Cue Health Stock Fair Value – Cue Health Reports Quarterly Earnings Beat of $0.13, Revenue of $24.76M Surpasses Estimates by $1.74M

May 11, 2023

Trending News 🌥️

Cue Health ($NASDAQ:HLTH), Inc., a digital health-tech company, recently reported its quarterly earnings, surpassing expectations. From its flagship AI-based health monitoring system to its wide range of home health care products, Cue Health strives to make healthcare easier, more affordable, and more accessible for all. The company is at the forefront of the digital health revolution and is committed to providing innovative solutions that make healthcare more efficient and effective.

Earnings

In its recently released quarterly earnings report for the fiscal year 2022 Q4, CUE HEALTH reported an impressive beat on its earnings of $0.13, with total revenue of $24.76M surpassing estimates by $1.74M. Total revenue for the quarter reached $146.78M USD, compared to $13.26M USD three years ago, a significant increase of 23.8%. The net income for the quarter was reported to be a loss of $31.51M USD, a 192.1% decrease from the previous year. However, this decrease still falls in-line with the company’s expectations.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cue Health. More…

| Total Revenues | Net Income | Net Margin |

| 474.17 | -194.06 | -40.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cue Health. More…

| Operations | Investing | Financing |

| -111.92 | -63.03 | -6.43 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cue Health. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 694.58 | 118.09 | 3.83 |

Key Ratios Snapshot

Some of the financial key ratios for Cue Health are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 315.2% | – | -42.8% |

| FCF Margin | ROE | ROA |

| -36.9% | -21.8% | -18.3% |

Stock Price

Following the release of the quarterly results, the stock opened at $0.8 and closed at the same price, up by 3.3% from its previous closing price of $0.8. This was a positive sign for investors, showing that the company’s financial performance is satisfactory and that it is in good standing. Live Quote…

