SelectQuote Closing Price Jumps 3.33%: Volatility Reaches 8.49%!

April 7, 2023

Trending News ☀️

SELECTQUOTE ($NYSE:SLQT): This jump in closing price caused an 8.49% increase in the stock’s volatility – an opportunity that can’t be missed! SelectQuote Inc. is an American technology and services company focused on providing customers with life insurance quotes. As they continue to expand, they offer customers more comprehensive coverage and peace of mind.

With such a large jump in price and volatility, investors and traders alike need to be on alert to make sure they don’t miss out on any opportunities. SelectQuote Inc. is a forward-thinking company with a bright future, so it could be a great chance to get in on the action!

Share Price

On Monday, SELECTQUOTE Inc. saw its stock price drop by 2.3% from the previous closing price of $2.2 to $2.1. This increase in stock price indicates a significant uptick in volatility, with the current volatility rate reaching 8.49%. This jump is likely the result of investors seeking to capitalize on SELECTQUOTE’s potential growth over the coming months. While this sudden surge in volatility may cause some concern for investors, there is still plenty of opportunity for those willing to take a chance on the company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Selectquote. SelectQuote_Closing_Price_Jumps_3.33_Volatility_Reaches_8.49″>More…

| Total Revenues | Net Income | Net Margin |

| 895.4 | -131.68 | -10.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Selectquote. SelectQuote_Closing_Price_Jumps_3.33_Volatility_Reaches_8.49″>More…

| Operations | Investing | Financing |

| -108.15 | -15.98 | -33.13 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Selectquote. SelectQuote_Closing_Price_Jumps_3.33_Volatility_Reaches_8.49″>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.3k | 916.15 | 2.14 |

Key Ratios Snapshot

Some of the financial key ratios for Selectquote are shown below. SelectQuote_Closing_Price_Jumps_3.33_Volatility_Reaches_8.49″>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 30.5% | 66.7% | -11.5% |

