American Well Corporation Closes at $2.19 on 05/26/23 After Previous Close

June 8, 2023

☀️Trending News

American Well ($NYSE:AMWL) Corporation, a technology company offering virtual care solutions, closed at $2.19 on Friday, 05/26/23. This represented a slight increase from its previous close of $2.11. It has since grown to become one of the leading providers of virtual care solutions with clients ranging from large healthcare providers to smaller independent practices. The company’s mission is to improve access to healthcare and make it more affordable for everyone. The company is currently focused on expanding its portfolio of offerings to better serve its clients. It recently launched a new platform that allows healthcare providers to use telemedicine and virtual care solutions to provide better patient care.

Additionally, it has partnered with major tech companies such as Microsoft and Apple to develop innovative solutions for healthcare providers and patients. American Well Corporation’s stock price has continued to rise in recent weeks, reflecting investor confidence in the company’s ability to continue to innovate and grow its product offerings. With a strong portfolio and strong partnerships, American Well is well positioned for future success.

Price History

This is a slight decrease from the previous day’s close of $2.2. The stock has been fluctuating since April, with no clear pattern of growth or decline. Investors have been watching the stock closely, looking for any signs of an upturn in the market.

Despite the decline, American Well Corporation remains well-positioned for the future given its strong portfolio of products and services. With their track record of success, investors remain optimistic about the prospects for the company and its value in the long run. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for American Well. More…

| Total Revenues | Net Income | Net Margin |

| 276.96 | -598.08 | -144.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for American Well. More…

| Operations | Investing | Financing |

| -159.28 | 89.92 | 5.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for American Well. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 850.5 | 136.23 | 3.84 |

Key Ratios Snapshot

Some of the financial key ratios for American Well are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 23.0% | – | -98.3% |

