Forward Air Intrinsic Value Calculation – Texas Teacher Retirement System Slashes 11.6% of Forward Air Co. Shares on June 7, 2023

June 9, 2023

☀️Trending News

On June 7, 2023, the Teacher Retirement System of Texas (TRS) revealed that it had reduced its holdings in Forward Air ($NASDAQ:FWRD) Co. stock by 11.6%. The now former largest investor of the logistics and transportation company had made the decision to decrease its stake in the company, which was a surprise to many on Wall Street. Forward Air Co., or FWRD, is a logistics and transportation company headquartered in Greenville, Tennessee with operations across the United States, Mexico, and Canada. It specializes in air and surface express services and provides a wide range of logistics offerings to its customers. FWRD also provides a variety of ancillary services such as intermodal, warehousing, temperature-controlled freight, and customs brokerage services.

The news of TRS reducing its stake in FWRD sent shockwaves throughout Wall Street as investors try to understand the reasoning behind the move. While some analysts point to the current economic climate as a potential cause, others suggest that TRS is simply looking to diversify their holdings in order to spread risk. Whatever the reason, this news will likely have an impact on the FWRD stock price in the near term and investors will be closely monitoring the situation going forward.

Analysis – Forward Air Intrinsic Value Calculation

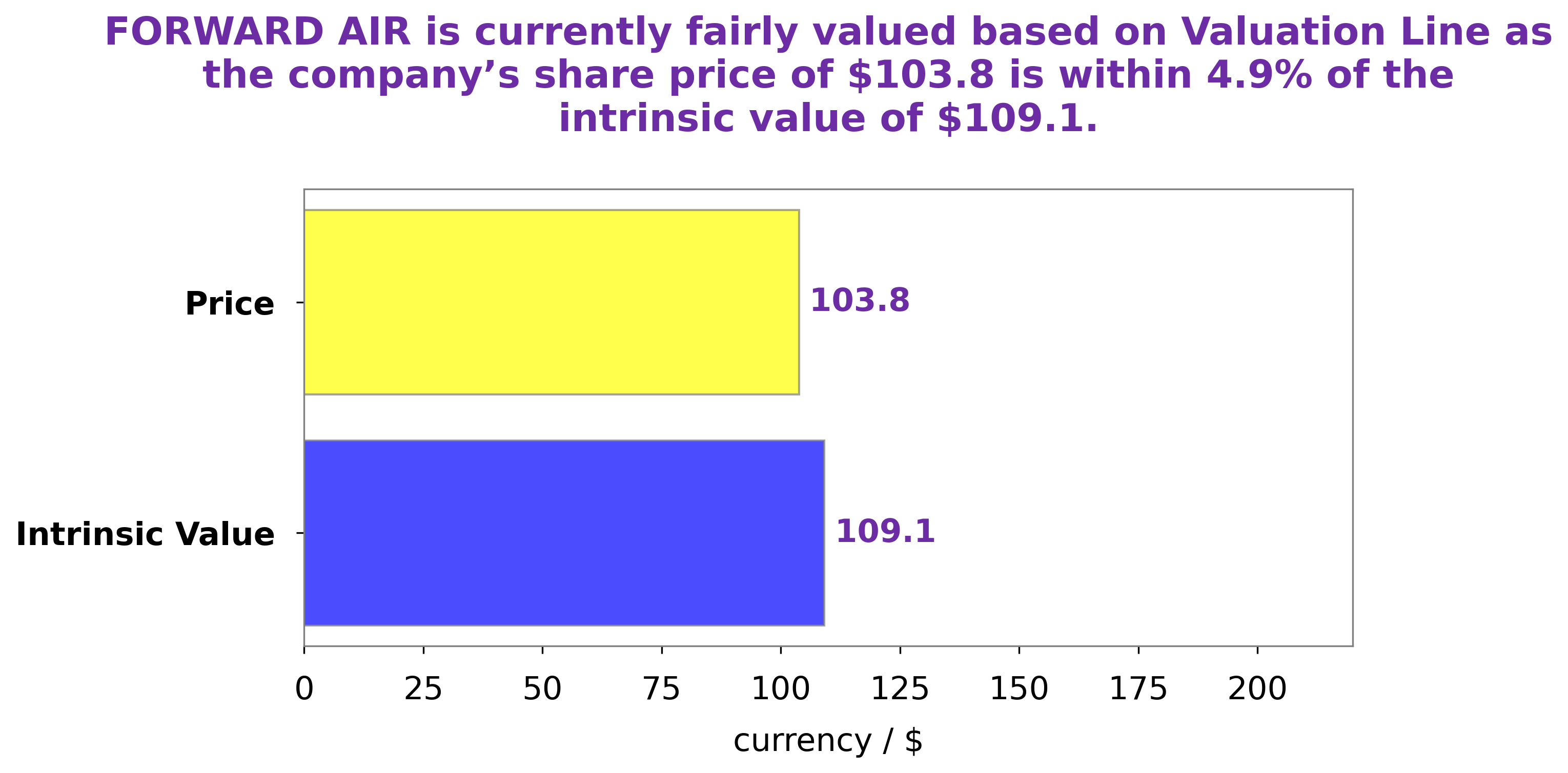

At GoodWhale, we recently conducted an in-depth analysis of FORWARD AIR’s wellbeing. Based on our proprietary Valuation Line, we have calculated the fair value of FORWARD AIR shares at around $109.1. However, the stock is currently traded at $103.8, making it a fair price that is undervalued by 4.8%. This presents a great opportunity for investors to purchase FORWARD AIR stocks at a reasonable price. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Forward Air. More…

| Total Revenues | Net Income | Net Margin |

| 1.93k | 186.05 | 9.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Forward Air. More…

| Operations | Investing | Financing |

| 262.6 | -156.61 | -135.59 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Forward Air. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.23k | 540.93 | 26.27 |

Key Ratios Snapshot

Some of the financial key ratios for Forward Air are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.5% | 34.8% | 13.4% |

| FCF Margin | ROE | ROA |

| 11.6% | 23.3% | 13.2% |

Peers

