Pool Corporation Needs to Reassess Performance After Latest Quarter

April 25, 2023

Trending News 🌥️

After its latest quarter, Pool Corporation ($NASDAQ:POOL) is urging caution before diving into the stock market. The company has experienced a tumultuous quarter, with its performance coming in below expectations. While the company’s outlook for the future remains strong, investors should remain cautious before investing any money into the stock market. Pool Corporation’s lackluster performance could be a sign of underlying issues, and investors should take a closer look at Pool Corporation’s financials before making any decisions. Pool Corporation needs to reassess its performance and make the necessary adjustments to ensure that its stock remains a good investment option.

The company needs to focus on improving its operations, maximizing efficiency and getting back on track with its growth targets. The company needs to take a closer look at its risk management strategies and find ways to minimize potential losses over the long-term. In conclusion, Pool Corporation needs to reassess its performance after its latest quarter and make the necessary changes to ensure that its stock remains a viable investment option. Investors should exercise caution before investing any money into the stock market and pay close attention to Pool Corporation’s financials in order to make an informed decision.

Market Price

On Monday, the company’s stock opened at $341.3 and closed at $350.2, up by 2.0% from last closing price of 343.2. This slight increase in the stock price is an indicator that the company’s performance is not as good as it has been in the past. As a result, POOL CORPORATION should take a closer look at their strategies and identify improvements that can be made to increase their performance. It is important to evaluate the company’s current strategies to ensure they are still effective and to identify any changes that need to be made to meet the goals of the company.

Additionally, POOL CORPORATION should look into other ways to drive profitability such as cost-cutting measures and diversifying their product offerings. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Pool Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 5.97k | 667.8 | 11.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Pool Corporation. More…

| Operations | Investing | Financing |

| 796.17 | -59.27 | -745.89 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Pool Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.86k | 2.61k | 31.61 |

Key Ratios Snapshot

Some of the financial key ratios for Pool Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 22.1% | 39.4% | 15.7% |