| FCF Margin | ROE | ROA |

| -13.9% | -17.4% | -5.0% |

Analysis

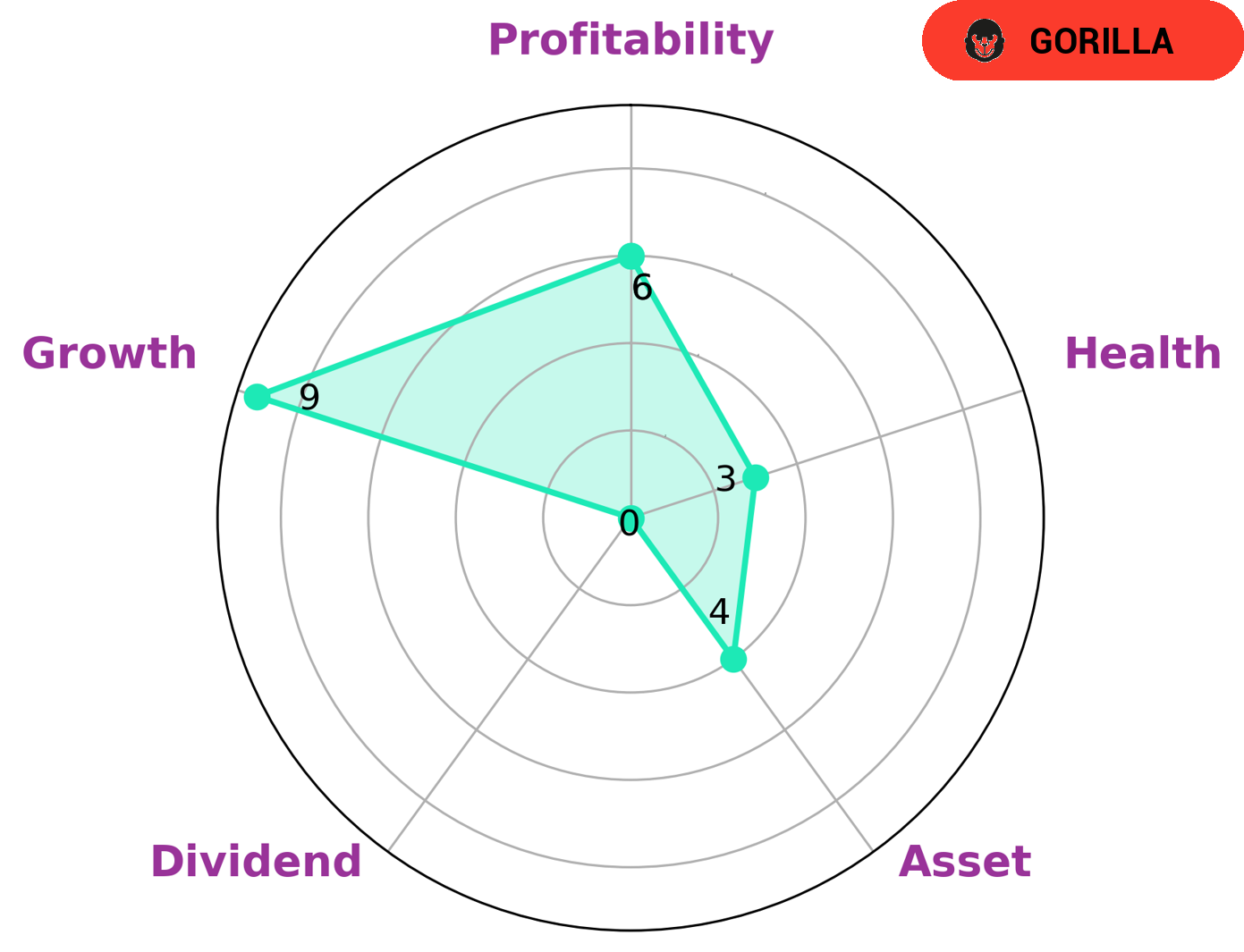

At GoodWhale, we analyzed SELECTQUOTE‘s financials and used our proprietary Star Chart to assess the company. According to the chart, SELECTQUOTE is classified as a ‘gorilla’, meaning that it has achieved strong and consistent revenue or earnings growth due to its strong competitive advantages. Given its strong growth prospects, SELECTQUOTE is likely to be of interest to growth investors including venture capitalists, private equity funds, and hedge funds. It should also be noted that SELECTQUOTE has a medium asset profile, medium profitability and a weak dividend profile, indicating that its focus lies in building up its core business. However, SELECTQUOTE has a low health score of 3/10 based on our analysis of its cashflows and debt. This indicates that the company is less likely to be able to pay off its debts or finance operations in the future. As such, it is important for investors to proceed with caution in making an investment decision. More…

Peers

The company has been in operation for more than 10 years and has a strong presence in the United States. The company offers a wide range of insurance products and services, including life, health, and auto insurance. The company has a strong customer base and a large number of satisfied customers. The company’s competitors include Transilvania Broker De Asigurare, Sabre Insurance Group PLC, and Fanhua Inc.

– Transilvania Broker De Asigurare ($LTS:0TCR)

Sabre Insurance Group PLC is a United Kingdom-based holding company engaged in the provision of general insurance products. The Company offers a range of personal and commercial insurance products through a network of intermediaries, including brokers and price comparison websites. It operates through three segments: Motor, Household and Commercial.

– Sabre Insurance Group PLC ($LSE:SBRE)

Founded in 2001, Fanhua Inc. is a leading provider of financial services in China. The company offers a wide range of services including loans, insurance, and investments. As of 2022, Fanhua Inc. had a market capitalization of 272.87 million and a return on equity of 6.21%. The company is headquartered in Guangzhou, China.

Summary

Investors should keep an eye on SelectQuote Inc. as the stock has recently experienced a significant increase in volatility. This brought the stock’s volatility to 8.49%, a noteworthy increase. Analysts suggest that investors should watch the stock closely for any further price movements and take appropriate action accordingly. Those looking to invest in SelectQuote should consider researching the company further and assessing both its potential rewards and risks.

Recent Posts