Principal Financial Group Reduces Stake in Certara,

June 12, 2023

🌥️Trending News

Certara ($NASDAQ:CERT), Inc. is a leading global provider of software and consulting services that enable biopharmaceutical companies to optimize drug development and regulatory strategies. Recently, the Principal Financial Group Inc. has reduced its ownership in Certara, Inc. shares. The details of the transaction have not been disclosed but this news has had an impact on the stock prices of Certara. The stock price dropped by almost 10% in the days following the announcement while the Nasdaq index was up by 2%.

This could be a sign that the market does not view this news favorably. It is unclear why the Principal Financial Group Inc. has decided to reduce its stake in Certara, Inc. It could be due to a number of factors such as changes in the market, a shift in the company’s strategy, or a lack of confidence in the company’s potential. Whatever the reason, this news has raised questions about the future of Certara, Inc. and its ability to remain competitive in a rapidly changing market.

Market Price

Thursday saw the Principal Financial Group Inc. reduce their stake in Certara, Inc., resulting in a drop of 8.0% from the prior day’s closing price of $18.8 to $17.2. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Certara. More…

| Total Revenues | Net Income | Net Margin |

| 344.39 | 13.88 | 4.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Certara. More…

| Operations | Investing | Financing |

| 92.7 | -21.89 | -6.69 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Certara. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.57k | 481.7 | 6.79 |

Key Ratios Snapshot

Some of the financial key ratios for Certara are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.2% | 18.4% | 10.9% |

