Evolent Health Stock Fair Value Calculation – Evolent Health Surpasses Q1 Earnings Estimates, Revenues Up 1.81%

May 5, 2023

Trending News 🌥️

Evolent Health ($NYSE:EVH) is a healthcare services company that specializes in population health management. In Q1 of 2023, Evolent Health reported higher than expected earnings and a 1.81% increase in revenues. This performance surpasses the estimates released by market analysts and gives investors hope of future growth. As the company continues to invest in its population health management services and expand its customer base, it is expected that the stock may continue to trend upwards in the near future.

However, investors should be cautious when investing in Evolent Health’s stock. The company’s success is dependent on its ability to continue to outpace its competitors in a highly competitive industry. Furthermore, any unexpected changes in the healthcare industry or economy could also lead to a decline in the stock’s performance. This performance indicates potential future success of the stock; however, investors should exercise caution when investing in the company’s stock due to the unpredictable nature of the healthcare industry and economy.

Earnings

EVOLENT HEALTH recently reported impressive numbers in their FY2022 Q1 ending December 31 2022 earnings report. The total revenue for the quarter was 382.43M USD, which is a 1.81% increase compared to the same period last year. On the other hand, net income for the quarter was 11.35M USD, a decrease from the previous quarter’s figures. The company has seen a steep rise in total revenue over the past 3 years, increasing from 271.92M USD to 382.43M USD, representing a 54.0% overall increase.

This is a testament to the company’s success and growth, despite the challenging market conditions of the past few years. Overall, EVOLENT HEALTH surpassed its Q1 earnings estimates and achieved positive growth in total revenue. This indicates that the company is on track to have another successful year.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Evolent Health. More…

| Total Revenues | Net Income | Net Margin |

| 1.35k | -19.16 | -2.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Evolent Health. More…

| Operations | Investing | Financing |

| -11.55 | -259.12 | 131.54 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Evolent Health. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.82k | 957.88 | 8.46 |

Key Ratios Snapshot

Some of the financial key ratios for Evolent Health are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.9% | – | -3.4% |

