Dan Loeb’s Third Point Takes Stake in AIG, Shares Rise 0.6%

February 10, 2023

Trending News ☀️

American International ($NYSE:AIG) Group (AIG) is a leading global insurance and financial services company that provides a wide range of products and services for individuals, businesses, and governments around the world. Shares of American International Group (AIG) rose 0.6% after it was revealed that Dan Loeb’s Third Point hedge fund had taken a stake in the insurer, as noted in their 4th quarter letter to investors. This is a developing story. The insurer has been undergoing a major restructuring, focusing on digital transformation and cost-cutting initiatives to simplify its operations and improve profitability. Third Point’s investment in AIG is seen as a vote of confidence in the company’s new management team and its ongoing efforts to improve its operations and increase shareholder value.

It is also seen as a sign of renewed interest from investors in the insurer’s stock, which has been under pressure in recent years due to increasing competition in the insurance market. Investors will be watching to see if Third Point’s investment will help boost investor confidence and send the stock higher over the long term. For now, it appears that the hedge fund’s stake in AIG is just the beginning of a developing story that could have implications for both the insurer and the broader stock market.

Price History

On Wednesday, shares of AMERICAN INTERNATIONAL Group (AIG) rose 0.6% after news broke that activist investor Dan Loeb’s Third Point had acquired a stake in the insurance giant. The stock opened at $60.2 and closed at $61.0, up from its last closing price of 60.6. The move marks the latest in a series of investments by Third Point, which is known for buying large stakes in companies and pushing for changes that can increase shareholder value. Loeb is known for his aggressive tactics, having previously pushed for changes at Yahoo!, Sotheby’s, and DowDuPont. The size of Third Point’s stake in AIG was not disclosed, but it appears to be significant given the sharp rise in the company’s share price. Loeb’s firm has been expanding into the insurance sector recently, with investments in Assurant and insurers in South Korea and Japan.

It is unclear what Loeb’s plan is for AIG, but investors appear to be encouraged by the move. If Loeb believes AIG is undervalued, he may push for changes such as cost cutting, share buybacks, or spinning off certain business units in order to increase the company’s value. Regardless of Loeb’s plans, it is clear that his decision to invest in AIG has been welcomed by investors. The stock has seen steady gains since news broke of the investment, signaling that the market believes Third Point will be successful in extracting value from the company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for American International. More…

| Total Revenues | Net Income | Net Margin |

| 58.95k | 13.72k | 20.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for American International. More…

| Operations | Investing | Financing |

| 4.53k | -2.62k | -2.55k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for American International. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 522.93k | 481.93k | 52.22 |

Key Ratios Snapshot

Some of the financial key ratios for American International are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.3% | – | 34.2% |

