SHUTTERSTOCK Reports Record-Breaking Earnings and Revenue

April 26, 2023

Trending News 🌥️

Shutterstock ($NYSE:SSTK), a leading provider of digital imagery and music, recently reported record-breaking earnings and revenue. The company’s Non-GAAP EPS of $1.29 exceeded expectations by $0.25, while revenue of $215.28M beat forecasts by $3.74M. This marks an impressive performance for the company. The company offers a wide selection of royalty-free images, vectors, illustrations, videos and music, giving customers access to millions of options to choose from.

In addition, Shutterstock also provides tools and services that help customers better manage, monetize and distribute their content. The company’s recent performance shows that its investments in technological innovation and customer service are paying off. Going forward, Shutterstock is committed to continuing to provide high-quality content and services to its customers, and is confident that it will continue to report strong financial results.

Price History

The stock opened at $70.5 and closed at $69.4, up by 3.0% from prior closing price of 67.4. The strong performance is largely attributed to the success of SHUTTERSTOCK’s subscription business model, which offers customers access to unlimited downloads of images, vectors, and videos. The company also noted that its Enterprise solution, which provides customers with tailored content solutions, has seen strong growth in the past quarter.

The results have enabled SHUTTERSTOCK to grow its customer base and expansion into new markets, further driving its revenue and profitability. These results demonstrate the strength of SHUTTERSTOCK’s subscription business model and underscore its ability to successfully navigate the challenging economic environment caused by the pandemic. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Shutterstock. SHUTTERSTOCK_Reports_Record-Breaking_Earnings_and_Revenue”>More…

| Total Revenues | Net Income | Net Margin |

| 827.83 | 76.1 | 11.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Shutterstock. SHUTTERSTOCK_Reports_Record-Breaking_Earnings_and_Revenue”>More…

| Operations | Investing | Financing |

| 158.45 | -275.55 | -79.49 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Shutterstock. SHUTTERSTOCK_Reports_Record-Breaking_Earnings_and_Revenue”>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 881.18 | 433.7 | 12.49 |

Key Ratios Snapshot

Some of the financial key ratios for Shutterstock are shown below. SHUTTERSTOCK_Reports_Record-Breaking_Earnings_and_Revenue”>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.4% | 77.3% | 11.2% |

