CTSH Stock Fair Value Calculation – Fisher Asset Management LLC Boosts Investment in Cognizant Technology Solutions

May 3, 2023

Trending News ☀️

Fisher Asset Management LLC has made a very strategic investment in the American multinational corporation, Cognizant Technology Solutions ($NASDAQ:CTSH). This is according to Defense World, an online news outlet that covers defense and military news. Cognizant Technology Solutions is a leading professional services company that focuses on consulting, technology, digital transformation, operations and other IT-based services. The company primarily offers digital transformation and AI-driven solutions and services to various industries such as banking, healthcare, retail, manufacturing and more.

In addition to providing robust digital solutions, Cognizant Technology Solutions is committed to responsible corporate citizenship. This includes initiatives such as their “Cognizant Technology Initiatives” program which works to improve the overall well-being of people in the communities they serve. This commitment to corporate responsibility only enhances their already impressive suite of services and makes them a great investment for Fisher Asset Management LLC.

Price History

Following the announcement, the company’s stock opened at a price of $59.7 and closed at $59.8, representing a slight increase of 0.2% from the previous closing price. The investment is expected to help COGNIZANT TECHNOLOGY SOLUTIONS continue to strengthen the quality of services and products it provides to its customers. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for CTSH. More…

| Total Revenues | Net Income | Net Margin |

| 19.43k | 2.29k | 11.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for CTSH. More…

| Operations | Investing | Financing |

| 2.57k | -106 | -1.94k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for CTSH. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.85k | 5.54k | 24.18 |

Key Ratios Snapshot

Some of the financial key ratios for CTSH are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.0% | 3.6% | 15.6% |