| FCF Margin | ROE | ROA |

| -3.7% | -3.4% | -1.6% |

Analysis – Evolent Health Stock Fair Value Calculation

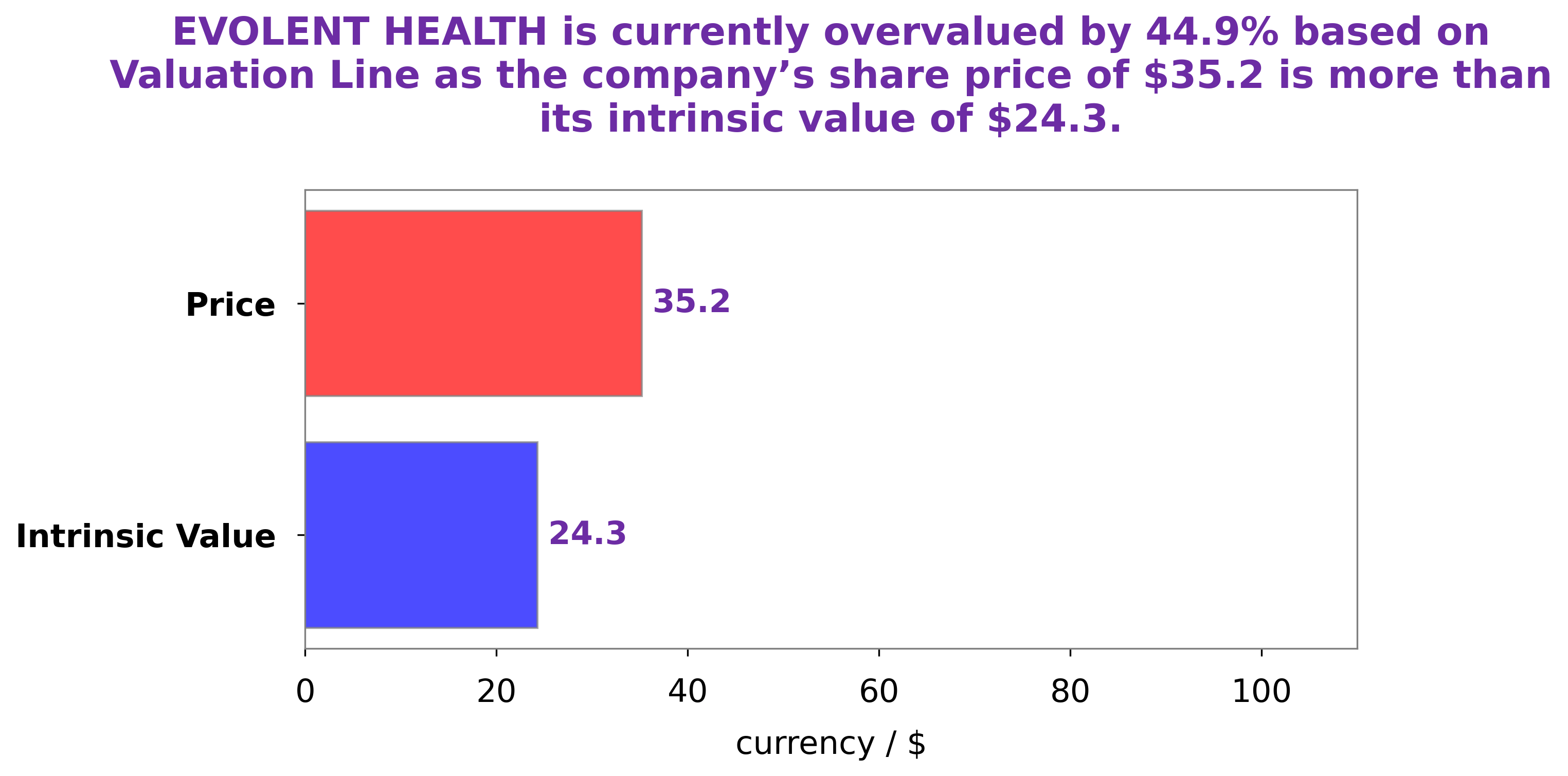

At GoodWhale, we have analyzed the fundamentals of EVOLENT HEALTH. Using our proprietary Valuation Line, we have determined that the intrinsic value of an EVOLENT HEALTH share is $24.3. However, the current trading price of an EVOLENT HEALTH share is $35.2, which indicates that the stock is currently overvalued by 44.6%. We believe that investors should take this into account when considering whether to buy or sell EVOLENT HEALTH shares. More…

Peers

The company’s products and services enable healthcare providers to receive and process payments from patients and third-party payers. Evolent Health Inc’s competitors include PreAxia Health Care Payment Systems Inc, Livecare Inc, PT Bundamedik Tbk, and other healthcare payment processing companies.

– PreAxia Health Care Payment Systems Inc ($OTCPK:PAXH)

PreAxia Health Care Payment Systems Inc is a healthcare technology company that provides solutions to healthcare organizations and payers. Its products and services include claims processing, payment processing, and data management. The company was founded in 1997 and is headquartered in Boston, Massachusetts.

– Livecare Inc ($OTCPK:LVCE)

The companyPT Bundamedik Tbk is a leading healthcare provider in Indonesia. The company has a market cap of 4.73T as of 2022 and a ROE of 10.69%. The company is focused on providing quality healthcare services to the Indonesian people. The company has a strong presence in the Indonesian healthcare market and is committed to providing the best possible care to its patients.

Summary

Evolent Health has recently reported financial results for the quarter ending March 2023, beating Q1 estimates. This strong performance was driven by continued growth in their core markets and strong cost control measures. Looking forward, Evolent will continue to focus on driving operational and financial discipline, as well as expanding its presence in new healthcare markets. Investors should consider these factors when evaluating Evolent Health as a potential investment.

Recent Posts