Jd.com Stock Intrinsic Value – 61% Discount Offered on JD.com: Now is the Time to Buy!

June 3, 2023

🌥️Trending News

JD.COM ($NASDAQ:JD): Now is the time to take advantage of the amazing 61% discount offered on JD.com! This Chinese online retailer has quickly become one of the biggest names in e-commerce, offering a wide variety of products, from apparel to electronics. As one of the largest publicly traded companies in the world, JD.com has seen tremendous growth over the last few years and is showing no signs of slowing down.

With this incredible discount, now is the perfect time to purchase items from their expansive selection at a fraction of the normal cost. Don’t miss out on this incredible opportunity – shop JD.com today!

Analysis – Jd.com Stock Intrinsic Value

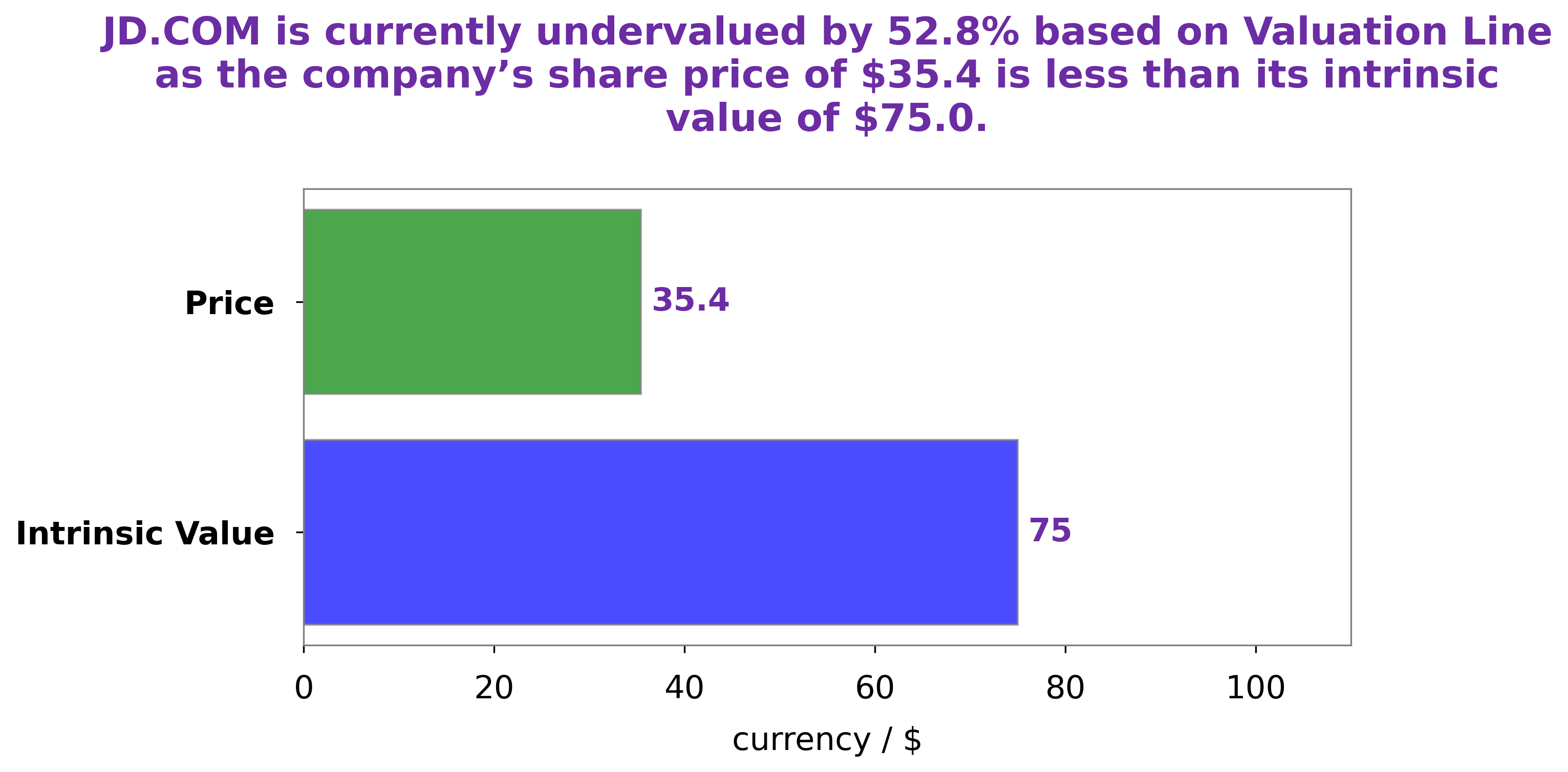

GoodWhale has conducted an analysis of JD.COM’s financials. Our proprietary Valuation Line indicates that the intrinsic value of a JD.COM share is around $75.0. This means that currently the stock is trading at $35.4, significantly lower than its intrinsic value, undervalued by 52.8%. This presents a great buying opportunity for investors looking to capitalize on this discrepancy and potentially reap significant rewards in the future. JD.com_Now_is_the_Time_to_Buy”>More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Jd.com. More…

| Total Revenues | Net Income | Net Margin |

| 1.05M | 19.63k | 2.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Jd.com. More…

| Operations | Investing | Financing |

| 39.7k | -41.9k | -10.26k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Jd.com. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 551.04k | 277.03k | 135.02 |

Key Ratios Snapshot

Some of the financial key ratios for Jd.com are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.4% | 42.6% | 2.6% |

| FCF Margin | ROE | ROA |

| 1.6% | 7.9% | 3.1% |

Summary

Investing in JD.com could be a lucrative opportunity, as the company is currently trading at a potential 61% discount. Analysts recommend investing in JD.com due to its strong fundamentals and promising outlook. The company has shown consistent year-over-year growth in both revenues and profits, and its user base and market share continue to expand.

Additionally, JD.com has made significant investments to upgrade its technology, infrastructure, and logistics capabilities. This has enabled it to become one of the most competitive e-commerce businesses in China. With all these factors in consideration, investing in JD.com could be a great way to diversify an investment portfolio and take advantage of the current discounted pricing.

Recent Posts