Guggenheim Raises Price Target on Phreesia Stock to $40, Maintains Buy Rating

April 9, 2023

Trending News 🌥️

Guggenheim recently raised its Price Target on Phreesia ($NYSE:PHR) stock to $40, while maintaining its Buy Rating. This increase comes after a positive outlook on the company’s growth prospects and its positive performance in the healthcare space. Phreesia Inc. is a healthcare technology company that provides patient intake solutions for healthcare providers. It helps automate and manage the patient intake process, allowing for patient information to be collected more quickly and efficiently than traditional methods. Phreesia’s platform also provides automated billing, secure payments, and real-time insights into patient data. With a Price Target of $40, investors can expect to see an increase in the stock’s value over time.

Additionally, with a Buy Rating from Guggenheim, Phreesia is seen as a safe bet for long-term investments.

Price History

On Thursday, PHREESIA stock opened at $31.2 and closed at $30.8, up by 0.2% from prior closing price of $30.8. Despite this marginal increase in share price, Guggenheim remains optimistic about the future of the company and its stock’s value. Investors should take note of Guggenheim’s positive outlook and consider buying shares in PHREESIA to take advantage of the potential long-term gain that could result from this positive rating. Phreesia_Stock_to_40_Maintains_Buy_Rating”>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Phreesia. More…

| Total Revenues | Net Income | Net Margin |

| 280.91 | -176.15 | -62.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Phreesia. More…

| Operations | Investing | Financing |

| -90.12 | -26.2 | -20.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Phreesia. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 370.06 | 82.24 | 5.41 |

Key Ratios Snapshot

Some of the financial key ratios for Phreesia are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 31.1% | – | -62.8% |

