Match Group Intrinsic Value – Maximize Your Investment with Match Group (MTCH)

April 2, 2023

Trending News 🌥️

Investing in Match Group ($NASDAQ:MTCH) Inc. (MTCH) can be a great way to maximize your investments while taking advantage of a secure and reliable source of income. Match Group is a leading provider of dating products, with a portfolio of brands including Tinder, Match, Meetic, OkCupid, Hinge, Pairs, PlentyOfFish and OurTime. The company operates in more than 40 languages, covering virtually all of the world’s largest markets. Match Group offers investors a portfolio of high-quality, diversified businesses with strong financial performance and attractive returns. The performance of the Match Group stock has been strong in recent years, making it a popular investment choice for many investors. Match Group also has a long history of financial stability and consistent growth, making it a reliable source of income for investors.

The company has also made strategic investments to maintain its competitive edge in the rapidly changing online dating landscape. This includes buying smaller dating companies to expand its portfolio and launching new services such as Tinder Gold and Tinder Plus. These investments have enabled Match Group to remain a market leader in the industry. Overall, Match Group Inc. (MTCH) is an attractive investment opportunity due to its strong financial performance and attractive returns. The company’s long-term prospects are bright, making it an ideal choice for investors looking to maximize their investments.

Price History

On Monday, Match Group Inc. (MTCH) opened its stock at $40.4 and closed at $40.3, representing a 0.3% increase from its previous closing price of $40.2. This slight growth in stock value makes Match Group a viable investment opportunity for those looking to maximize their return. In addition, the company’s strong portfolio of popular dating and social media apps, such as Tinder and Hinge, means that users are more likely to keep paying for their subscriptions, thereby increasing the stock value. As MTCH continues to grow in the coming years, investing in it now could be a profitable choice for investors interested in maximizing their investments. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Match Group. More…

| Total Revenues | Net Income | Net Margin |

| 3.19k | 361.95 | 22.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Match Group. More…

| Operations | Investing | Financing |

| 525.69 | -71.7 | -689.17 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Match Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.18k | 4.54k | -1.29 |

Key Ratios Snapshot

Some of the financial key ratios for Match Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -12.5% | 14.7% | 16.4% |

