Comparing Mid-Cap Transportation Companies: Who Will Come Out On Top – RXO or Verra Mobility?

June 3, 2023

☀️Trending News

When analyzing mid-cap transportation companies, two names stand out: RXO and Verra Mobility ($NASDAQ:VRRM). In this article we’ll take a critical look at both businesses to determine which one is the better investment. Verra Mobility is a global leader in smart transportation and technology solutions, providing a full suite of integrated services that enable cities, law enforcement agencies, and private clients to monitor, manage, and enforce their roadways and parking lots. Verra Mobility’s solutions are used to improve safety, reduce traffic congestion, manage parking resources, and increase access to public transport. The company’s products include radar-based speed enforcement systems, intelligent traffic cameras, automated parking enforcement systems, and mobile applications.

Verra Mobility also provides services such as roadside assistance and incident management. The company’s impressive portfolio of products and services allow it to provide unparalleled service to its clients, which include municipalities, law enforcement agencies, fleet operators, and private companies. With their comprehensive suite of solutions, Verra Mobility is well positioned to continue to serve as an industry leader in the mid-cap transportation sector.

Share Price

On Tuesday, VERRA MOBILITY stock opened at $17.7 and closed at $17.6, down by 0.7% from prior closing price of 17.7. This slight decrease in stock price puts the mid-cap transportation company in a tight competition with rivals RXO. Both companies provide digital mobility solutions to government and commercial customers, including license plate recognition, violations processing, parking management, tolling, and vehicle registration services. Verra Mobility‘s primary competitive advantage is its vast portfolio of services, which provides customers with a comprehensive set of solutions to manage their mobility needs. The company also boasts an extensive network of partners in various industries, such as automotive, insurance, service providers, and government agencies. This wide range of partners allows Verra Mobility to offer tailored solutions for each customer. On the other hand, RXO has a more focused approach to providing digital mobility solutions, focusing on license plate recognition, violations processing, parking management, and vehicle registration services. RXO has become a leader in this space by incorporating its advanced technologies into its products and services.

However, based on their respective strengths and competitive advantages, Verra Mobility and RXO both appear to be well-positioned to succeed in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Verra Mobility. More…

| Total Revenues | Net Income | Net Margin |

| 763.12 | 87.01 | 11.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Verra Mobility. More…

| Operations | Investing | Financing |

| 232.31 | -56.31 | -202.91 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Verra Mobility. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.71k | 1.47k | 1.58 |

Key Ratios Snapshot

Some of the financial key ratios for Verra Mobility are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.8% | 20.8% | 26.3% |

