Match Group Up 15.30% YTD, But Is It Still a Loss Stock?

January 30, 2023

Trending News 🌧️

The company is headquartered in Dallas, Texas and is publicly traded on the Nasdaq exchange under the ticker symbol “MTCH”. Despite being up 15.30% year-to-date, some investors may be wondering if Match Group ($NASDAQ:MTCH) Inc. is still a loss stock in the recent session. Since the IPO, the stock has seen significant volatility with multiple peaks and valleys. In the past few months, however, the stock has seen some positive momentum as the company continues to expand its product offerings and partner with new companies. The company also recently announced a three-year partnership with the NBA to further expand its reach and increase user engagement.

This news has pushed the stock up 15.30% year-to-date and may be a sign that the company is beginning to turn around. Although Match Group Inc. has been a loss stock in the past, there are signs that the company may be on the upswing. Investors should keep an eye on the stock to see if it can continue its positive momentum and break out of its bearish trend of the past few years. With its strong product portfolio and new partnerships, Match Group Inc. may be well on its way to becoming a profitable stock in the near future.

Price History

At the start of the year, its stock price was up 15.30% year-to-date (YTD).

However, the news sentiment surrounding the stock has been mostly negative. On Monday, MATCH GROUP opened at $50.8 and closed at $52.1, up by 3.3% from prior closing price of 50.4. Despite the positive price movement, many investors are still wary about investing in the company. The company has been dealing with a lot of legal issues in recent months and its future outlook is uncertain. Many analysts believe that MATCH GROUP is still a loss stock due to its current business model and its lack of profitability. The company’s main source of income is advertising, which is becoming an increasingly competitive market. Furthermore, the company’s growth prospects are limited as it is already well established in the market.

In addition, there are concerns about the company’s ability to handle the increasing competition from other companies in the sector. There are also concerns that the company may not be able to handle the increasing regulatory scrutiny in the industry. All these factors have cast doubt on its future prospects. Overall, while MATCH GROUP may have seen a surge in its share price YTD, investors should still exercise caution when investing in it as there are many risks involved. It remains to be seen whether the company will be able to turn things around and become profitable in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Match Group. More…

| Total Revenues | Net Income | Net Margin |

| 3.21k | 108.74 | 3.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Match Group. More…

| Operations | Investing | Financing |

| 546.02 | -85.22 | -562.85 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Match Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.91k | 4.61k | -2.5 |

Key Ratios Snapshot

Some of the financial key ratios for Match Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -11.6% | 4.9% | 7.0% |