| FCF Margin | ROE | ROA |

| 11.9% | 13.2% | 6.6% |

Analysis

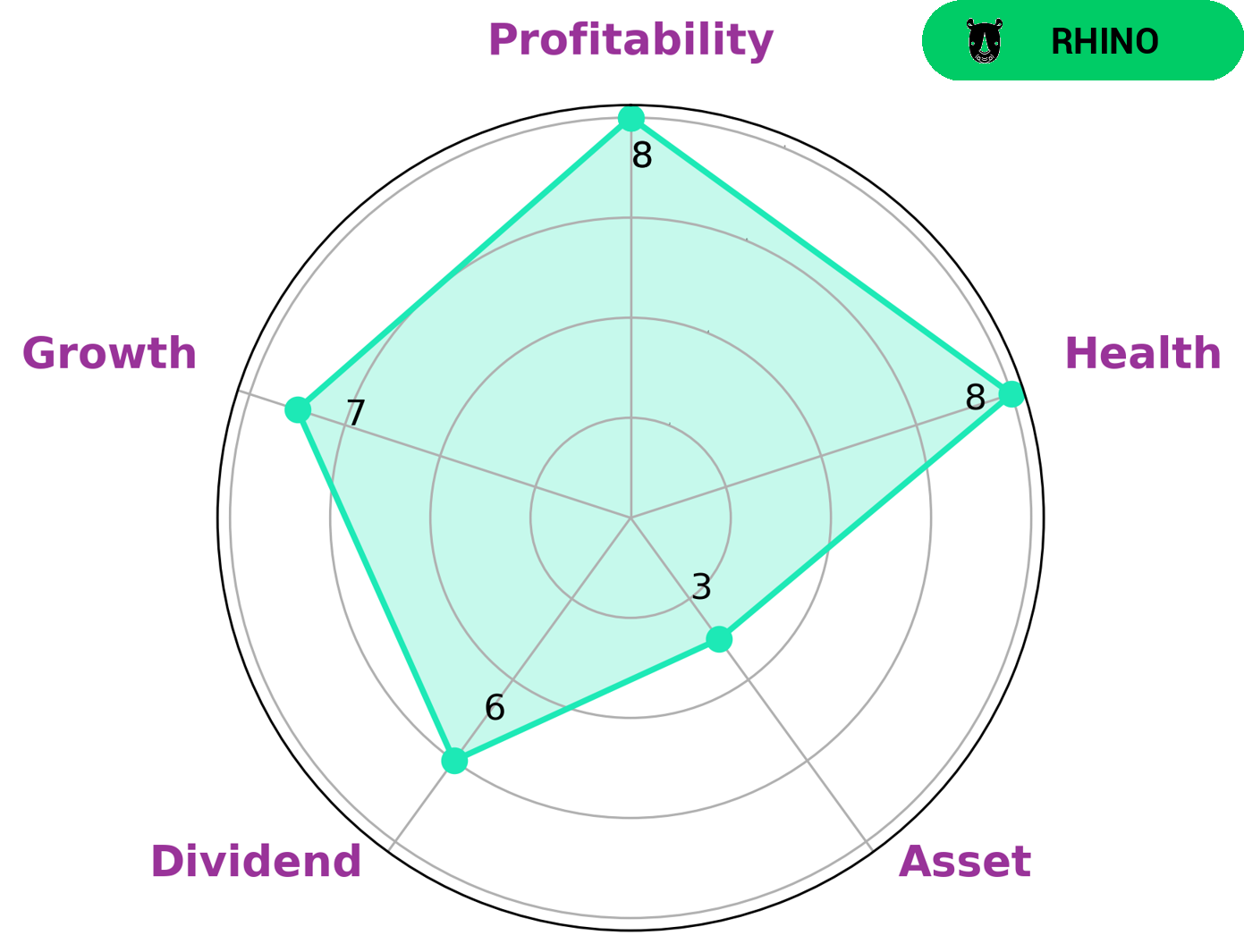

GoodWhale has done an analysis on the fundamental of SHUTTERSTOCK and made the following assessment. Our star chart shows that SHUTTERSTOCK is strong in growth and profitability, medium in dividend, and weak in asset. Its high health score of 8/10 with regard to its cashflows and debt indicates that it is capable to safely ride out any crisis without the risk of bankruptcy. After further evaluation, SHUTTERSTOCK is classified as a ‘rhino’, a type of company we conclude that has achieved moderate revenue or earnings growth. Given the fundamentals and characteristics of SHUTTERSTOCK, investors who are looking for a secure but steady investment may be interested in the company. Investors looking to invest in a company with a strong track record of growth and profitability may also find it attractive. In addition, those looking for a dividend stock may find SHUTTERSTOCK appealing as well given its medium rating in dividend. More…

Peers

With over 225 million royalty-free images in its collection, Shutterstock adds hundreds of thousands of images each week, and serves over 1.5 million customers in 150 countries. Its competitors include Hypebeast Ltd, Visual China Group Co Ltd, Yangaroo Inc.

– Hypebeast Ltd ($SEHK:00150)

Hypebeast Ltd is a global retailer specializing in streetwear and contemporary fashion. As of 2022, the company has a market capitalization of 1.01 billion and a return on equity of 20.07%. Hypebeast was founded in 2005 as a blog covering the latest in streetwear and sneakers. Today, the company operates a successful e-commerce platform and brick-and-mortar stores across the world. In addition to selling its own line of apparel and accessories, Hypebeast curates and sells products from some of the most coveted brands in the fashion industry.

– Visual China Group Co Ltd ($SZSE:000681)

Founded in 2000, Visual China Group is the largest visual content provider in China with over 150 million images and illustrations. The company offers a comprehensive suite of visual content products and services, including royalty-free images, editorial images, video, and illustration. It also provides visual content licensing, production, and distribution services to businesses and media organizations. As of 2022, Visual China Group has a market cap of 7.61B and a return on equity of 1.87%. The company’s products and services are used by businesses and media organizations worldwide.

– Yangaroo Inc ($TSXV:YOO)

Kangaroo is a provider of secure digital workspaces. The company has a market cap of 3.11M and a return on equity of 21.73%. Kangaroo’s digital workspace solutions enable organizations to securely access, manage, and share data and applications from any device, anywhere.

Summary

The company posted a Non-GAAP earnings per share (EPS) of $1.29, which was $0.25 higher than analyst estimates. Revenue of $215.28M also beat estimates by $3.74M. Stock prices reacted positively to the news, increasing on the same day.

From an investment perspective, Shutterstock appears to be in a strong financial position, with better than expected performance from both earnings and revenue. Investors should continue to monitor the stock to ensure that the company can maintain its current growth trajectory going forward.

Recent Posts