Russell Investments Group Ltd. Increases Investment in CDW Corporation

May 16, 2023

Trending News 🌥️

CDW ($NASDAQ:CDW) Corporation is a leading provider of technology solutions in North America, offering a complete range of technology solutions and services. CDW provides world-class IT solutions to organizations of all sizes, including small businesses, mid-market companies, government entities and large enterprises. Recently, Russell Investments Group Ltd. has announced an increase in its ownership in CDW Corporation. This move comes as part of the company’s strategy to expand its presence in the technology solutions and services sector. This investment is expected to bring significant value to CDW’s shareholders.

Through this investment, Russell Investments will be able to leverage its expertise in the technology sector, while at the same time providing access to CDW’s large customer base and industry-leading product portfolio. With this new investment, CDW Corporation is well positioned to continue to provide its customers with innovative technology solutions and services that meet their unique needs. It is clear that Russell Investments Group Ltd. sees the potential in investing in CDW Corporation and expects to reap the rewards of their increased ownership of the company.

Market Price

This news sent the stock of CDW soaring and the stock opened at $170.6 and closed at $171.4, up by 0.7% from the prior closing price of $170.2. The increased investment by the Russell Investments Group Ltd. is seen as a vote of confidence in the future of CDW and its capabilities in the technology market. The news further bolstered investor sentiment and is likely to have a positive impact on the stock price of CDW in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cdw Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 22.9k | 1.09k | 4.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cdw Corporation. More…

| Operations | Investing | Financing |

| 1.32k | -177.4 | -1.24k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cdw Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 12.77k | 11.2k | 11.61 |

Key Ratios Snapshot

Some of the financial key ratios for Cdw Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.4% | 14.0% | 7.4% |