| FCF Margin | ROE | ROA |

| 23.2% | 53.5% | 7.3% |

Analysis

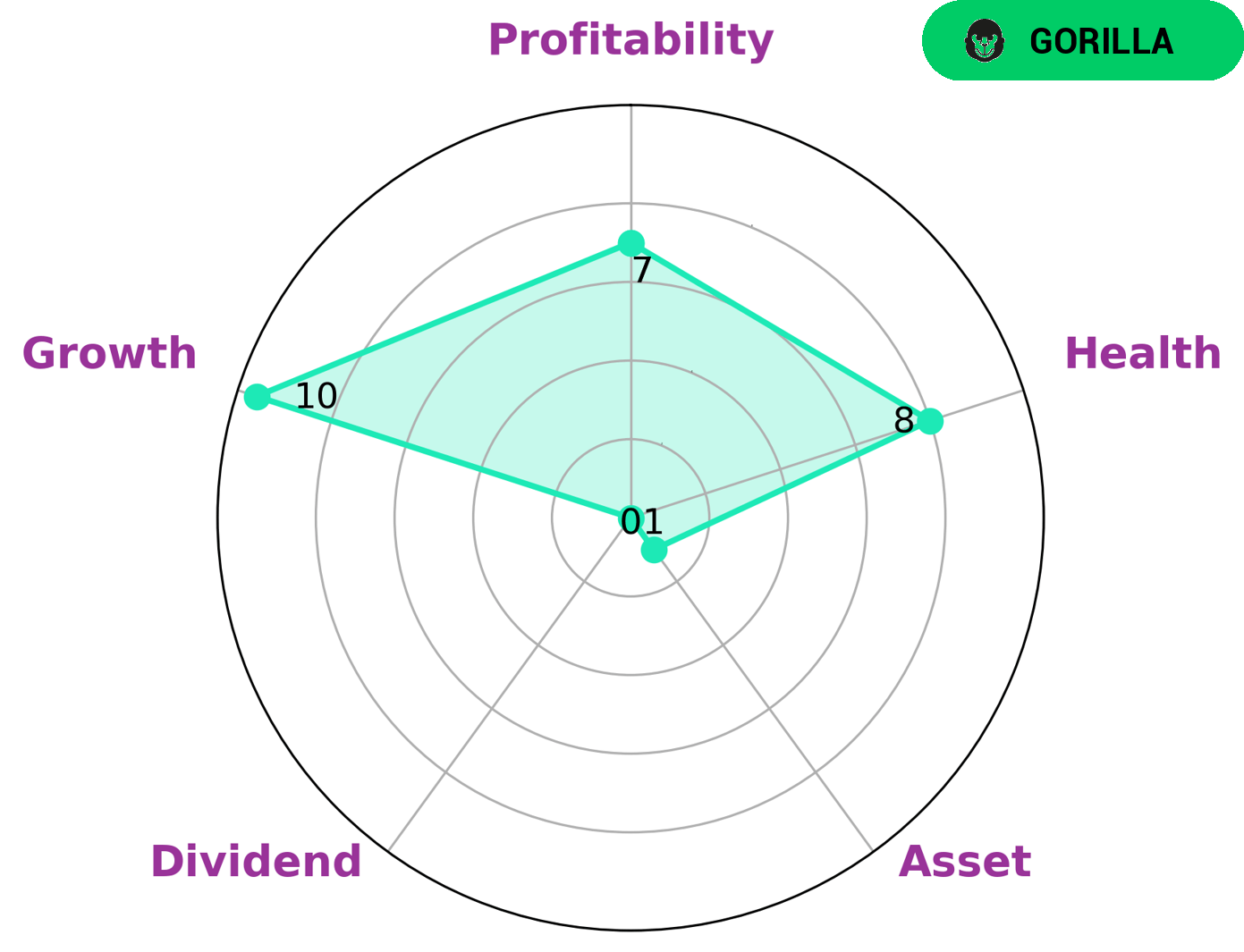

GoodWhale has analyzed the wellbeing of VERRA MOBILITY. After evaluating the company with the Star Chart, GoodWhale has concluded that it is classified as a ‘gorilla’ – a type of company that has achieved steady and high revenue or earning growth due to its strong competitive advantage. Investors who are looking for companies that offer high growth potential with a strong competitive edge will likely be interested in VERRA MOBILITY. According to GoodWhale’s evaluation, VERRA MOBILITY is strong in growth, profitability, and weak in asset and dividend. It has a health score of 8/10 with regard to its cashflows and debt, indicating that it is capable of paying off its debt and funding future operations. More…

Peers

The competition between Verra Mobility Corp and its competitors is fierce. Each company is striving to be the best in the industry and to provide the best products and services to their customers. Fluor Corp, Shenzhen Genvict Technologies Co Ltd, and ComfortDelGro Corp Ltd are all major players in the transportation industry and are constantly innovating to provide the best possible products and services to their customers.

– Fluor Corp ($NYSE:FLR)

Fluor Corp is a engineering and construction company with a market cap of 4.51B as of 2022. The company has a ROE of 11.56%. Fluor Corp provides engineering, procurement, construction, and project management services to government and commercial clients worldwide.

– Shenzhen Genvict Technologies Co Ltd ($SZSE:002869)

Shenzhen Genvict Technologies Co Ltd is a leading provider of Internet of Things (IoT) solutions. The company has a market cap of 4.06B as of 2022 and a ROE of -3.9%. The company provides IoT solutions for a wide range of industries, including smart cities, transportation, energy, and healthcare. The company’s products and solutions are used by government agencies, enterprises, and consumers in over 100 countries.

– ComfortDelGro Corp Ltd ($SGX:C52)

ComfortDelGro Corp Ltd is a Singapore-based land transport company. The Company’s segments include Buses, Taxi, Rail, Automotive Engineering Services, and Others. It offers a range of services, including bus chartering, bus advertising, bus assembly, and spare parts trading. The Company’s businesses include bus operations in Singapore, taxi operations in Singapore, UK, China and Vietnam, railway operations in Singapore and Australia, automotive engineering services and car rental and leasing operations. ComfortDelGro Corp Ltd has a market cap of 2.86B as of 2022, a Return on Equity of 5.96%. The company’s market capitalization is 2.86B, and its ROE is 5.96%.

Summary

Verra Mobility is a mid-cap transportation company that offers a variety of services to help manage traffic safety and electronic toll collection. It also posts steady revenue growth and has a record of paying dividends. In terms of valuation, Verra Mobility’s P/E ratio is slightly higher than the industry average, but it still has plenty of room to grow, which makes it an attractive long-term investment.

Recent Posts