Spectrum Brands Rebound Despite Delayed DOJ Court Trial

May 6, 2023

Trending News ☀️

Spectrum Brands ($NYSE:SPB), a leading global consumer products company, has experienced a powerful rebound despite the U.S. Department of Justice’s decision to delay a court trial. The company, which specializes in small appliances, home and garden products, pet supplies and batteries, has seen its stock price soar in recent weeks as investors remain bullish on the company. Despite the uncertain regulatory environment, Spectrum Brands has been able to weather the storm and demonstrate its resilience in the face of adversity. The company has implemented a strategy of diversifying its product offering and increasing its focus on global markets, allowing it to emerge stronger than ever before.

Additionally, Spectrum Brands has taken a proactive approach to reduce costs and increase efficiency, resulting in improved profitability and sustainability. Overall, the market has responded positively to Spectrum Brands’ recent performance, leading to an increase in the company’s share price. This reflects investors’ confidence in the company’s ability to navigate the current environment and remain successful in the long term. Despite the postponed court trial, Spectrum Brands looks poised for a successful future.

Stock Price

Despite a delay in the Department of Justice’s court trial, SPECTRUM BRANDS‘ stock bounced back on Friday. The stock opened at $69.0 and closed at $70.4, representing an increase of 3.1% from its previous closing price of 68.3. This indicates that investors remain optimistic about the company’s prospects despite the uncertainty surrounding the court proceedings. While the delay could potentially have a negative impact on its revenue, the resilience of its stock shows that investors are confident that SPECTRUM BRANDS will be able to weather the storm. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Spectrum Brands. More…

| Total Revenues | Net Income | Net Margin |

| 3.09k | 42.5 | -3.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Spectrum Brands. More…

| Operations | Investing | Financing |

| 153.1 | -354.4 | 234.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Spectrum Brands. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.77k | 4.53k | 30.07 |

Key Ratios Snapshot

Some of the financial key ratios for Spectrum Brands are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -6.6% | -14.7% | 0.5% |

