Spectrum Brands Intrinsic Value – Spectrum Brands Reaches Agreement with Department of Justice on Assa Abloy Sale

April 12, 2023

Trending News ☀️

Spectrum Brands ($NYSE:SPB), a leading manufacturer and marketer of consumer batteries, personal care products, pet supplies, and home and garden controls, has recently reached an agreement with the Department of Justice (DOJ) concerning the sale of its Assa Abloy business. This sale has resulted in a significant gain for the company, which was confirmed during the hearing with the DOJ. Since then, the company has been able to expand and diversify its operations and product lines, becoming a leader in its fields. The sale of Assa Abloy, a Swedish-based global leader in access control solutions, is a great accomplishment for Spectrum Brands.

This agreement with the DOJ is a sign of the company’s success and its ability to strengthen its financial position. With this sale, Spectrum Brands has been able to generate significant gains that will help the company continue its growth trajectory.

Stock Price

On Tuesday, SPECTRUM BRANDS announced that it had reached an agreement with the U.S. Department of Justice regarding the sale of its Assa Abloy business unit. This agreement resulted in the stock of SPECTRUM BRANDS opening at $66.0 and closing at $67.7, up by 3.2% from its prior closing price of 65.6. This rise in the stock price indicates the market’s confidence in the company’s plans as they move forward with this sale. The details of the agreement have yet to be disclosed, but SPECTRUM BRANDS is optimistic that the transaction will be completed soon. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Spectrum Brands. More…

| Total Revenues | Net Income | Net Margin |

| 3.09k | 42.5 | -3.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Spectrum Brands. More…

| Operations | Investing | Financing |

| 153.1 | -354.4 | 234.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Spectrum Brands. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.77k | 4.53k | 30.07 |

Key Ratios Snapshot

Some of the financial key ratios for Spectrum Brands are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -6.6% | -14.7% | 0.5% |

