IAMGOLD Corporation [IAG] Reaches Historic High in 2023: What It Means For Investors.

April 4, 2023

Trending News ☀️

IAMGOLD ($TSX:IMG) Corporation (IAG) is a leading mid-tier gold producer with operations on four continents, including four operating gold mines, as well as a number of development and exploration projects. This significant increase in price is an indication that investors are placing greater value on the company’s current and projected performance. The increase in IAG’s stock price can be attributed to a number of factors. Firstly, the company’s strong financials have been a major contributing factor, with a healthy balance sheet, steady revenue growth, and high profitability providing further evidence of the company’s long-term prospects. Secondly, the company has experienced strong performance from its operations, with multiple mines in production and high quality production outputs making it an attractive investment option.

Finally, the company’s corporate strategy has been focused on creating shareholder value through strategic investments and operational efficiencies. It is a strong indication that the company is well-positioned for continued success and that investors are beginning to recognize the potential of IAG’s operations and investments. It is also a sign that the gold mining industry is continuing to show signs of strength despite periods of volatility, making it a viable investment option for those looking for an opportunity to capitalize on continued growth in the sector.

Share Price

On Thursday, IAMGOLD Corporation IAG reached a historic high, opening at CA$3.7 and closing at the same price, representing a 1.6% increase from its last closing price of CA$3.7. This move bodes well for investors and indicates that IAMGOLD is a strong and reliable investment in the future. The company is well-positioned in the gold mining industry and has a strong portfolio of projects across North and South America. As global gold prices remain strong, IAMGOLD is expected to benefit from this positive trend and continue to increase its shareholder value.

Additionally, the company has been engaging in strategic investments and acquisitions over the past few years which have enabled it to become a market leader in the gold mining industry. IAMGOLD’s strong performance and long-term outlook could make it an attractive investment for investors who are looking for stability in their portfolios. With a market cap of more than CA$4 billion, it is well-positioned to capitalize on opportunities in the gold mining industry and provide investors with steady returns. As gold prices remain high, IAMGOLD is expected to continue to rise in 2023 and beyond, offering investors an opportunity for great returns. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Iamgold Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 958.8 | -70.1 | -4.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Iamgold Corporation. More…

| Operations | Investing | Financing |

| 408.7 | -891.9 | 404 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Iamgold Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.43k | 2.22k | 4.45 |

Key Ratios Snapshot

Some of the financial key ratios for Iamgold Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -3.5% | 36.8% | 4.3% |

