American Well Corp. Reiterates ‘Hold’ as Convergence Plans Move Forward

June 7, 2023

☀️Trending News

American Well ($NYSE:AMWL) Corp. is an innovative healthcare technology company that is revolutionizing the healthcare industry. Their mission is to provide access to quality and reliable health care services for people everywhere. Recently, the company has been working towards the implementation of its Converge platform, which is projected to revolutionize the way healthcare is delivered. In light of this news, I am reiterating my “Hold” rating for American Well Corp. stock. American Well Corp. is known for their cutting-edge technology that is revolutionizing the healthcare industry by providing consumers with easy access to quality and reliable healthcare services. As part of their mission, the company has launched a number of initiatives, such as their Converge platform, which allows healthcare providers to collaborate with each other to provide better patient care.

The platform is expected to be fully operational soon and has the potential to bring major changes in the healthcare industry. Given the potential of the Converge platform and the promise of American Well Corp., I am reiterating my “Hold” rating for their stock. As the full implementation of the platform progresses, I am confident that American Well Corp. will continue to prove its worth in the market and provide investors with long-term value. Until then, I recommend investors look at other companies in the healthcare sector as they are likely to benefit more from the Converge platform.

Price History

On Tuesday, American Well Corporation (AMERICAN WELL) stock opened at $2.5 and closed at $2.6, up by 4.4% from its last closing price of 2.5. This was a positive sign for the company amid its plans to expand its presence in the health care industry through the convergence of health care delivery and technology solutions. The recent stock rise is seen as a signal of investor confidence in the company’s long-term plans and strategy. This is particularly true given the current uncertainty in the global economy due to the pandemic. American Well’s plans are to become an integrated health care delivery organization, combining telehealth, digital health, and in-person care.

The company is focusing on providing high-quality care through digital solutions that are accessible to all patients, regardless of their location or economic situation. The company has made significant progress on their convergence plans and is well-positioned to capitalize on the opportunities presented by the digital transformation of health care. Given the progress they have made so far, analysts reiterate their “Hold” rating on the stock. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for American Well. More…

| Total Revenues | Net Income | Net Margin |

| 276.96 | -598.08 | -144.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for American Well. More…

| Operations | Investing | Financing |

| -159.28 | 89.92 | 5.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for American Well. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 850.5 | 136.23 | 3.84 |

Key Ratios Snapshot

Some of the financial key ratios for American Well are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 23.0% | – | -98.3% |