| FCF Margin | ROE | ROA |

| 11.5% | 15.6% | 10.6% |

Analysis – CTSH Stock Fair Value Calculation

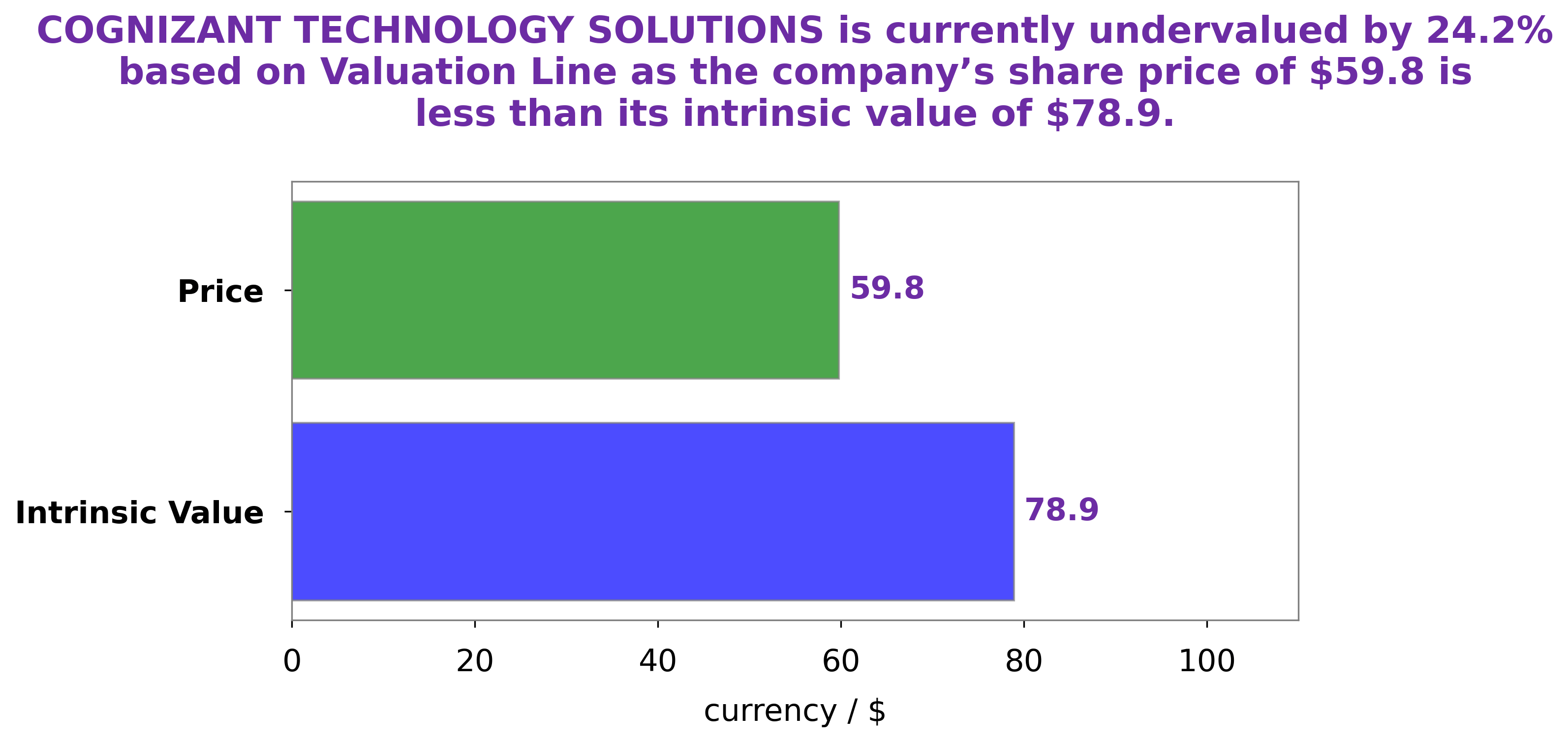

At GoodWhale, we have conducted an in-depth analysis of the fundamentals of COGNIZANT TECHNOLOGY SOLUTIONS (CTSH). Our proprietary Valuation Line indicates that the intrinsic value of CTSH share is around $78.9. This means that CTSH is currently trading at a price of $59.8, which is undervalued by 24.3%. This presents a good opportunity for investors to buy into CTSH at a discounted price. We believe that CTSH is a solid investment for the long term, and our fundamental analysis supports this position. More…

Peers

Cognizant Technology Solutions Corp is a leading provider of information technology, consulting, and business process outsourcing services. It has a strong presence in India, the United States, and Europe. The company operates in four segments: Banking and Financial Services, Healthcare, Manufacturing, and Retail, Consumer Goods, and Logistics. Cognizant’s competitors include Accenture PLC, Genpact Ltd, Shunliban Information Service Co Ltd, and others.

– Accenture PLC ($NYSE:ACN)

Accenture PLC is a professional services company that provides consulting, technology, and outsourcing services. It has a market cap of 166.38B as of 2022 and a Return on Equity of 26.56%. The company operates in more than 200 countries and employs more than 373,000 people.

– Genpact Ltd ($NYSE:G)

Genpact is a global professional services firm that offers a range of services in the areas of consulting, digital transformation, technology, and operations. The company has a market cap of $8.29 billion and a return on equity of 17.54%. Genpact has a strong focus on digital transformation and offers a range of services that helps businesses to digitally transform their operations. The company has a strong client base and a strong track record in delivering results.

– Shunliban Information Service Co Ltd ($SZSE:000606)

Shunliban Information Service Co Ltd is a Chinese company that provides information services. It has a market cap of 1.34 billion as of 2022 and a return on equity of 130.37%. The company offers services such as data analysis, information management, and online marketing. It also provides software development and consultation services.

Summary

Fisher Asset Management LLC recently announced an increase in their holdings of shares in Cognizant Technology Solutions Co. (CTSH). This implies that the company is bullish on the future prospects of CTSH. An analysis of Cognizant’s performance shows that it has been consistently delivering strong financial results. Cognizant also boasts a robust cash balance and a healthy debt-to-equity ratio, indicating that the company is well positioned to navigate the economic uncertainty posed by the pandemic. Its customer base is diversified across industries and regions, enabling the company to mitigate any risk associated with a specific sector or geography.

Additionally, Cognizant’s focus on digital transformation initiatives has enabled it to remain competitive and fuel further growth. All of these factors suggest that CTSH is an attractive investment opportunity.

Recent Posts