| FCF Margin | ROE | ROA |

| -41.4% | -36.3% | -29.8% |

Analysis

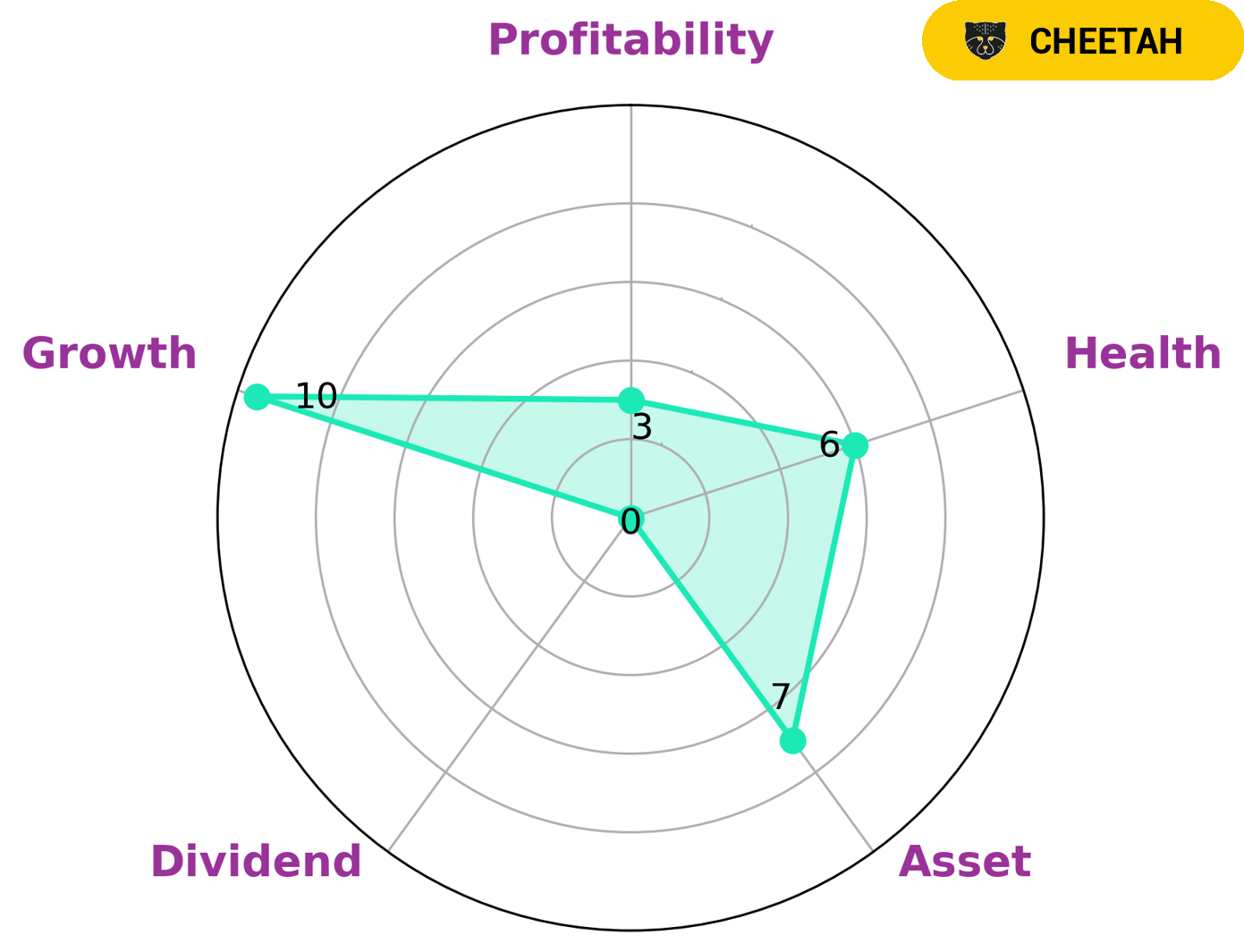

At GoodWhale, we conducted an analysis of PHREESIA’s well-being. Our Star Chart assessment identified PHREESIA as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. PHREESIA is strong in asset and growth but weak in dividend and profitability. Considering its cashflows and debt, PHREESIA has an intermediate health score of 6/10, indicating it may be able to sustain future operations in times of crisis. This makes it an attractive option for investors looking for high growth, but with a higher risk tolerance. Investors looking for profitability and stability may want to look elsewhere. Phreesia_Stock_to_40_Maintains_Buy_Rating”>More…

Peers

Its competitors include Sharecare Inc, Aclarion Inc, and Cloud DX Inc.

– Sharecare Inc ($NASDAQ:SHCR)

Sharecare is a digital health company that allows users to manage their health and wellness in one place. The company has a wide range of products and services, including a social media platform, a health information database, and a mobile app. The company also offers a variety of health and wellness products and services, including fitness tracking, nutrition counseling, and stress management.

– Aclarion Inc ($NASDAQ:ACON)

Aclarion Inc is a publicly traded company with a market cap of 6.36M as of 2022. The company has a Return on Equity of -186.66%. Aclarion is a provider of cloud-based software solutions for the management of enterprise content. The company’s products and services include content management, document management, records management, and compliance management. Aclarion’s solutions are used by organizations in a variety of industries, including healthcare, financial services, government, and education.

– Cloud DX Inc ($TSXV:CDX)

A market cap is the total value of all a company’s shares of stock. Market cap is calculated by multiplying a company’s shares outstanding by the current market price of one share. The return on equity is a financial ratio that measures the profitability of a company in relation to the equity. The company’s equity is the difference between its total assets and total liabilities. The company’s ROE is its net income divided by its equity.

The company’s market cap is 10.81M as of 2022. The company’s ROE is 111.76%. The company’s net income is its total assets minus its total liabilities. The company’s market cap is its shares outstanding multiplied by the current market price of one share.

Summary

Phreesia Inc (NYSE: PHR) has recently been given an adjusted price target of $40 from Guggenheim, while maintaining a ‘Buy’ rating. Analysts have been impressed with the company’s performance and prospects, citing the strong financials and growing customer base as key factors. The recent stock price appreciation highlights the increasing demand for its innovative healthcare technologies, such as patient intake and payments processing.

Phreesia’s value proposition is further strengthened by its HIPAA-compliant data security measures, which ensure the integrity of patient information. Guggenheim’s price target adjustment demonstrates the confidence in Phreesia’s ability to continue to deliver results in the future.

Recent Posts