Analysis – Cue Health Stock Fair Value

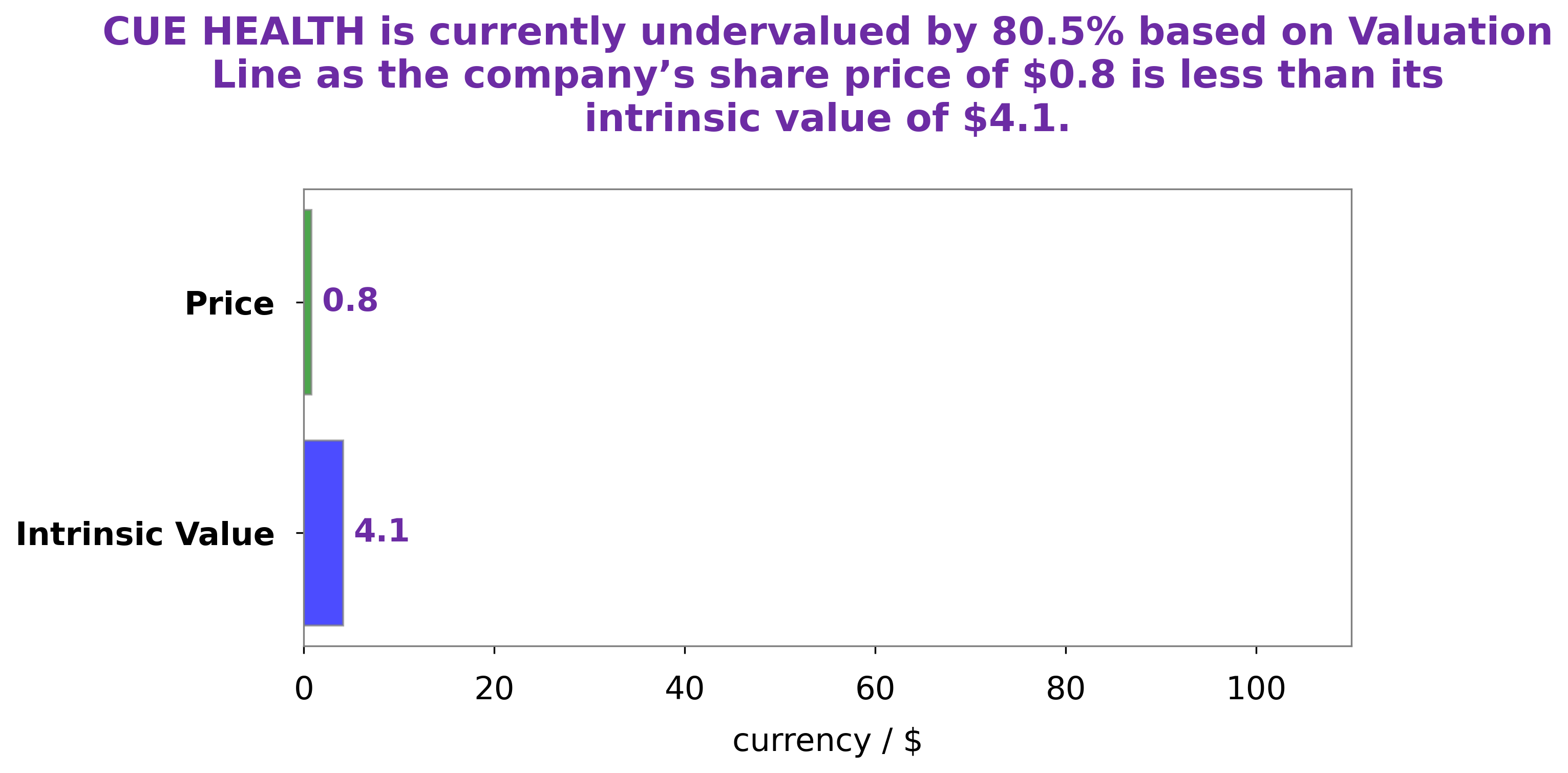

GoodWhale has conducted an extensive analysis of CUE HEALTH‘s wellbeing. Through our proprietary Valuation Line, we have determined that the intrinsic value of CUE HEALTH share is around $4.1. Currently, CUE HEALTH stock is traded at $0.8, which is undervalued by a staggering 80.4%. This gap in valuation provides a great opportunity for investors to capitalise on CUE HEALTH’s potential. More…

Peers

The healthcare industry is intensely competitive, with companies vying for market share in a variety of ways.

– Galileo Life Sciences Inc ($OTCPK:MDRM)

Galileo Life Sciences Inc is a publicly traded company with a market capitalization of 2.93M as of 2022. The company’s return on equity, a measure of profitability, is 199.87%. Galileo Life Sciences is a clinical-stage biopharmaceutical company focused on the development and commercialization of novel therapies for the treatment of cancer and other serious diseases. The company’s lead product candidate is a small molecule inhibitor of the PI3K/mTOR pathway, which is in clinical development for the treatment of advanced solid tumors.

– Privia Health Group Inc ($NASDAQ:PRVA)

Privately held Privia Health Group, Inc. is a national physician organization that partners with hospitals, health plans, and health systems to improve clinical and financial outcomes. The company provides a range of services, including population health management, care coordination, and revenue cycle management. Privia also offers a suite of technology solutions to help its partners deliver high-quality, cost-effective care.

– LifeStance Health Group Inc ($NASDAQ:LFST)

LifeStance Health Group Inc is a healthcare company with a focus on mental health and addiction. The company has a market cap of 2.92B as of 2022 and a Return on Equity of -14.92%. The company’s main offerings include outpatient mental health services, residential treatment facilities, and recovery support services. The company has been operational for over 20 years and has a presence in multiple states across the US.

Summary

Non-GAAP earnings of -$0.48 per share beat analysts’ estimates by $0.13, and revenue of $24.76M beat estimates by $1.74M. Investors responded positively to these results, sending the stock price up on the same day. Analysts are encouraged by the company’s strong performance, noting its potential to continue growing in the coming quarters. The company has a strong balance sheet, with no debt, and is well-positioned to continue its success.

Investors should consider CUE as a promising long-term investment. The company is highly innovative and has seen solid growth in recent quarters. Furthermore, its strong balance sheet suggests that it can continue to invest in further product development and expansion in the future.

Recent Posts