| FCF Margin | ROE | ROA |

| 5.2% | 66.6% | 8.3% |

Analysis

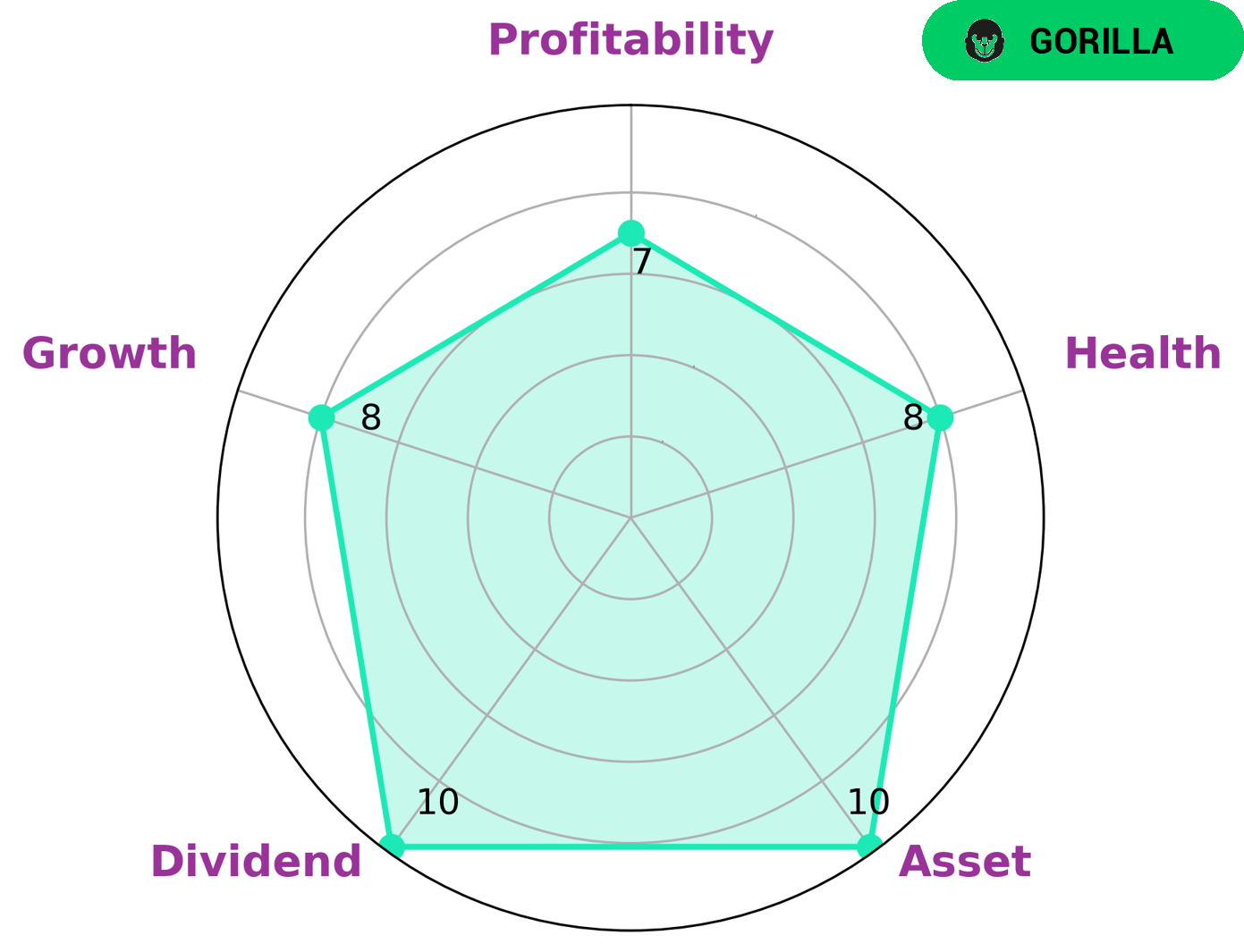

At GoodWhale, we believe that CDW CORPORATION is an ideal company for investors to consider for their portfolios. Based on our Star Chart, it is classified as a ‘gorilla’, which means that it has achieved stable and high revenue or earnings growth due to its strong competitive advantage. This is one of the main reasons why CDW CORPORATION is a great investment opportunity. Additionally, CDW CORPORATION has a high health score of 8/10 with regard to its cashflows and debt, meaning that it is capable of sustaining future operations even in times of crisis. It is also strong when it comes to asset, dividend, growth, and profitability. All these qualities make CDW CORPORATION an attractive investment opportunity for any investor. More…

Peers

In the market for human resources management software, CDW Corp competes with Paycor HCM Inc, Softcat PLC, and Business Warrior Corp. All four companies offer software that helps businesses manage employee data, payroll, and benefits.

– Paycor HCM Inc ($NASDAQ:PYCR)

Paycor HCM Inc is a provider of human capital management solutions for small and medium-sized businesses. The company offers a cloud-based platform that enables businesses to manage their human resources, payroll, and benefits. Paycor HCM Inc has a market cap of 5.04B as of 2022 and a return on equity of -6.69%. The company’s human capital management solutions enable businesses to manage their human resources, payroll, and benefits more effectively and efficiently.

– Softcat PLC ($LSE:SCT)

Softcat PLC is a British provider of IT infrastructure and software products. The company is headquartered in Marlow, Buckinghamshire, and has over 4,000 employees. Softcat PLC is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index. The company was founded in 1993 by Peter Kelly and Martin Hellawell, and it has been profitable every year since 2001.

Softcat PLC’s market cap is 2.23B as of 2022. The company’s ROE is 59.71%. Softcat PLC is a provider of IT infrastructure and software products. The company was founded in 1993 and it has been profitable every year since 2001.

– Business Warrior Corp ($OTCPK:BZWR)

Warrior Corp is a publicly traded company with a market capitalization of 3.69 million as of 2022. The company has a return on equity of -25.43%. Warrior Corp is engaged in the business of providing military training and support services to the United States government and its allies.

Summary

Russell Investments Group Ltd. has recently increased its stake in CDW Corporation, a company that provides technology services and solutions. The investment is an indication of confidence in the future prospects of the company. Analysts have found that CDW Corporation has been performing strongly, with steady growth in both revenue and profits. Their ability to provide cost-efficient services and solutions makes them an attractive target for investors.

They also have a strong potential for growth due to their broad range of services and solutions. With their strong presence in the technology industry, they can also capitalize on emerging trends. All these factors point to a promising future for CDW Corporation.

Recent Posts