American Well Intrinsic Value Calculator – Analyzing American Well Corporation’s Stock Market Performance

April 9, 2023

Trending News ☀️

Analyzing American Well ($NYSE:AMWL) Corporation’s stock market performance is an important factor in understanding how well the company is doing. American Well Corporation is a telehealth services company that provides online and on-demand healthcare solutions to patients nationwide. By analyzing the market value of American Well Corporation stock, investors can gain insight into how the company is performing in terms of its ability to generate revenue and profits, as well as the overall state of the economy. The stock market provides a wealth of information about American Well Corporation’s performance, including their share price, market capitalization, and analyst ratings. By studying these metrics, investors can gain insight into how American Well Corporation is doing financially.

In addition to the stock market, investors can also study the company’s financial statements to gain a better understanding of the company’s overall financial health. By analyzing American Well Corporation’s stock market performance, investors can make more informed decisions about whether or not to invest in the company. This is especially important given the current volatility of the stock market and the ever-evolving state of the economy. Ultimately, understanding the company’s performance in the stock market can help investors make wise decisions when it comes to allocating their capital.

Share Price

On Thursday, AMERICAN WELL stock opened at $2.4 and closed at $2.2, indicating a 3.9% decrease from its previous closing price of $2.3. This decrease suggests that investors are uncertain about the company’s current stock market performance. Therefore, it is important to analyze American Well Corporation’s stock market performance to understand why its stock is trending downwards. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for American Well. More…

| Total Revenues | Net Income | Net Margin |

| 277.19 | -270.43 | -97.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for American Well. More…

| Operations | Investing | Financing |

| -192.32 | -11.63 | -3.61 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for American Well. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.22k | 133.71 | 3.84 |

Key Ratios Snapshot

Some of the financial key ratios for American Well are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 23.0% | – | -99.5% |

