SiteOne Landscape Supply Reports Missed GAAP EPS, but Beating Revenue Expectations

May 5, 2023

Trending News 🌧️

SITEONE ($NYSE:SITE): For the quarter, SiteOne Landscape Supply reported a GAAP earnings per share (EPS) of -$0.10, which was below expectations by $0.14. On the other hand, the company reported a revenue of $837.4M, which was above expectations by $47.6M. The company offers a wide selection of products from leading industry brands, including fertilizers, herbicides, and insecticides.

The company remains confident in the long-term prospects for their business and their ability to deliver long-term value to shareholders. Management believes that their competitive advantages and customer relationships will position them well to continue to capitalize on market opportunities and drive growth in the future.

Earnings

In its earnings report of FY2022 Q4 as of December 31 2022, SITEONE LANDSCAPE SUPPLY reported total revenue of 890.0M USD, which is a 10.5% increase compared to the same period of the previous year. However, net income was 0.9M USD, a 103.3% decrease compared to the same period of the previous year. This marks a significant change in performance of SITEONE LANDSCAPE SUPPLY from the prior 3 years, when its total revenue only reached from 675.1M USD to 890.0M USD. This result indicates that SITEONE LANDSCAPE SUPPLY missed GAAP EPS expectations for this period despite beating revenue expectations.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SITE. More…

| Total Revenues | Net Income | Net Margin |

| 4.05k | 208.6 | 5.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SITE. More…

| Operations | Investing | Financing |

| 182.9 | -283 | 96.2 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SITE. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.83k | 1.53k | 28.96 |

Key Ratios Snapshot

Some of the financial key ratios for SITE are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.0% | 32.2% | 7.2% |

| FCF Margin | ROE | ROA |

| 3.6% | 14.0% | 6.4% |

Price History

On Wednesday, SITEONE LANDSCAPE SUPPLY released its quarterly report, which reported a missed GAAP earnings per share (EPS), but managed to beat revenue expectations. The stock opened at $154.6 and closed at $156.9, representing a 6.6% increase from its prior closing price of $147.3. Despite missing estimates on the EPS, the stock still rose due to the beating of revenue expectations.

This indicates that investors remain bullish on the potential for long-term growth in the company. Although the company did not meet its EPS expectations, investors appear to be looking beyond the current performance and into potential future gains. Live Quote…