| FCF Margin | ROE | ROA |

| 7.7% | 29.9% | 2.4% |

Analysis

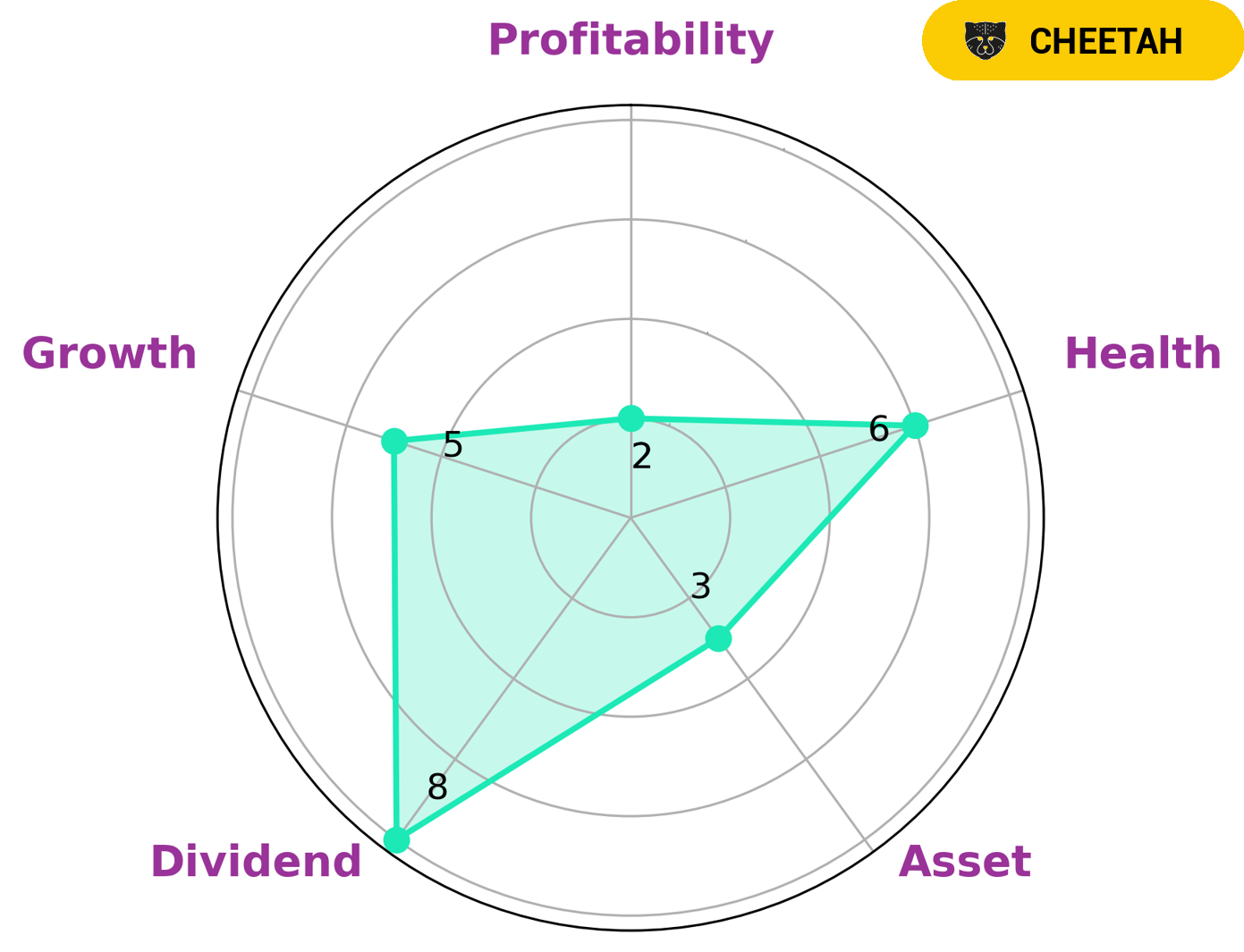

GoodWhale’s analysis of AMERICAN INTERNATIONAL‘s financials classifies it as a ‘cheetah’ company, meaning it has achieved high revenue or earnings growth but is considered less stable due to lower profitability. AMERICAN INTERNATIONAL is strong in dividend, medium in growth, and weak in asset and profitability. Its intermediate health score of 6/10 takes into account its cashflows and debt, suggesting it might be able to pay off debt and fund future operations. Given this information, investors interested in such a company may include those seeking short-term gains, short-term traders, and those attracted to the potential of high returns. Investors who are more risk-averse may not be as interested in AMERICAN INTERNATIONAL’s profile. Long-term investors with an appetite for higher risks may also find AMERICAN INTERNATIONAL attractive. Overall, the analysis of AMERICAN INTERNATIONAL’s financials provides insight into the type of investors who may be interested in its stock. In particular, those seeking short-term gains or those with a higher risk appetite may be the most likely to invest in the company. Those who are more conservative and prefer lower risks may not find this company as attractive. More…

Peers

Its competitors include Old Republic International Corp, UNIQA Insurance Group AG, and Zavarovalnica Triglav DD.

– Old Republic International Corp ($NYSE:ORI)

Old Republic International Corp is a holding company that operates in three segments: Insurance Group, Title Insurance Group, and the Commercial Group. The Insurance Group offers property and casualty insurance products, such as automobile and homeowners insurance, to individuals and businesses in the United States. The Title Insurance Group provides title insurance and related real estate products and services in the United States. The Commercial Group offers a range of products and services, including surety bonds, commercial credit insurance, and commercial title insurance.

– UNIQA Insurance Group AG ($LTS:0GDR)

UNIQA Insurance Group AG is one of the leading insurance groups in Austria and Central and Eastern Europe with a market share of around 15 per cent. The Group is represented in more than 20 countries with around 9,000 employees. In the 2019 financial year, UNIQA generated gross premiums written of EUR 5.6 billion. UNIQA Group is part of UNIQA Insurance Group AG.

– Zavarovalnica Triglav DD ($LTS:0KFO)

Triglav is the largest Slovenian insurance company and one of the leading insurers in the Adriatic region. It has been operating for over 125 years and offers a wide range of insurance products for individuals, families and businesses. Triglav is also active in the field of asset management. The company’s share is listed on the Prague and Ljubljana Stock Exchanges.

Triglav’s market capitalization is 726.75 million as of 2022. The company’s return on equity is 10.44%. Triglav is a leading insurer in the Adriatic region with a wide range of insurance products for individuals, families and businesses. The company is also active in asset management.

Summary

American International Group (AIG) shares rose 0.6% on news that investor Dan Loeb’s Third Point had taken a stake in the insurer. This is seen as a positive for AIG, as Third Point is known for its activist investment strategy. The exact size of the stake is unknown at this point, but it is expected to be significant. This investor confidence in AIG signals that the company has strong potential for growth and profitability.

AIG’s share price has been volatile this year, but this investment could be a sign of things to come. Investors should watch AIG’s performance closely to see if the Third Point stake has any impact on the company’s future.

Recent Posts