| FCF Margin | ROE | ROA |

| 14.9% | -61.7% | 7.8% |

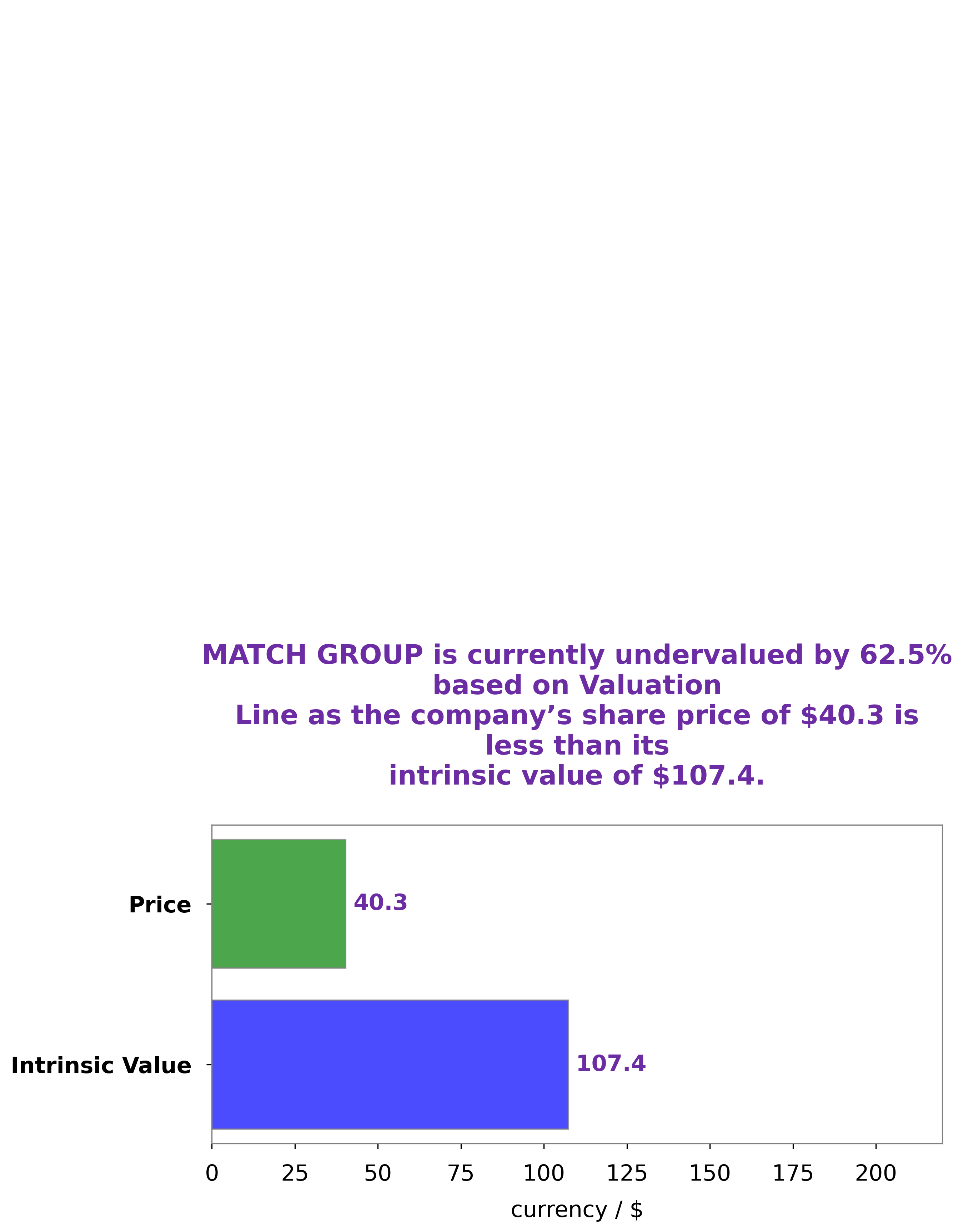

Analysis – Match Group Intrinsic Value

At GoodWhale, we have performed an analysis of MATCH GROUP‘s wellbeing and our proprietary Valuation Line has calculated an intrinsic value of $107.4 for its shares. Currently, its stock is being traded at $40.3, which is 62.5% lower than the intrinsic value. This indicates that MATCH GROUP’s shares are highly undervalued and therefore, presents an excellent opportunity for investors to buy at a discounted price. More…

Peers

– Baltic Classifieds Group PLC ($LSE:BCG)

Baltic Classifieds Group PLC is a leading digital classifieds business in the Baltic and Nordic region. The company operates some of the region’s most popular and successful websites, including Skelbiu, Osta.ee and City24. It has a market capitalization of 670.58M as of 2022. Its Return on Equity (ROE) is 4.84%, which is an indicator of the company’s performance and ability to generate profits from its shareholders’ investments. The company continues to grow through acquisitions and expansion into new markets, as well as developing new products and services for its customers.

– Bylog Group Corp ($OTCPK:BYLG)

Darelle Online Solutions Inc is a software development and technology consulting firm headquartered in California. It has a market cap of 552.81k as of 2022, which reflects its financial performance and potential for further growth. The company’s Return on Equity (ROE) stands at 11.04%, which is an impressive figure that highlights the efficiency of capital management within the firm. Darelle Online Solutions Inc specializes in offering IT solutions to organizations in the fields of e-commerce, automation, analytics, cloud computing, and more. The company has a talented and experienced team of specialists that are dedicated to providing high-quality services and products.

Summary

Match Group Inc. (MTCH) is an attractive investment for those looking for a reliable stock with high potential for growth. Analysts have expressed confidence in the company’s business model, citing its strong track record of success and the diversification of its portfolio of services. The company has been able to capitalize on growing demand in the online dating market, and its presence is expected to continue to increase as more people become familiar with the ease and convenience of online services. The company is also increasingly tapping into other areas such as gaming, livestreaming, and even professional networking.

Recent Posts