Singapore Post Limited: Majority Ownership Held by Individual Investors

April 27, 2023

Trending News 🌧️

Singapore Post ($SGX:S08) Limited, commonly known as SingPost, is a leading provider of postal, e-commerce and logistics services in Singapore. Public companies own the remaining 37%. This strong ownership by individual investors suggests that they have a strong influence in the company’s management and business decisions. SingPost offers a wide range of services, from conventional mail services, to e-commerce logistics, and even parcel locker delivery. Its core postal business is supported by a strong and reliable delivery infrastructure, all backed by its commitment to customer service excellence.

The company’s advanced logistics capabilities have also enabled it to become an e-commerce enabler in the region by providing end-to-end e-commerce logistics solutions. SingPost is currently developing new services such as advanced data analytics, to help its customers excel in the digital age. SingPost has a long history of providing reliable postal services throughout Singapore, and its recent expansions have been designed to help customers keep pace with the rapid growth of the e-commerce industry in the region. With the majority ownership held by individual investors, Singapore Post Limited promises to continue innovating and delivering effective solutions to its customers.

Share Price

On the day of the opening, SingPost’s stock opened at SG$0.5 and closed at an identical value. This is indicative of the confidence in the company from investors, as well as the steady growth that SingPost has experienced over the past few years. As one of the leading postal and logistics companies in Singapore, SingPost has been a reliable source of growth for individual investors. Whether through direct ownership or through funds, this has been a great way to gain exposure to the company’s shares. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Singapore Post. More…

| Total Revenues | Net Income | Net Margin |

| 1.89k | 26.66 | 2.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Singapore Post. More…

| Operations | Investing | Financing |

| 70.93 | -56.24 | -58.22 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Singapore Post. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.77k | 1.43k | 0.67 |

Key Ratios Snapshot

Some of the financial key ratios for Singapore Post are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.6% | -5.6% | 4.5% |