| FCF Margin | ROE | ROA |

| 3.0% | 0.7% | 0.2% |

Analysis – Spectrum Brands Intrinsic Value

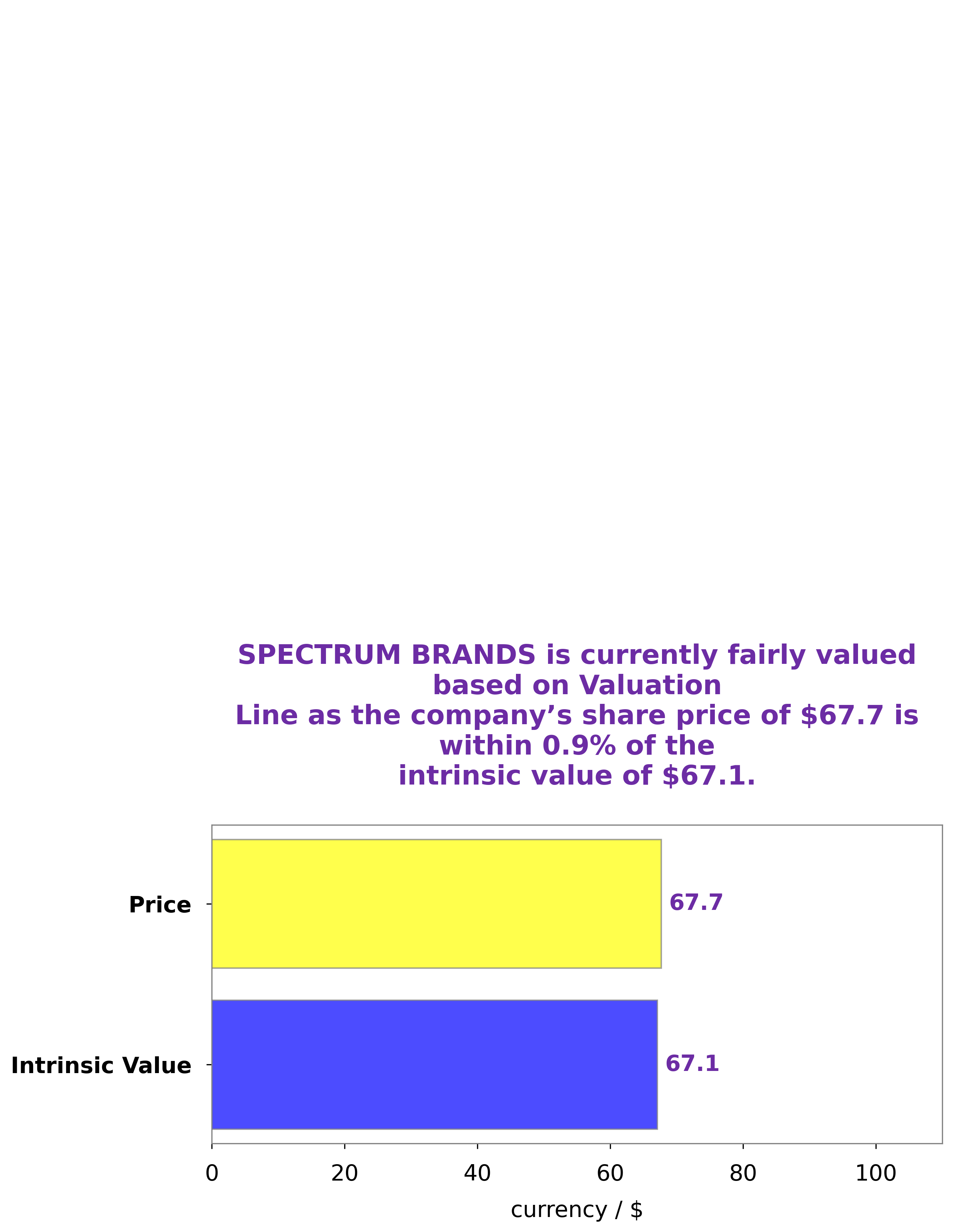

At GoodWhale, we conducted an analysis based on SPECTRUM BRANDS fundamentals and found that their intrinsic value is around $67.1. This value was calculated using our proprietary Valuation Line. We believe that SPECTRUM BRANDS stock is currently trading at a fair price of $67.7. We have also seen in our analysis that the current market price for SPECTRUM BRANDS shares is in line with the intrinsic value. Therefore, we recommend investors to consider investing in SPECTRUM BRANDS stock. More…

Peers

Despite the intense competition, Spectrum Brands Holdings Inc has been able to remain a top player in the industry by focusing on innovation, customer service, and providing high-quality products at competitive prices.

– Godrej Consumer Products Ltd ($BSE:532424)

Godrej Consumer Products Ltd is a leading Indian fast-moving consumer goods company, headquartered in Mumbai. It manufactures and markets a wide range of products across food, personal care, and home care segments. The company has a market cap of 937.97B as of 2023, which is indicative of its strong performance in the market. Its Return on Equity (ROE), which is an indicator of how effectively the company uses its shareholders’ equity to generate profits, is 10.44%. This high ROE reflects the company’s ability to generate profits for its shareholders.

– Ontex Group NV ($OTCPK:ONXYY)

Ontex Group NV is a leading global hygiene company with over 20 years of experience in the hygiene and personal care market. It is headquartered in Belgium and serves markets in Europe, Africa, Latin America, the Middle East, and Asia Pacific. The company’s market cap as of 2023 stands at 593.34M, indicating a strong financial standing in the market. Its Return on Equity (ROE) is -7.25%, which is a measure of how efficient the company utilizes its assets to generate profits. Ontex Group NV is engaged in the production, distribution and marketing of products such as baby diapers, adult incontinence products, feminine care products, and wet wipes.

– Henkel AG & Co KGaA ($OTCPK:HENOY)

Henkel AG & Co KGaA is a multinational consumer goods company based in Düsseldorf, Germany. It specializes in the production of laundry detergents, beauty care products, and adhesives, among other products. As of 2023, the company’s market capitalization was 28.76 billion euros. This figure reflects the company’s success in increasing shareholder value over the past year. Henkel’s return on equity (ROE) was 4.84%, which indicates that the company is efficiently utilizing its assets to generate a return. Henkel’s strong financial performance is testament to its business model and commitment to innovation.

Summary

Spectrum Brands has been the subject of much attention recently due to the Department of Justice’s antitrust suit against its planned sale of Assa Abloy to an American private equity firm. Despite the legal challenge, investors have responded positively and the stock has seen a significant increase on the same day. Analysts suggest that Spectrum Brands may be in a strong position to benefit from the sale, as it could generate significant cost savings and further expand the company’s footprint in the security technology space. Additionally, Spectrum Brands has strong fundamentals and a solid reputation, making it an attractive investment for investors.

Recent Posts