| FCF Margin | ROE | ROA |

| -38.8% | 1.2% | 0.6% |

Analysis

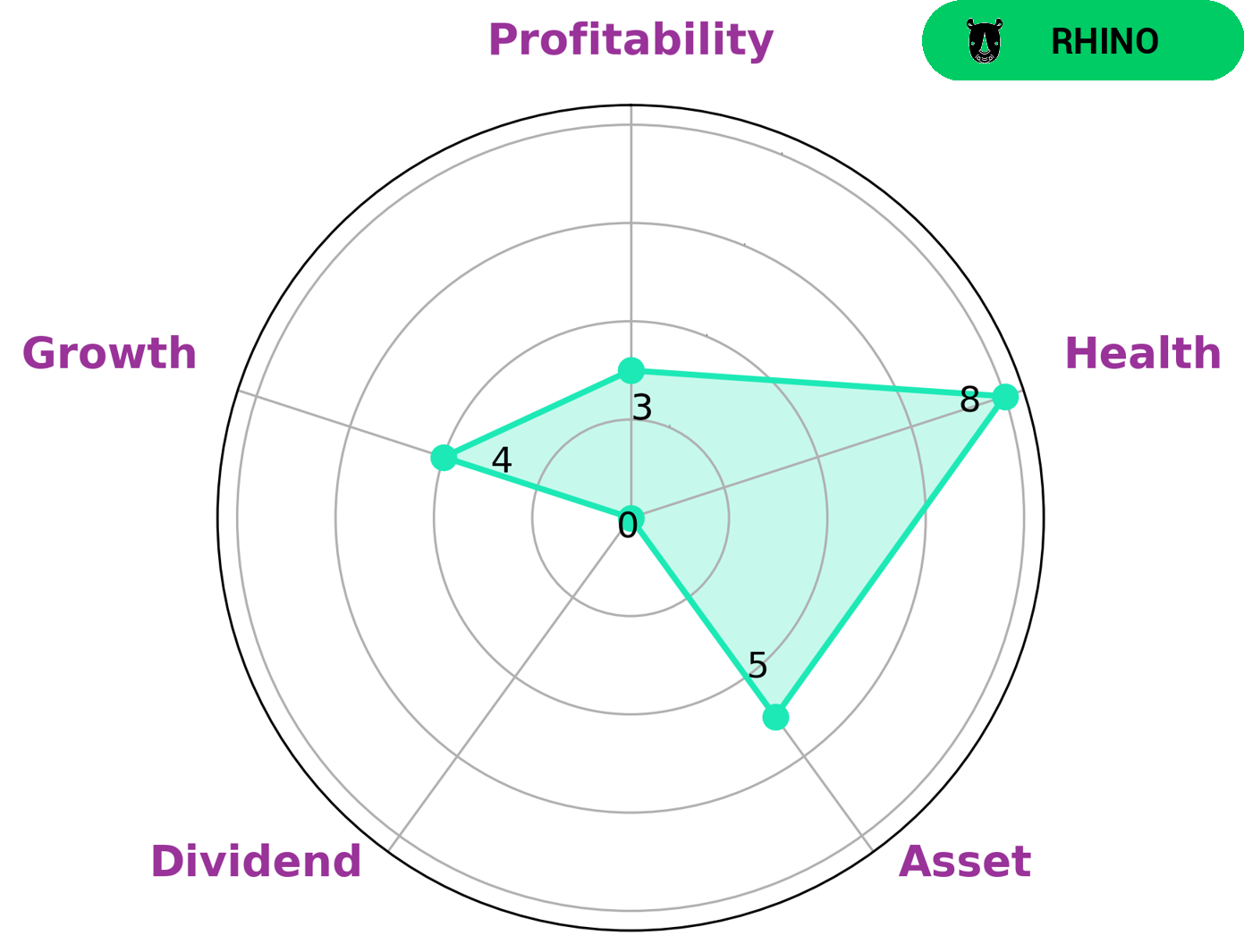

We analyzed IAMGOLD CORPORATION‘s financials and based on the Star Chart, it is classified as ‘rhino’. This classification indicates that the company has achieved moderate revenue or earnings growth. IAMGOLD CORPORATION is strong in asset, medium in growth and weak in dividend and profitability. The company has a high health score of 8/10 considering its cashflows and debt, which indicates that it is capable of sustaining future operations in times of crisis. Given these findings, investors who are looking for a moderately growing company with strong asset base, medium growth and weak dividend and profitability would find IAMGOLD CORPORATION attractive. Investors who are risk-averse and looking for dividend income may not find the company appealing. More…

Peers

The company’s primary competitors in the gold mining industry are Collective Mining Ltd, Orosur Mining Inc, and First Mining Gold Corp. Iamgold Corp has a market capitalization of $2.4 billion, while Collective Mining Ltd has a market capitalization of $1.3 billion, Orosur Mining Inc has a market capitalization of $720 million, and First Mining Gold Corp has a market capitalization of $500 million.

– Collective Mining Ltd ($TSXV:CNL)

Collective Mining Ltd is a company that engages in mining and exploration activities. The company has a market capitalization of 115.35 million as of 2022 and a return on equity of -71.12%. The company’s main operations are located in the United Kingdom, Canada, and Australia.

– Orosur Mining Inc ($TSXV:OMI)

Orosur Mining Inc is a Canadian-based gold producer with operations in Uruguay, Chile and Colombia. The Company has a portfolio of assets including the San Gregorio Project in Uruguay, the advanced exploration stage Aiken Project in Chile and the producing Apogeo Gold Mine in Colombia.

– First Mining Gold Corp ($TSX:FF)

First Mining Gold Corp is a Canadian gold mining company with a market capitalization of $163.72 million as of 2022. The company has a return on equity of -2.22%. First Mining Gold Corp is engaged in the business of acquiring, exploring, developing, and producing gold and other mineral properties.

Summary

IAMGOLD Corporation (IAG) has reached an all-time high in 2023, a milestone event for investors. The company’s stock price has been driven by a number of factors, such as higher gold prices, increasing demand for its products, and changing market conditions. With several projects in the pipeline, IAG is well positioned to capitalize on future growth opportunities.

Investors should consider its strong cash flow, healthy balance sheet, and solid management team when evaluating their investment decision. IAG is a great choice for those looking to diversify their portfolio and benefit from both potential growth and income.

Recent Posts