Forward Air Corporation is an American freight transportation and logistics company with its headquarters in Greeneville, Tennessee. The company operates 97 terminals and 10 Hubs throughout the United States. Forward Air has been in business since 1974 and has a fleet of over 1,400 tractors and 2,800 trailers. The company’s revenue was $946 million in 2017.

– Janel Corp ($OTCPK:JANL)

Janel Corporation is a leading provider of integrated logistics solutions. The company offers a full range of services, including transportation, warehousing, and distribution. Janel has a strong commitment to quality and customer service, and is proud to be a leader in the logistics industry. The company has a market cap of 47.09M as of 2022 and a return on equity of 35.82%. Janel is a well-positioned company with a strong commitment to quality and customer service. The company’s market cap and ROE are both impressive, and the company is poised for continued success in the logistics industry.

– Grand Power Logistics Group Ltd ($SEHK:08489)

Grand Power Logistics Group Ltd is a Hong Kong-based investment holding company principally engaged in the provision of integrated logistics solutions. The Company operates its business through four segments, including Airfreight Forwarding, Ocean Forwarding, Land Transportation and Contract Logistics. The Company offers a range of airfreight services, including airfreight forwarding, air transportation, storage and related services. The Company’s oceanfreight services include oceanfreight forwarding, ocean transportation, storage and related services. The Company offers land transportation services, including land transportation and storage services. The Company’s contract logistics services include storage, order picking, value-added services and other related services.

– Wiseway Group Ltd ($ASX:WWG)

Wiseway Group Ltd is a holding company that operates through its subsidiaries. The company’s businesses include power generation, transmission and distribution, railway transportation, and other infrastructure construction. The company was founded in 1949 and is headquartered in Beijing, China.

Summary

Investors should take note of Forward Air Co., as the Teacher Retirement System of Texas recently revealed that it had reduced its position in shares of the company by 11.6%. This decrease indicates that investors should be cautious when considering investing in this company, as there could be potential risks associated with it. It is important to research the company’s financial history, management team, and competitive landscape before deciding to invest. Additionally, investors should be aware of the potential for volatility in the stock price over time, and carefully weigh their investment options before making a decision.

Recent Posts