| FCF Margin | ROE | ROA |

| -63.7% | -19.4% | -20.0% |

Analysis

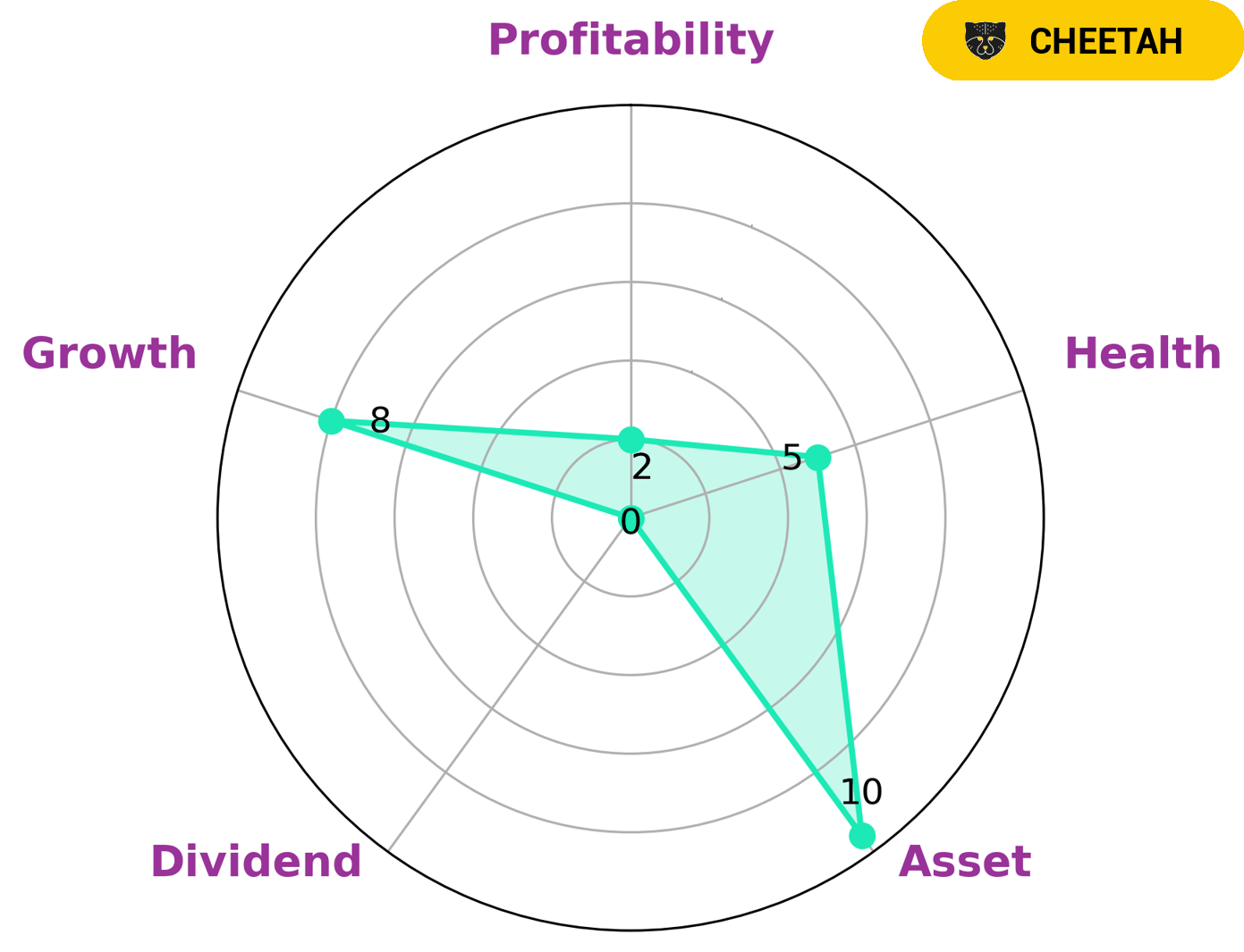

At GoodWhale, we conducted an analysis of AMERICAN WELL‘s fundamentals. From our Star Chart, it is clear that AMERICAN WELL is strong in asset and growth, but weak in dividend and profitability. We determined its health score to be 5/10, which suggests that AMERICAN WELL might have sufficient cashflows and debt to be able to pay off its debt and finance future operations. Additionally, AMERICAN WELL is classified as a ‘cheetah’, a type of company that we believe has achieved high revenue or earnings growth but is considered less stable due to its lower profitability. Investors looking for potential capital appreciation and those willing to take on additional risk may be interested in investing in such a company. More…

Peers

The company offers a wide range of services, including primary care, urgent care, behavioral health, and more. American Well also provides care coordination and care management services. The company’s competitors include Mednow Inc, Think Research Corp, and InnovAge Holding Corp.

– Mednow Inc ($TSXV:MNOW)

Mednow Inc. is a medical technology company that focuses on delivering innovative and convenient healthcare solutions. The company’s products and services include online medical consultation, telemedicine, and home health monitoring. Mednow Inc. has a market cap of 6.69M as of 2022 and a ROE of -57.05%. The company’s products and services are designed to improve access to care, increase patient engagement, and reduce costs.

– Think Research Corp ($TSXV:THNK)

Think Research Corp is a healthcare technology company that provides software and services to help healthcare organizations deliver evidence-based care. The company has a market cap of 21.55M and a ROE of -47.72%. Think Research Corp is headquartered in Toronto, Canada.

– InnovAge Holding Corp ($NASDAQ:INNV)

InnovAge Holding Corp is a holding company that provides senior living and health care services through its subsidiaries. The company has a market capitalization of 951.7 million as of 2022 and a return on equity of -0.87%. InnovAge Holding Corp’s subsidiaries provide a variety of services including assisted living, skilled nursing, and memory care. The company’s assisted living facilities provide residents with 24-hour supervision and assistance with activities of daily living such as bathing, dressing, and eating. The company’s skilled nursing facilities provide residents with around-the-clock nursing care and rehabilitation services. The company’s memory care facilities provide specialized care for residents with Alzheimer’s disease, dementia, and other forms of memory impairment.

Summary

American Well Corporation (AMWL) is a healthcare technology company that offers virtual doctor visits. Investors should closely monitor the stock’s performance and consider the potential upside that AMWL appears to offer.

Recent Posts