | Financing |

| -48.73 | 12.42 | 31.63 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Accelerate Diagnostics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 65.02 | 87.28 | -0.1 |

Key Ratios Snapshot

Some of the financial key ratios for Accelerate Diagnostics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.1% | – | -461.1% |

| FCF Margin | ROE | ROA |

| -386.5% | 229.2% | -56.5% |

Analysis – Accelerate Diagnostics Stock Intrinsic Value

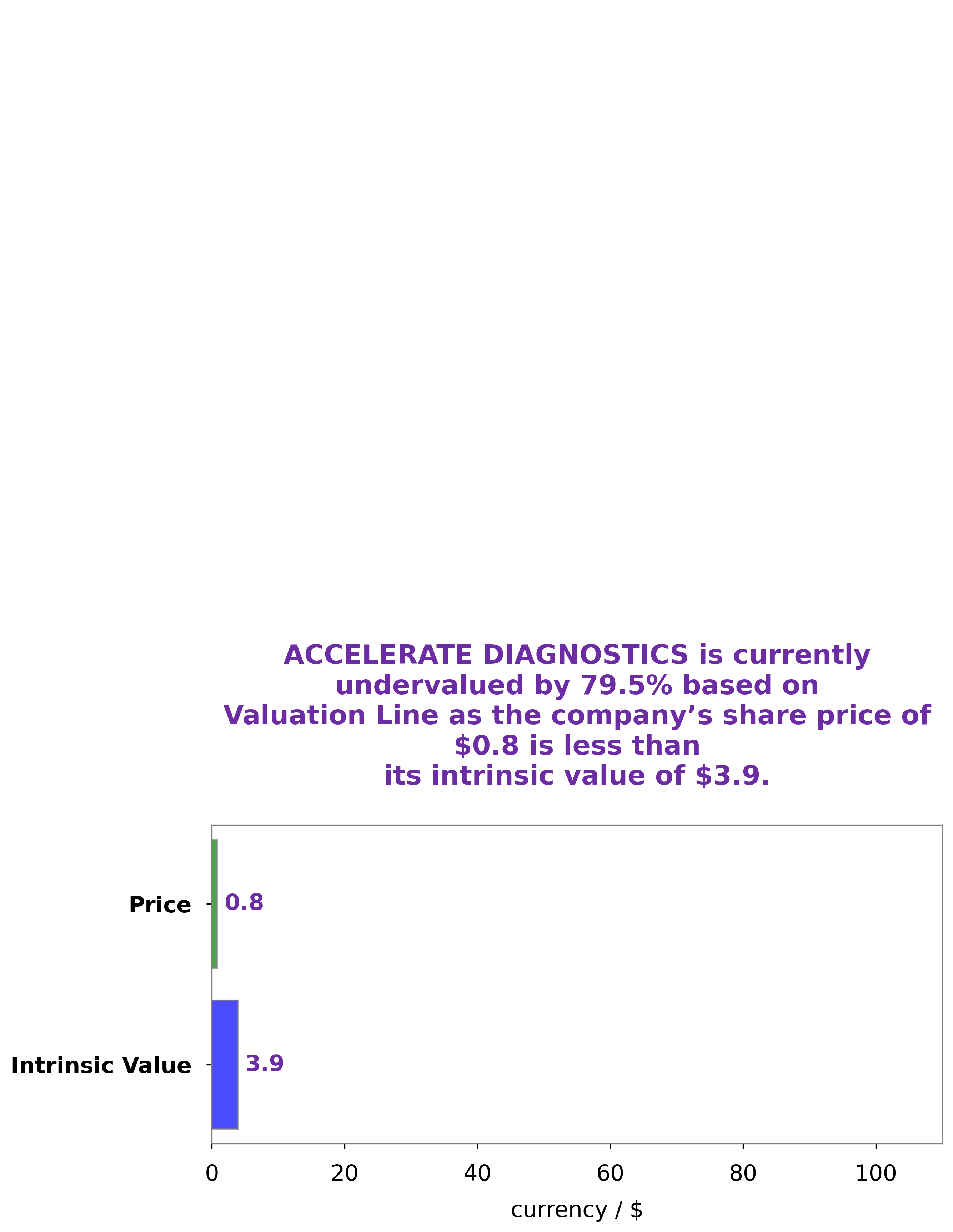

At GoodWhale, we provide a detailed analysis of ACCELERATE DIAGNOSTICS and their fundamentals. Our proprietary Valuation Line provides an intrinsic value of $3.9 per share for ACCELERATE DIAGNOSTICS. This suggests that ACCELERATE DIAGNOSTICS stock is currently undervalued at $0.8 per share, by 79.3%. Therefore, investing in ACCELERATE DIAGNOSTICS stock now could provide good returns over the long term. More…

Peers

It is the leader in the field and is making advancements in the development of products to enable faster and more accurate diagnosis of infectious diseases. It faces competition from Lexagene Holdings Inc, Lucira Health Inc, and Novacyt SA, all of which are developing cutting-edge technology and products to improve the accuracy and speed of diagnosis.

– Lexagene Holdings Inc ($TSXV:LXG)

Lexagene Holdings Inc is a biotechnology company that focuses on developing molecular diagnostic solutions to improve the accuracy of diagnostic results, enhance the speed of testing, and reduce the cost of molecular diagnostics. The company has a market cap of 37.46M as of 2023, reflecting a strong presence in the biotechnology industry. Additionally, Lexagene Holdings Inc has a Return on Equity of -164.09% which is an indication of the company’s inability to generate profits from its investments. The negative return on equity is likely due to the company’s high research and development costs.

– Lucira Health Inc ($NASDAQ:LHDX)

Lucira Health Inc is a healthcare technology company based in California. The company specializes in the development and commercialization of molecular diagnostics and devices for the detection of infectious diseases. As of 2023, Lucira Health Inc had a market cap of 12.64M, indicating that its total value is greater than its current liabilities. Despite its relatively small size, Lucira Health Inc had a Return on Equity of -71.77%, indicating that it has not been able to generate sufficient profits to cover its equity investments. This suggests that the company may be facing various challenges, such as low profit margins or high operating costs.

– Novacyt SA ($OTCPK:NVYTF)

Novacyt SA is a biotechnology company that specializes in providing innovative solutions to the global healthcare sector. The company is based in France and focuses on the development of advanced diagnostic tests and clinical pathology products. With a market capitalization of 72.21 million euros, Novacyt SA is a relatively small but growing player in the biotechnology industry. Despite its size, the company has managed to generate an impressive -1.05% return on equity, indicating that it is making sound investments and managing its capital efficiently. This suggests that Novacyt SA is well-positioned to continue its growth trajectory in the coming years.

Summary

Investors of Accelerate Diagnostics, Inc. have seen a 38% increase in share price over the past day. This jump appears to be a result of recognition of the company’s growing revenues, signaling a strong outlook for its future. Based on the current market sentiment, now may be a good time for investors to take a closer look at Accelerate Diagnostics, Inc. and consider it for long-term investments.

Recent Posts