| FCF Margin | ROE | ROA |

| 23.3% | 2.2% | 1.5% |

Analysis

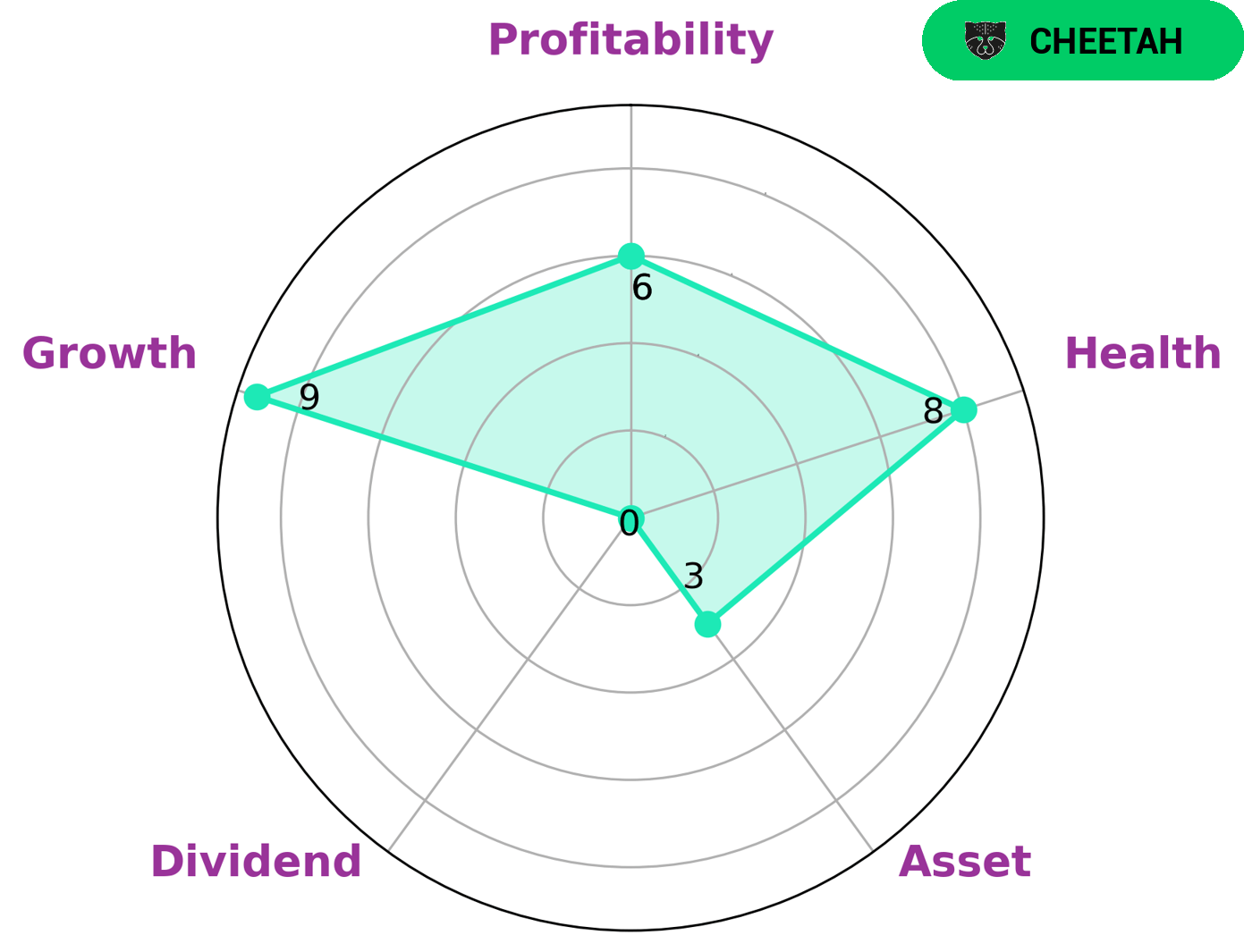

GoodWhale’s analysis of CERTARA has revealed a ‘cheetah’ type of company, meaning that it has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. We believe that investors who are interested in a company that has a strong focus on growth may find CERTARA to be an attractive investment option. The company’s health score of 8/10 indicates that it is capable to sustain future operations in times of crisis, as CERTARA’s cashflows and debt are strong enough to do so. It is important to note, however, that other areas such as asset, profitability and dividend are not as strong as these two. Therefore, investors who are looking for more stability or higher returns may not find CERTARA to be the right fit for them. More…

Peers

The competition in the genomics market is heating up as Certara Inc goes up against 10x Genomics Inc, Cambridge Cognition Holdings PLC, and Schrodinger Inc. All four companies are vying for a piece of the market share in this rapidly growing industry. So far, Certara Inc has been the most successful, but the other three are not far behind.

– 10x Genomics Inc ($NASDAQ:TXG)

As of 2022, 10x Genomics Inc has a market cap of 2.93B. The company’s Return on Equity for that year was -10.81%. 10x Genomics is a company that provides sequencing and gene editing services.

– Cambridge Cognition Holdings PLC ($LSE:COG)

Cambridge Cognition Holdings PLC is a neuropsychological testing company. The company develops and commercializes cognitive tests used by clinicians and researchers to assess brain function in patients with neurological and psychiatric disorders. Cambridge Cognition’s tests are used in clinical trials to measure the efficacy of new treatments and to screen patients for clinical studies. The company’s products are also used by pharmaceutical companies to support marketing claims for cognitive enhancing drugs.

– Schrodinger Inc ($NASDAQ:SDGR)

Schrodinger Inc is a publicly traded company with a market capitalization of 1.55 billion as of 2022. The company has a return on equity of -15.16%. Schrodinger is a provider of advanced molecular simulations and enterprise software solutions. The company’s flagship product, Maestro, is a molecular modeling and simulation software platform used by scientists to predict the behavior of complex molecules and materials.

Summary

Certara, Inc. is a biopharmaceutical technology company specializing in research and development of novel therapeutics. Investors have taken note of the company’s growth potential, and its stock price has been increasing steadily since its market debut. Recently, Principal Financial Group Inc. reduced its stake in Certara, Inc. This caused a slight dip in the stock price, though it appears to have been only a temporary setback.

Overall, Certara appears to be a promising investment opportunity for those looking to capitalize on the growing biopharmaceutical industry. With cutting-edge technologies and robust development pipelines, the company is well-positioned to generate strong returns for investors in the long-term.

Recent Posts