Inter Parfums Intrinsic Value Calculator – Inter Parfums Share Price Drops 15%, Shedding 3.5% This Week as Yearly Returns Fall In Line With Earnings Growth

June 2, 2023

☀️Trending News

Inter Parfums ($NASDAQ:IPAR), Inc., a leading producer of fragrances and beauty products, has seen its share price take a hit this week, falling 3.5% and 15% over the past week. This drastic decrease in value has caused the company’s yearly returns to be more closely in line with the growth of their earnings. This drop in value has likely been concerning for shareholders of Inter Parfums, as they look to see the investment they have made yield returns. The company has been striving to reach success with its product line-up, and the decrease in stock value reflects this.

The fragrances and beauty products produced by Inter Parfums have been successful in many markets, however, this week’s dip in value puts a damper on the company’s progress. Although market fluctuations are unavoidable, shareholders of Inter Parfums will be hoping that the stock returns to its previous level as soon as possible. It remains to be seen whether Inter Parfums will be able to recover from this setback and make up for the losses incurred this week.

Earnings

The latest earnings report of INTER PARFUMS as of March 31, 2023 saw total revenue of 311.72M USD and net income of 54.07M USD. This marks a 24.3% increase in revenue and a 53.2% increase in net income compared to the previous year, making it clear that the company is on the rise. In the past 3 years, INTER PARFUMS’s total revenue has grown exponentially from 198.53M USD to 311.72M USD.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Inter Parfums. More…

| Total Revenues | Net Income | Net Margin |

| 1.15k | 139.71 | 13.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Inter Parfums. More…

| Operations | Investing | Financing |

| 131.74 | -59.32 | -38.09 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Inter Parfums. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.38k | 530.6 | 19.29 |

Key Ratios Snapshot

Some of the financial key ratios for Inter Parfums are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.1% | 37.3% | 20.0% |