| FCF Margin | ROE | ROA |

| -63.7% | -19.4% | -20.0% |

Analysis

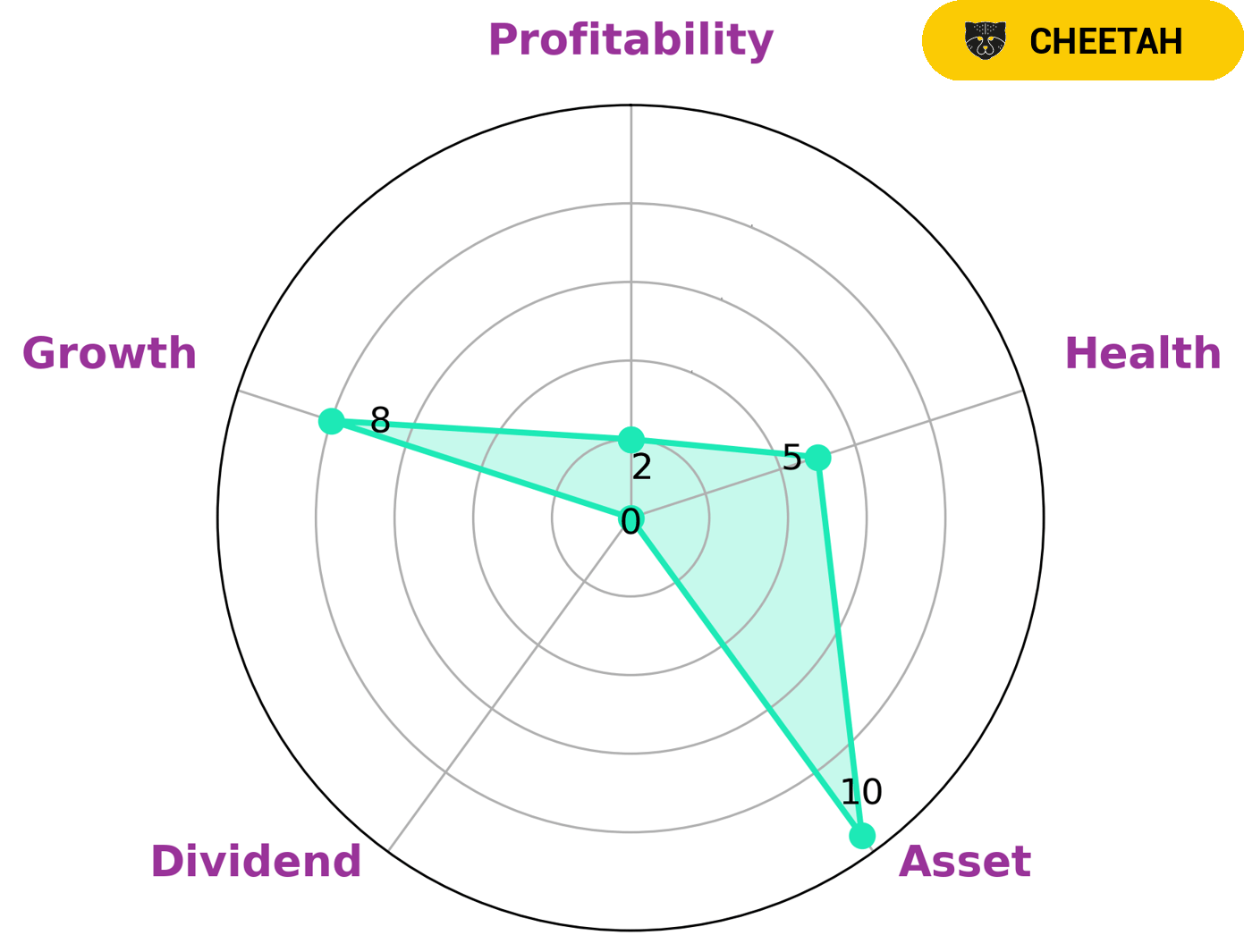

GoodWhale’s analysis of AMERICAN WELL‘s fundamentals revealed that the company is classified as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. This type of company might be attractive to investors who are seeking higher returns despite the potential for greater volatility. The company has an intermediate health score of 5/10 with regard to its cashflows and debt, which suggests that AMERICAN WELL is likely to sustain future operations in times of crisis. Additionally, the analysis reveals that AMERICAN WELL is strong in asset and growth, but weak in dividend and profitability. This suggests that investors should be aware of the risk-reward associated with investing in the company. More…

Peers

The company offers a wide range of services, including primary care, urgent care, behavioral health, and more. American Well also provides care coordination and care management services. The company’s competitors include Mednow Inc, Think Research Corp, and InnovAge Holding Corp.

– Mednow Inc ($TSXV:MNOW)

Mednow Inc. is a medical technology company that focuses on delivering innovative and convenient healthcare solutions. The company’s products and services include online medical consultation, telemedicine, and home health monitoring. Mednow Inc. has a market cap of 6.69M as of 2022 and a ROE of -57.05%. The company’s products and services are designed to improve access to care, increase patient engagement, and reduce costs.

– Think Research Corp ($TSXV:THNK)

Think Research Corp is a healthcare technology company that provides software and services to help healthcare organizations deliver evidence-based care. The company has a market cap of 21.55M and a ROE of -47.72%. Think Research Corp is headquartered in Toronto, Canada.

– InnovAge Holding Corp ($NASDAQ:INNV)

InnovAge Holding Corp is a holding company that provides senior living and health care services through its subsidiaries. The company has a market capitalization of 951.7 million as of 2022 and a return on equity of -0.87%. InnovAge Holding Corp’s subsidiaries provide a variety of services including assisted living, skilled nursing, and memory care. The company’s assisted living facilities provide residents with 24-hour supervision and assistance with activities of daily living such as bathing, dressing, and eating. The company’s skilled nursing facilities provide residents with around-the-clock nursing care and rehabilitation services. The company’s memory care facilities provide specialized care for residents with Alzheimer’s disease, dementia, and other forms of memory impairment.

Summary

American Well is a telehealth company that provides digital healthcare services to connect patients with healthcare providers. Their services allow for virtual visits, online doctor consultations, and prescription refills in addition to traditional care services. Recently, the company has seen its stock price move up as investors anticipate the full implementation of their Converge platform, which is set to offer a wide array of features and improve overall user experience.

For those looking for a long-term investment opportunity, American Well is currently rated as a “Hold” as investors await further evidence of the success of Converge. Short-term traders, however, will want to keep a close eye on the stock as it continues to move up in anticipation of the platform’s full deployment.

Recent Posts