Analysis

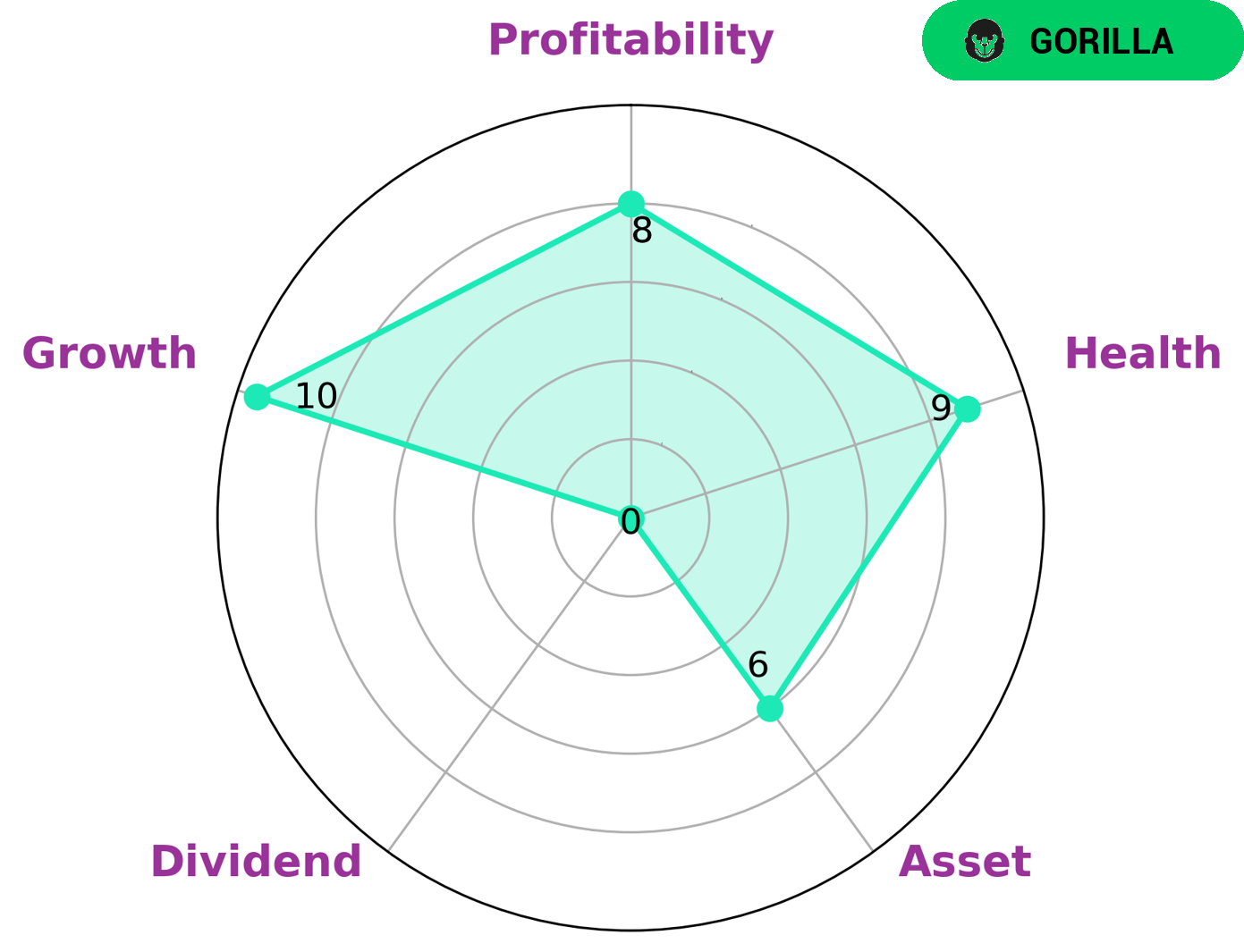

GoodWhale recently performed an analysis on SITEONE LANDSCAPE SUPPLY’s wellbeing. Our Star Chart rated SITEONE LANDSCAPE SUPPLY as having strong growth, profitability, and medium assets and weak dividend. We believe that this classification as a ‘gorilla’ indicates a company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. This type of company is likely to be attractive to several types of investors, particularly those looking for long-term investments that are capable of sustaining themselves in the face of changing market conditions. Moreover, SITEONE LANDSCAPE SUPPLY has a high health score of 9/10, indicating its capability to pay off debt and fund future operations. Together, this paints a rosy picture for investors interested in investing in SITEONE LANDSCAPE SUPPLY. More…

Peers

The company offers a wide range of products, including irrigation supplies, nursery stock, landscape tools and accessories, and more. SiteOne Landscape Supply Inc competes with Hydrofarm Holdings Group Inc, MAX Co Ltd, Thorpe (F W) PLC, and others in the landscape supplies industry.

– Hydrofarm Holdings Group Inc ($NASDAQ:HYFM)

Hydrofarm Holdings Group Inc is a leading manufacturer and distributor of hydroponic equipment and supplies in the United States. The company has a market cap of 102.81M as of 2022 and a Return on Equity of -41.86%. Hydrofarm Holdings Group Inc is a publicly traded company on the NASDAQ stock exchange under the ticker symbol HYFG. The company’s products are used by commercial and hobbyist growers to produce fruits, vegetables, and herbs.

– MAX Co Ltd ($TSE:6454)

As of 2022, Daikin Industries, Ltd. has a market capitalization of 97.87 billion dollars and a return on equity of 7.15%. Daikin is a Japanese multinational air conditioning manufacturing company with headquarters in Osaka. The company makes a wide range of products including air conditioners, refrigerators, and chemicals. It also provides services such as installation, repair, and maintenance.

– Thorpe (F W) PLC ($LSE:TFW)

Thorpe (F W) PLC is a British engineering company. The company is headquartered in Derby, England. Thorpe (F W) PLC designs, manufactures, and supplies equipment and services for the rail, construction, and mining industries. The company’s products and services include locomotives, railway cars, and railway infrastructure. Thorpe (F W) PLC has a market cap of 474.63M as of 2022, a Return on Equity of 10.79%.

Summary

Following the news, the stock price moved up significantly. Overall, this positive news suggests that the company is doing well and is on track with its financial performance. Analysts are optimistic about the company’s prospects and believe that it can continue to benefit from market trends and continue to grow in the future. Investors should be aware of the risks associated with investing in SiteOne Landscape Supply, but in general, the stock may be a good long-term investment for those who are looking for a stable, growing company.

Recent Posts