WESCO Strategic Positioning Leaves Them Well-Positioned in Growing, Consolidating Markets

June 3, 2023

☀️Trending News

It is a leading provider of electrical, industrial, and communications maintenance, repair, and operating (MRO) and original equipment manufacturers (OEM) products, construction materials, and advanced supply chain management and logistics services. Over the past several years, WESCO ($NYSE:WCC) has been strategically positioning itself to take advantage of growing and consolidating markets. This positioning has allowed WESCO to capitalize on the trend of consolidation in many of its main markets. The company has made strategic investments in areas such as data-driven supply chain optimization and digital capabilities to increase its competitive advantage and maximize efficiency for its customers. WESCO has also pursued acquisitions to gain access to new markets and increase its presence in existing ones. These moves have allowed them to expand their product offerings and customer base, while also strengthening their position as a premier MRO and OEM solutions provider.

In addition to its strategic positioning in growing markets, WESCO has also taken steps to ensure it continues to be well-positioned as these markets continue to evolve. This includes investing in new technologies such as artificial intelligence (AI) and automation to increase efficiency, reduce costs, and improve customer service. WESCO’s commitment to these investments has enabled them to remain on the leading edge of the rapidly evolving MRO and OEM marketplaces. Overall, WESCO’s strategic positioning over the past several years leaves them well-positioned for future growth in both expanding and consolidating markets. With their advanced technologies, strong customer focus, and commitment to staying at the forefront of the industry, they are well-positioned to capitalize on the many opportunities that lie ahead.

Stock Price

WESCO INTERNATIONAL is well-positioned to take advantage of the growing and consolidating markets. On Friday, the company’s stock opened at $139.7 and closed at $146.1, an increase of 7.2% from the previous closing price of 136.3. This indicates a strong strategic position in the market, as investors are confident in WESCO INTERNATIONAL’s future prospects. The company’s continuity and consistency in the market have allowed them to find success in the dynamic market environment. The company’s ambitious expansion plans are also contributing to their strong position. WESCO INTERNATIONAL is investing heavily in new technologies and processes that will allow them to further capitalize on the consolidating markets. This investment will likely result in more efficient operations, which can lead to increased profits and market share.

Additionally, the company’s focus on customer service will help them better serve their customers, leading to increased customer satisfaction and loyalty. With the right moves, the company could see further increases in their stock price and a larger market share. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Wesco International. More…

| Total Revenues | Net Income | Net Margin |

| 22.01k | 818.87 | 4.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Wesco International. More…

| Operations | Investing | Financing |

| -72.45 | -281.04 | 505.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Wesco International. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.97k | 10.38k | 89.55 |

Key Ratios Snapshot

Some of the financial key ratios for Wesco International are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 38.0% | 64.6% | 6.8% |