| FCF Margin | ROE | ROA |

| 2.1% | 3.8% | 1.9% |

Analysis

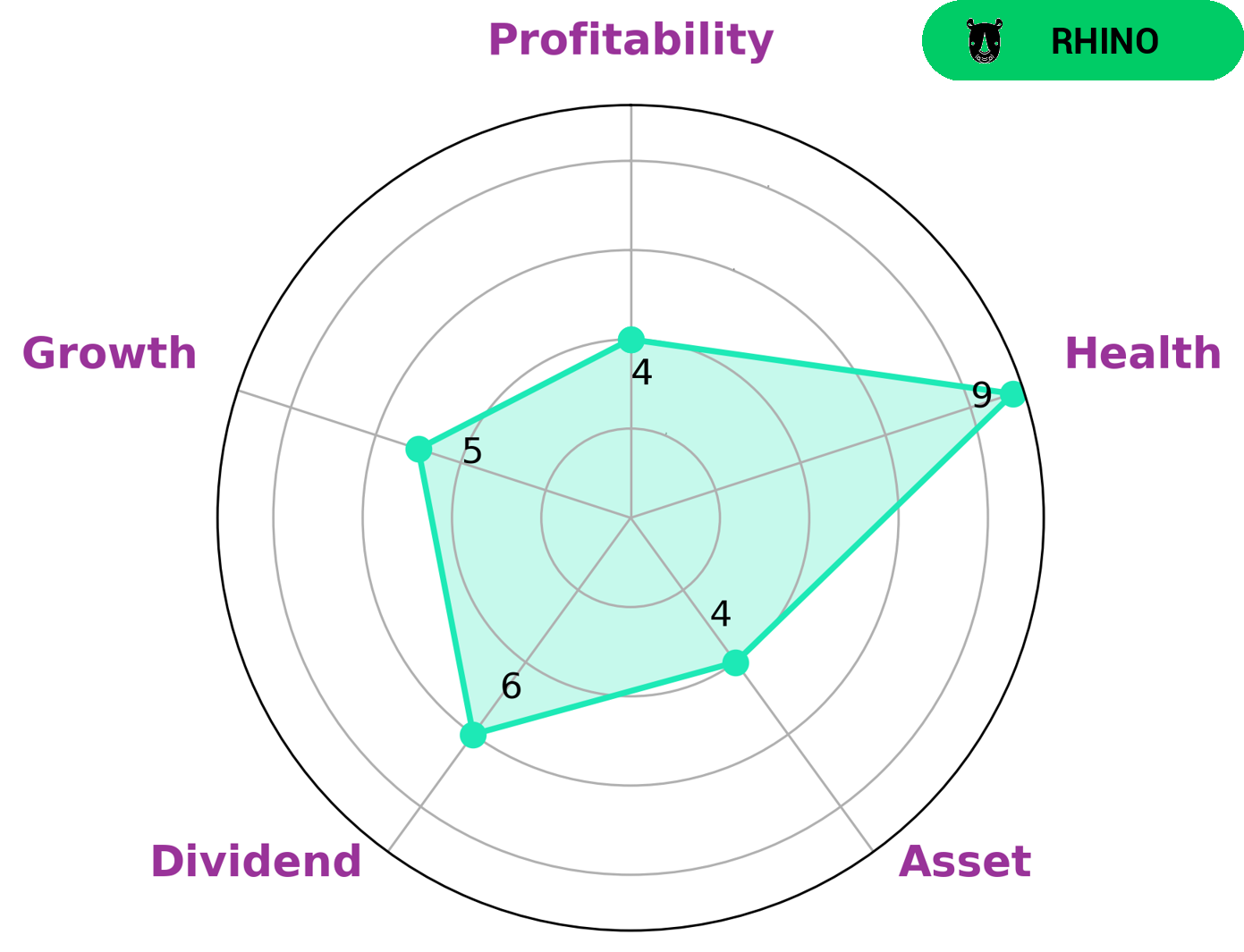

GoodWhale has conducted a thorough analysis of SINGAPORE POST’s fundamentals. According to our Star Chart, SINGAPORE POST has a high health score of 9/10, indicating strong cashflow and debt capabilities that can be used to pay off debt and fund future operations. Overall, SINGAPORE POST scores well in terms of asset, dividend, growth, and profitability, and is classified as a ‘rhino’, which means that the company has achieved moderate revenue or earnings growth. This type of company would likely be attractive to more conservative investors who are looking for steady returns over time, rather than those seeking short-term growth or high returns. Investors who are interested in such companies should consider all the risks involved before making their final decision. Ultimately, it is up to the individual investor to determine whether or not an investment in SINGAPORE POST is right for them. More…

Peers

The competition between Singapore Post Ltd and its competitors, GDEX Bhd, Tiong Nam Logistics Holdings Bhd, and CTI Logistics Ltd, is fierce. All four companies are working hard to provide the best delivery services and customer experience, with each vying for a larger share of the market. With their diverse offerings and innovative approaches, customers have a lot of choice when it comes to selecting a provider.

– GDEX Bhd ($KLSE:0078)

GDEX Bhd is a Malaysian-based logistics and courier service provider that offers a range of delivery services for both domestic and international customers. With a market capitalization of 835.27 million as of 2022, GDEX Bhd is one of the largest logistics and courier service companies in the region. Its return on equity (ROE) stands at 8.41%, which indicates that the company is able to generate a return that is above the industry average. This suggests that the company’s management has been able to make the best use of its resources and investments, resulting in higher returns for shareholders.

– Tiong Nam Logistics Holdings Bhd ($KLSE:8397)

Tiong Nam Logistics Holdings Bhd is a Malaysian-based logistics and transport services provider. The company has a market capitalization of 408.67M as of 2022, representing the total value of the company’s outstanding shares. Additionally, it has a Return on Equity (ROE) of 4.51%, which measures how much profit the company produces relative to the amount of shareholder equity. The company provides a wide range of services including freight forwarding, warehousing, and transportation services. It also provides supply chain management solutions to its customers. Tiong Nam Logistics Holdings Bhd is one of the leading players in the logistics and transport industry in Malaysia.

– CTI Logistics Ltd ($ASX:CLX)

CTI Logistics Ltd is a leading provider of supply chain and logistics solutions. The company provides services such as freight forwarding, customs clearance, warehousing and distribution, and other services related to international trade. Its market capitalization of 122.67 million as of 2022 reflects the company’s immense growth, making it one of the leading players in the industry. Its Return on Equity (ROE) of 16.49% indicates the company’s strong financial performance and indicates CTI Logistics Ltd’s ability to efficiently utilize its assets and generate returns.

Summary

Investing in Singapore Post can be a lucrative opportunity for investors. The company is 54% owned by individual investors and 37% by public companies. This indicates a strong individual investor presence, with greater potential for input into management and business decisions. Singapore Post is renowned for its reliable mail service, but is also diversifying its services to include logistics and e-commerce solutions. It remains an attractive prospect for investors looking to diversify their portfolios, given its high dividend yield and low equity risk.

Additionally, Singapore Post has a stable cash flow and a positive outlook, making it a solid choice for long-term investments.

Recent Posts