| FCF Margin | ROE | ROA |

| 3.0% | 0.7% | 0.2% |

Analysis

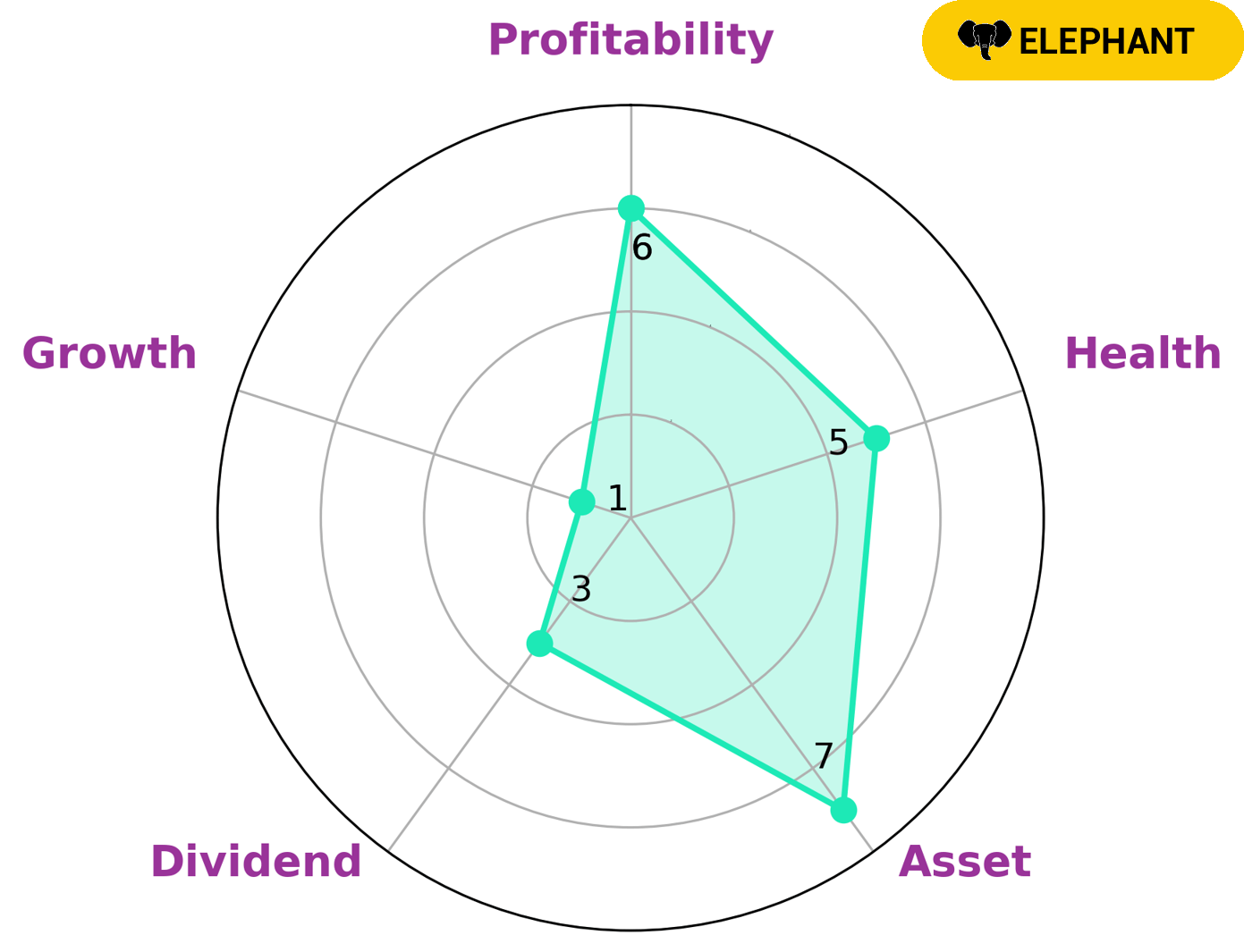

GoodWhale has conducted an analysis of SPECTRUM BRANDS, to determine its wellbeing. Our Star Chart indicates that SPECTRUM BRANDS has an intermediate health score of 5/10, taking into account its cashflows and debt. This means SPECTRUM BRANDS might be able to pay off debt and fund future operations. Looking at SPECTRUM BRANDS’ performance across different metrics, it is clear that the company is strong in asset, medium in profitability, and weak in dividend and growth. We have classified SPECTRUM BRANDS as an ‘elephant’ – a type of company we conclude is rich in assets after deducting off liabilities. Given SPECTRUM BRANDS’ strong asset position, investors looking for steady income may be interested in this company. Those seeking more growth potential may want to look elsewhere. More…

Peers

Despite the intense competition, Spectrum Brands Holdings Inc has been able to remain a top player in the industry by focusing on innovation, customer service, and providing high-quality products at competitive prices.

– Godrej Consumer Products Ltd ($BSE:532424)

Godrej Consumer Products Ltd is a leading Indian fast-moving consumer goods company, headquartered in Mumbai. It manufactures and markets a wide range of products across food, personal care, and home care segments. The company has a market cap of 937.97B as of 2023, which is indicative of its strong performance in the market. Its Return on Equity (ROE), which is an indicator of how effectively the company uses its shareholders’ equity to generate profits, is 10.44%. This high ROE reflects the company’s ability to generate profits for its shareholders.

– Ontex Group NV ($OTCPK:ONXYY)

Ontex Group NV is a leading global hygiene company with over 20 years of experience in the hygiene and personal care market. It is headquartered in Belgium and serves markets in Europe, Africa, Latin America, the Middle East, and Asia Pacific. The company’s market cap as of 2023 stands at 593.34M, indicating a strong financial standing in the market. Its Return on Equity (ROE) is -7.25%, which is a measure of how efficient the company utilizes its assets to generate profits. Ontex Group NV is engaged in the production, distribution and marketing of products such as baby diapers, adult incontinence products, feminine care products, and wet wipes.

– Henkel AG & Co KGaA ($OTCPK:HENOY)

Henkel AG & Co KGaA is a multinational consumer goods company based in Düsseldorf, Germany. It specializes in the production of laundry detergents, beauty care products, and adhesives, among other products. As of 2023, the company’s market capitalization was 28.76 billion euros. This figure reflects the company’s success in increasing shareholder value over the past year. Henkel’s return on equity (ROE) was 4.84%, which indicates that the company is efficiently utilizing its assets to generate a return. Henkel’s strong financial performance is testament to its business model and commitment to innovation.

Summary

Spectrum Brands is an American maker of home and hardware products, and its stock has been on an upward trend recently. This is due to the company winning a stay in a Department of Justice court trial, which was delayed due to procedural issues. Investors have been taking this news positively, and the stock price has moved up since then. Analysts believe that the company has a bright future ahead, as the ongoing court trial does not appear to be affecting its performance.

Furthermore, its growth initiatives, such as cost-saving measures, could help the company remain financially healthy in the long run. Therefore, Spectrum Brands is an attractive investment option for those looking for a stable return on their investments.

Recent Posts