| FCF Margin | ROE | ROA |

| 0.9% | 22.5% | 10.4% |

Analysis – Inter Parfums Intrinsic Value Calculator

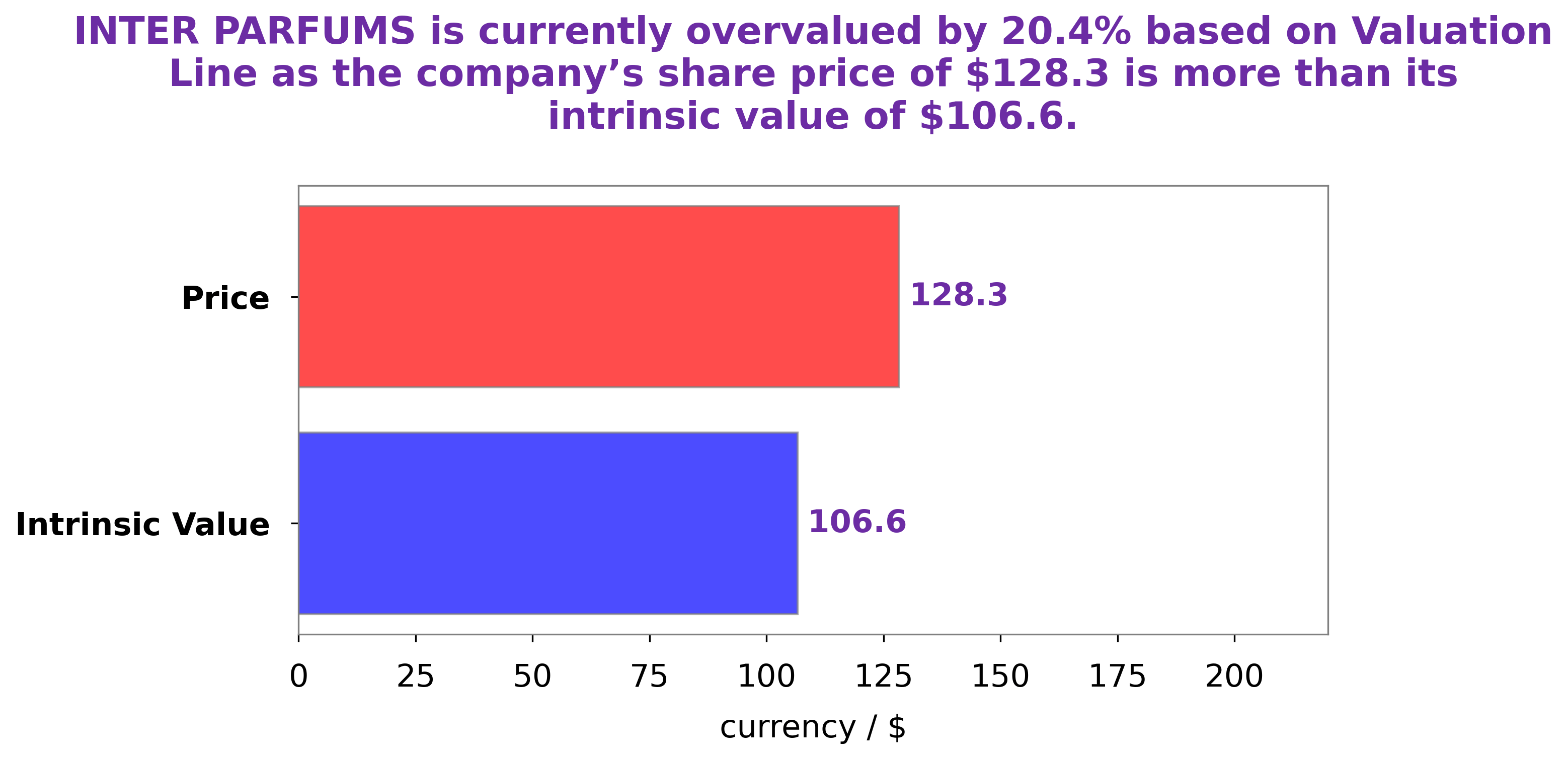

At GoodWhale, we have conducted an analysis of INTER PARFUMS‘s wellbeing and believe the fair value of INTER PARFUMS share to be around $106.6, as calculated by our proprietary Valuation Line. Currently, INTER PARFUMS stock is being traded at $128.3 – this is an overvaluation of 20.3%. With this information, investors may determine whether the current stock price reflects true worth and make decisions accordingly. More…

Peers

The company holds licenses for the brands of Burberry, Coach, Jimmy Choo, Karl Lagerfeld, Montblanc, Oscar de la Renta, Paul Smith, Van Cleef & Arpels, and S.T. Dupont. It competes with Kose Corp, Rocky Mountain Chocolate Factory Inc, MamaMancini’s Holdings Inc.

– KOSE Corp ($TSE:4922)

KOSE Corporation is a Japanese cosmetics company. It was founded in 1946 and its products are sold in over 30 countries. The company has a market capitalization of 843.21 billion as of 2022 and a return on equity of 5.91%. KOSE Corporation’s products include skincare, makeup, and fragrances. The company’s brands include Sekkisei, Jurlique, and La Mer.

– Rocky Mountain Chocolate Factory Inc ($NASDAQ:RMCF)

With a market cap of just under $40 million, Rocky Mountain Chocolate Factory is a small company. Nevertheless, it is a publicly traded company with a long history, dating back to its founding in 1981. The company produces and sells a variety of chocolate and caramel confections, as well as other sweet treats. It has over 300 franchise locations across the United States, Canada, and the United Arab Emirates. While the company’s ROE of -12.68% is not particularly impressive, it is worth noting that this figure is an improvement over its -21.67% ROE from the previous year. The company’s market cap and ROE are both likely to continue to fluctuate in the coming years, depending on a variety of factors.

– MamaMancini’s Holdings Inc ($NASDAQ:MMMB)

MamaMancini’s Holdings Inc is a producer of ready-to-eat, all-natural beef, turkey, and pork meatballs, as well as other Italian-American cuisine. As of 2022, the company has a market cap of 39.22M and a ROE of -14.63%. MamaMancini’s specializes in ready-to-eat, all-natural beef, turkey, and pork meatballs, as well as other Italian-American cuisine. The company was founded in 1992 and is headquartered in Carlstadt, New Jersey.

Summary

Inter Parfums, Inc. saw its share price drop 15% this week, bringing its yearly returns in line with earnings growth. It is important for investors to analyze the company’s financials in order to understand the current investment climate for Inter Parfums. Investors should consider the company’s revenue, expenses, and cash flow to provide insight into the company’s current and future prospects. It is also important to analyze the competitive landscape, considering how Inter Parfums stacks up against other companies in the same industry.

Analyzing Inter Parfums’ management team and strategic goals can provide further insight into what to expect from the company in the future. Ultimately, investors need to weigh the risks and rewards of investing in Inter Parfums before making any decisions.

Recent Posts