| FCF Margin | ROE | ROA |

| 15.0% | -24.4% | 3.6% |

VI Analysis

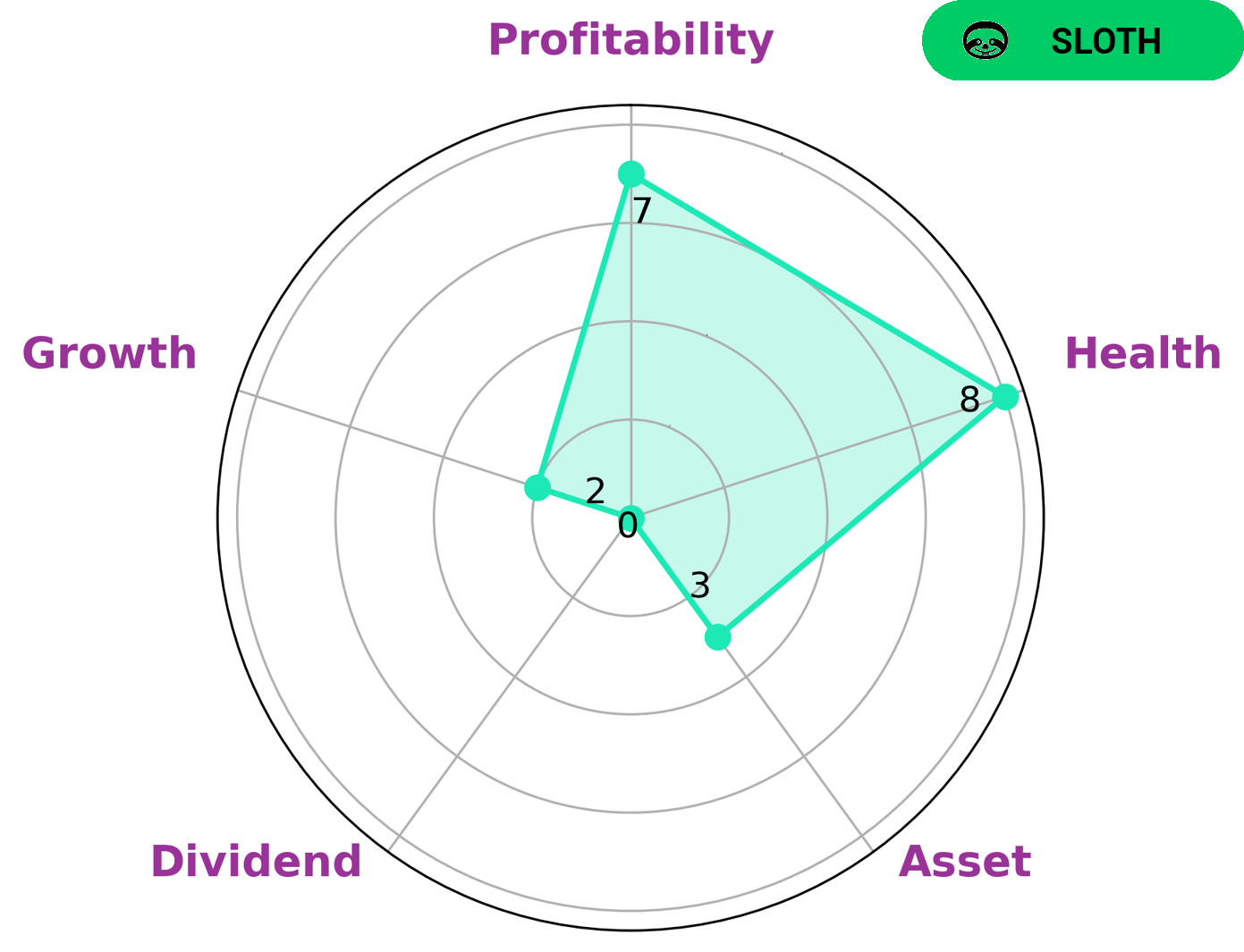

The VI app simplifies the analysis of MATCH GROUP‘s fundamentals, which indicates its long term potential. It provides a VI Star Chart showing that MATCH GROUP has a high health score of 8/10 due to its cashflows and debt, capable of sustaining any crisis without the risk of bankruptcy. The company is classified as ‘sloth’, a type of company that has achieved revenue or earnings growth slower than the overall economy. Given this information, investors may be interested in MATCH GROUP if they are looking for a company with strong profitability, but weak in asset, dividend, and growth. This could be attractive to value investors, who look for undervalued stocks, or income investors, who are looking for dividend-paying stocks. However, the company’s slow growth rate may be a deterrent for growth investors. In conclusion, MATCH GROUP’s fundamentals indicate its potential as a long-term investment. Although it is classified as ‘sloth’, it has strong profitability and is able to ride out any crisis. Investors should assess their own goals and risk tolerance when considering whether to invest in MATCH GROUP. More…

VI Peers

– Baltic Classifieds Group PLC ($LSE:BCG)

Baltic Classifieds Group PLC is a leading digital classifieds business in the Baltic and Nordic region. The company operates some of the region’s most popular and successful websites, including Skelbiu, Osta.ee and City24. It has a market capitalization of 670.58M as of 2022. Its Return on Equity (ROE) is 4.84%, which is an indicator of the company’s performance and ability to generate profits from its shareholders’ investments. The company continues to grow through acquisitions and expansion into new markets, as well as developing new products and services for its customers.

– Bylog Group Corp ($OTCPK:BYLG)

Darelle Online Solutions Inc is a software development and technology consulting firm headquartered in California. It has a market cap of 552.81k as of 2022, which reflects its financial performance and potential for further growth. The company’s Return on Equity (ROE) stands at 11.04%, which is an impressive figure that highlights the efficiency of capital management within the firm. Darelle Online Solutions Inc specializes in offering IT solutions to organizations in the fields of e-commerce, automation, analytics, cloud computing, and more. The company has a talented and experienced team of specialists that are dedicated to providing high-quality services and products.

Summary

Investors should take a closer look at Match Group Inc. despite the current negative news sentiment. The stock has seen a 15.30% increase year-to-date, making it a potentially profitable investment opportunity. Analysts suggest that investors delve further into the company’s performance, financials, and outlook before investing and consider potential risks as well as rewards.

Factors to consider include the company’s competitive position in the industry, technological advancements, regulatory changes, and overall economic conditions. It is important to do your own research and draw your own conclusions before investing in Match Group Inc.

Recent Posts