| FCF Margin | ROE | ROA |

| -0.8% | 20.6% | 6.2% |

Analysis

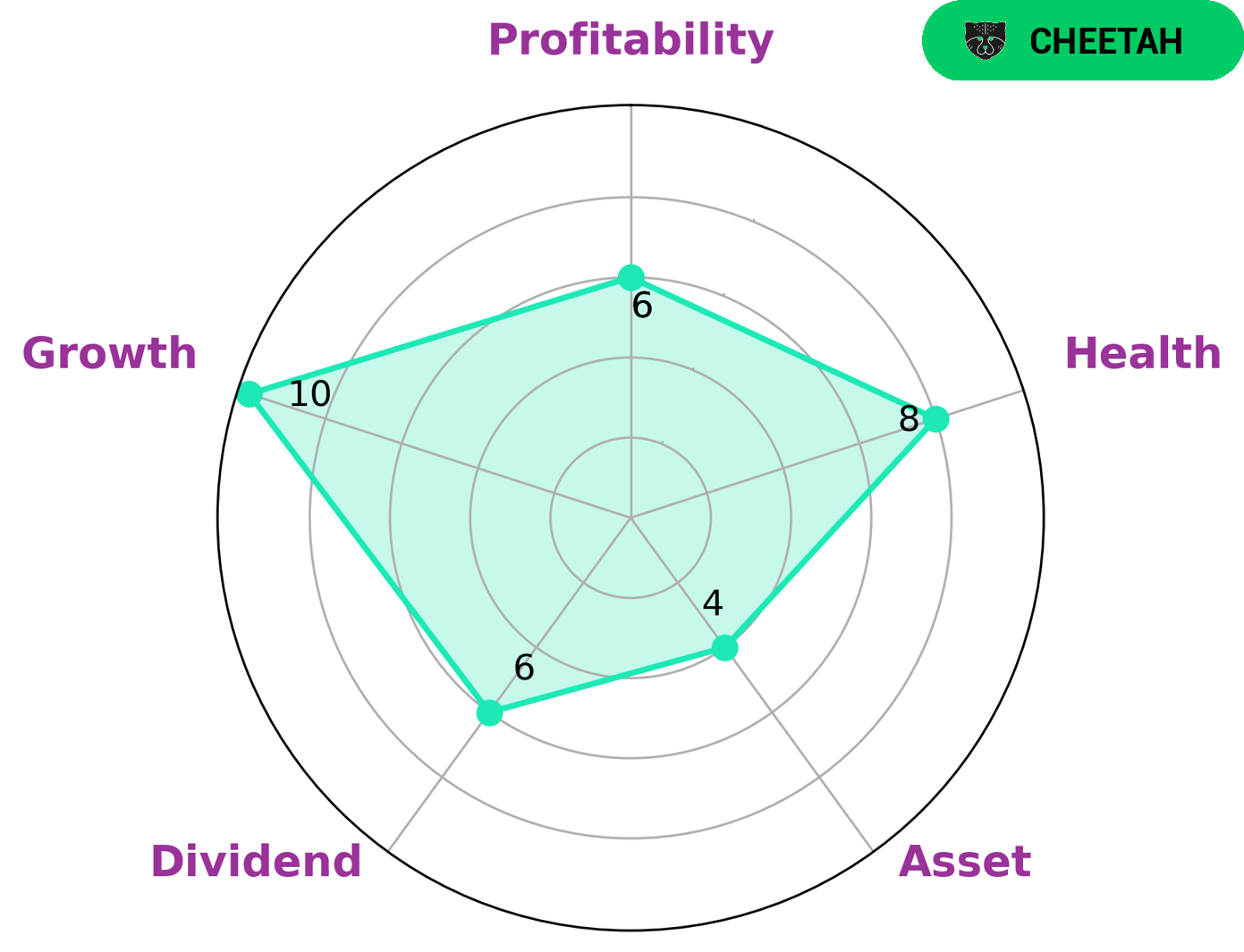

GoodWhale has conducted an analysis of WESCO INTERNATIONAL‘s wellbeing and the results are very positive. Our Star Chart shows that WESCO INTERNATIONAL has a high health score of 8/10 with regard to its cashflows and debt, indicating that it is capable to pay off debt and fund future operations. Further, by classifying WESCO INTERNATIONAL as a ‘cheetah’, a type of company we conclude that achieved high revenue or earnings growth but is considered less stable due to lower profitability, investors can get a fuller picture of the company. WESCO INTERNATIONAL is strong in growth, and has a medium score in asset, dividend, and profitability. This could be attractive to investors that are looking for relatively safe investments in growing companies. Additionally, investors who value growth over stability may be interested in this company as well due to its strong growth potential. More…

Peers

The Company’s primary competitors are Fastenal Co, MSC Industrial Direct Co Inc, and Addtech AB.

– Fastenal Co ($NASDAQ:FAST)

The company’s market cap is $27.97B as of 2022 and its ROE is 28.04%. The company is engaged in the distribution of industrial and construction supplies.

– MSC Industrial Direct Co Inc ($NYSE:MSM)

MSC Industrial Direct Co, Inc. engages in the distribution of metalworking and maintenance, repair, and operations (MRO) products and services. It operates through the following segments: Metalworking Solutions Group, MRO Solutions Group, and Fluid Power & Automation Solutions Group. The Metalworking Solutions Group segment offers cutting tools, measuring instruments, tooling components, abrasives, and machine tools. The MRO Solutions Group segment comprises of products used to maintain, repair, and operate facilities and equipment. The Fluid Power & Automation Solutions Group segment provides fluid power components and systems, and automation and control products. The company was founded by Martin Schwartz in 1941 and is headquartered in Melville, NY.

MSC Industrial Direct Co Inc has a market cap of 4.71B as of 2022 and a Return on Equity of 22.14%. The company engages in the distribution of metalworking and maintenance, repair, and operations (MRO) products and services. It operates through the following segments: Metalworking Solutions Group, MRO Solutions Group, and Fluid Power & Automation Solutions Group. The Metalworking Solutions Group segment offers cutting tools, measuring instruments, tooling components, abrasives, and machine tools. The MRO Solutions Group segment comprises of products used to maintain, repair, and operate facilities and equipment. The Fluid Power & Automation Solutions Group segment provides fluid power components and systems, and automation and control products.

– Addtech AB ($LTS:0QI7)

Addtech AB is a Swedish company that provides technology solutions for industrial customers. The company has a market cap of 36 billion as of 2022 and a return on equity of 28.17%. Addtech’s solutions include products and services for automation, motion control, and fluid power. The company operates in four segments: Automation, Motion, Fluid Power, and Industrial Supplies. Addtech employs approximately 3,700 people and has sales offices in Europe, North America, and Asia.

Summary

WESCO International is an industrial distribution company that operates in high-growth and consolidating markets. The company has been performing well in recent years, as evidenced by their stock price continuing to move upward. Investors are likely to find WESCO’s market positioning attractive, as the company stands to benefit from the potential of further consolidation in the industry, as well as from increased demand for their products and services.

WESCO’s financials are also strong, as their profitability has been consistently increasing to the point where they consistently beat analyst expectations. With a growing presence in multiple high-growth markets, WESCO is well-positioned to continue growing in the coming years and should be an attractive option for investors.

Recent Posts