| FCF Margin | ROE | ROA |

| -73.2% | -16.1% | -14.2% |

Analysis – American Well Intrinsic Value Calculator

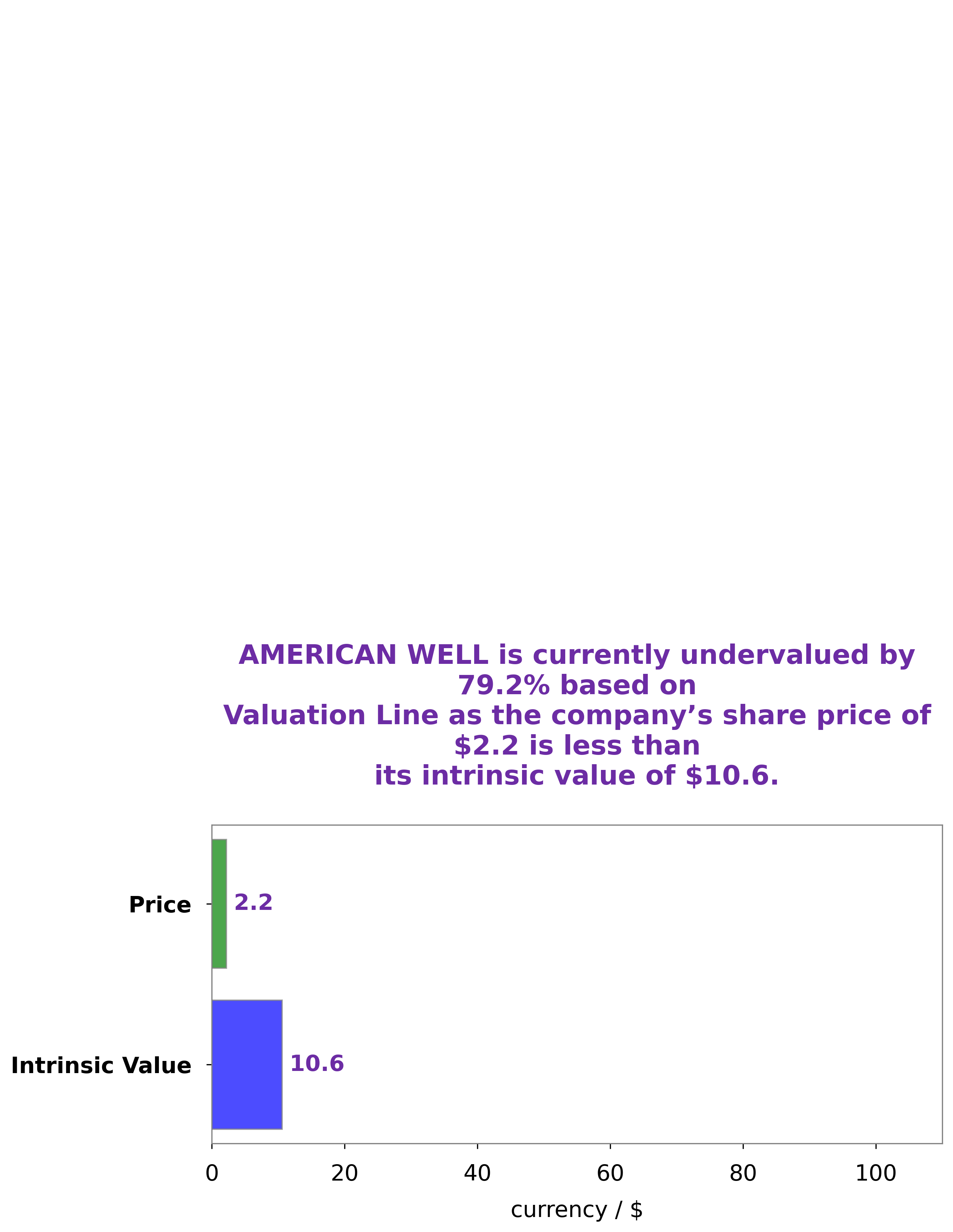

GoodWhale has conducted an analysis of AMERICAN WELL‘s financials to assess the company’s current standing. We believe the fair value of AMERICAN WELL’s stock is around $10.6, based on our proprietary Valuation Line. Remarkably, the company’s current stock price is $2.2, representing a 79.3% discount from the fair value. We see this as an opportunity to invest in a valuable asset at a lower rate than it should be valued. More…

Peers

The company offers a wide range of services, including primary care, urgent care, behavioral health, and more. American Well also provides care coordination and care management services. The company’s competitors include Mednow Inc, Think Research Corp, and InnovAge Holding Corp.

– Mednow Inc ($TSXV:MNOW)

Mednow Inc. is a medical technology company that focuses on delivering innovative and convenient healthcare solutions. The company’s products and services include online medical consultation, telemedicine, and home health monitoring. Mednow Inc. has a market cap of 6.69M as of 2022 and a ROE of -57.05%. The company’s products and services are designed to improve access to care, increase patient engagement, and reduce costs.

– Think Research Corp ($TSXV:THNK)

Think Research Corp is a healthcare technology company that provides software and services to help healthcare organizations deliver evidence-based care. The company has a market cap of 21.55M and a ROE of -47.72%. Think Research Corp is headquartered in Toronto, Canada.

– InnovAge Holding Corp ($NASDAQ:INNV)

InnovAge Holding Corp is a holding company that provides senior living and health care services through its subsidiaries. The company has a market capitalization of 951.7 million as of 2022 and a return on equity of -0.87%. InnovAge Holding Corp’s subsidiaries provide a variety of services including assisted living, skilled nursing, and memory care. The company’s assisted living facilities provide residents with 24-hour supervision and assistance with activities of daily living such as bathing, dressing, and eating. The company’s skilled nursing facilities provide residents with around-the-clock nursing care and rehabilitation services. The company’s memory care facilities provide specialized care for residents with Alzheimer’s disease, dementia, and other forms of memory impairment.

Summary

American Well Corporation is a leading provider of telehealth services, providing virtual medical, behavioral, and other healthcare services via video and mobile. Investing in American Well Corporation’s stock can be a high-risk, high-reward endeavor. The stock price can be volatile as it responds to market forces, news reports, and investors’ sentiment. To evaluate the potential return on investment, investors should analyze the company’s past financial performance, current market trends, and potential future plans.

Additionally, investors should be aware of the company’s competitors, any upcoming events that could impact the stock price, and changes in the industry. By doing their research, investors can make informed decisions about investing in American Well Corporation’s stock.

Recent Posts