| FCF Margin | ROE | ROA |

| 12.5% | 47.4% | 15.1% |

Analysis

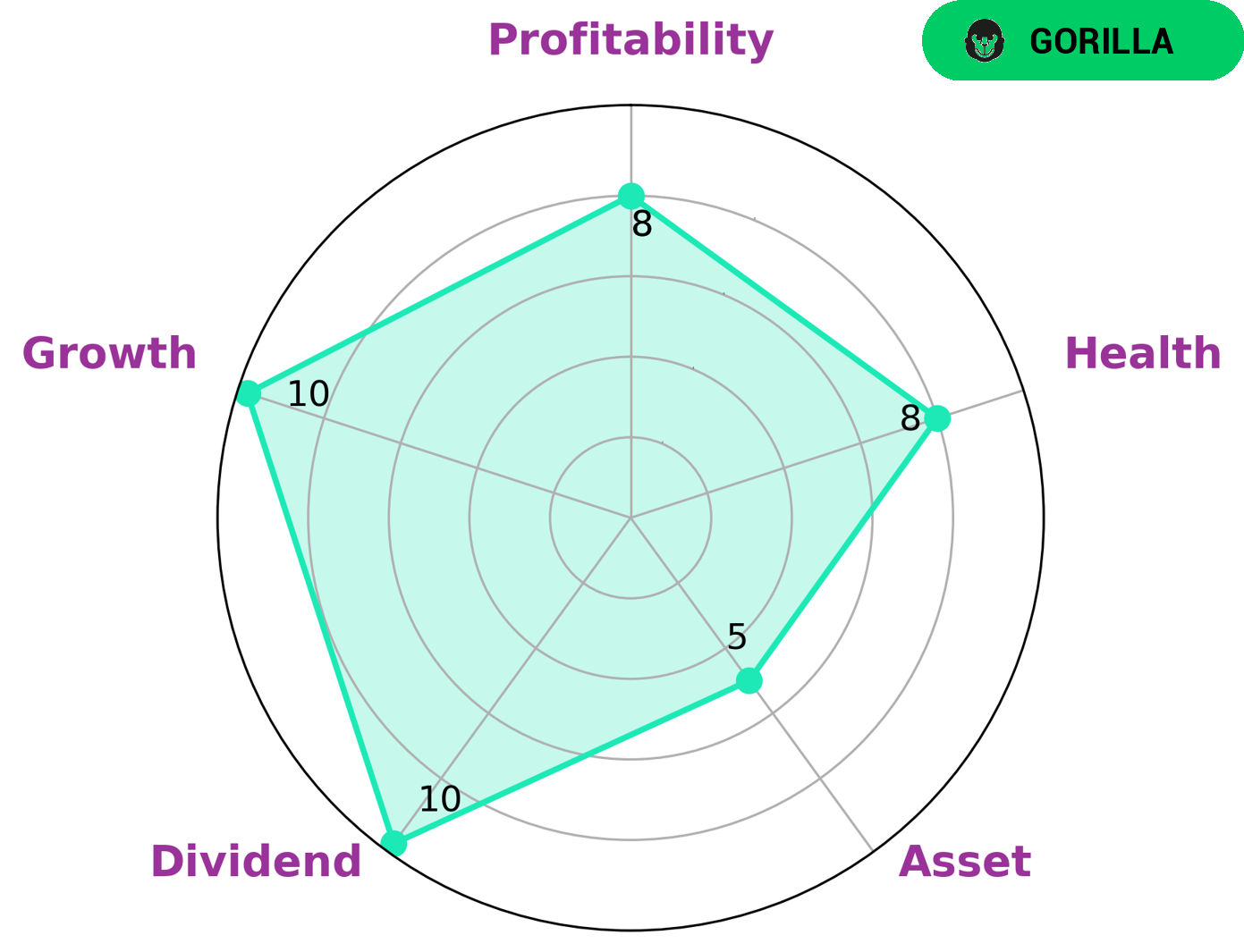

GoodWhale conducted an analysis of POOL CORPORATION‘s wellbeing and our analysis identified that POOL CORPORATION is a ‘gorilla’ type of company, which we consider to have achieved stable and high revenue or earning growth due to its strong competitive advantage. According to the Star Chart, POOL CORPORATION is strong in dividend, growth, profitability, and medium in asset. Additionally, POOL CORPORATION’s health score is 8/10 for its cashflows and debt which shows it is capable of riding out any crisis without the risk of bankruptcy. Because of these qualities, POOL CORPORATION may be of interest to value investors, who are looking for a stable, well established company with a history of growth and profitability. It may also appeal to dividend investors who want to benefit from the company’s dividend payments, as well as growth investors who are looking for a company with the potential for long-term growth. More…

Peers

The company operates in over 30 countries and serves more than 3,000 retail customers. Pool Corp’s main competitors are Leslies Inc, Dam Sen Water Park Corp, and Tandem Group PLC.

– Leslies Inc ($NASDAQ:LESL)

Leslies Inc is a pool and spa company that has a market cap of 2.38B as of 2022. The company has a Return on Equity of -51.73%. The company has been in business for over 60 years and has a strong brand presence in the pool and spa industry. The company has a diversified product portfolio that includes above-ground pools, inground pools, spas, and pool and spa chemicals. The company operates in North America, Europe, and Asia Pacific.

– Dam Sen Water Park Corp ($HOSE:DSN)

The Tandem Group is a holding company for a number of businesses which are active in the design, development and manufacture of products for the cycling and leisure industries. Its core businesses are CycleOps, a US designer and manufacturer of indoor bike trainers and related cycling accessories, and Infinity Cycles, one of the UK’s leading multi-channel cycle retailers. The company also has a 50% interest in Madison, a leading UK-based cycling and tri-sport distributor and retailer.

The Tandem Group’s market capitalisation is 13.55M as of 2022. The company has a Return on Equity of 9.17%.

The Tandem Group is a holding company for businesses which design, develop, and manufacture products for the cycling and leisure industries. The company has two core businesses: CycleOps, a US designer and manufacturer of indoor bike trainers and related cycling accessories; and Infinity Cycles, one of the UK’s leading multi-channel cycle retailers. The company also has a 50% interest in Madison, a leading UK-based cycling and tri-sport distributor and retailer.

Summary

Investors should wait to observe the company’s performance over the next few quarters before making any decisions.

Recent Posts