Agnico Eagle Mines: Ready to Soar Even Higher After Impressive 35% Return

April 13, 2023

Trending News ☀️

Agnico Eagle Mines ($NYSE:AEM) (AEM) has had an impressive 35% return this year, and I believe it is ready to soar even higher. AEM is a Canadian gold mining company that operates nine mines across Canada, Finland, and Mexico. It also has exploration and development activities in those countries as well as the United States. AEM has a strong management team with a track record of successful acquisitions and strategic investments. The company has also benefited from its strong balance sheet, allowing it to take advantage of opportunities in the current market. With its impressive return this year, AEM appears to be well-positioned to continue to deliver positive returns for its shareholders.

In addition, the company has a strong portfolio of projects, as well as a diversified geographic presence which should help to reduce risk and create further upside potential. With all these factors in mind, I am optimistic that Agnico Eagle Mines is ready to soar even higher in the near future.

Stock Price

This marks yet another success for the Canadian-based gold mining and exploration company. Analysts are bullish on Agnico Eagle Mines, citing their strong balance sheet and diverse portfolio of mines located in Canada, Finland, and Mexico. Over the past year, the company has made considerable investments in expanding their production capacity and increasing their costs efficiency.

Those investments have paid off handsomely, and the company is now well-positioned to take advantage of the recent surge in gold prices. Investors looking for exposure to gold mining and exploration should pay close attention to AEM, as it could provide them with lucrative returns in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AEM. More…

| Total Revenues | Net Income | Net Margin |

| 5.74k | 670.25 | 13.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AEM. More…

| Operations | Investing | Financing |

| 2.1k | -710.46 | -914.85 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AEM. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 23.49k | 7.25k | 35.58 |

Key Ratios Snapshot

Some of the financial key ratios for AEM are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 32.0% | 46.5% | 20.9% |

| FCF Margin | ROE | ROA |

| 9.7% | 4.6% | 3.2% |

Analysis

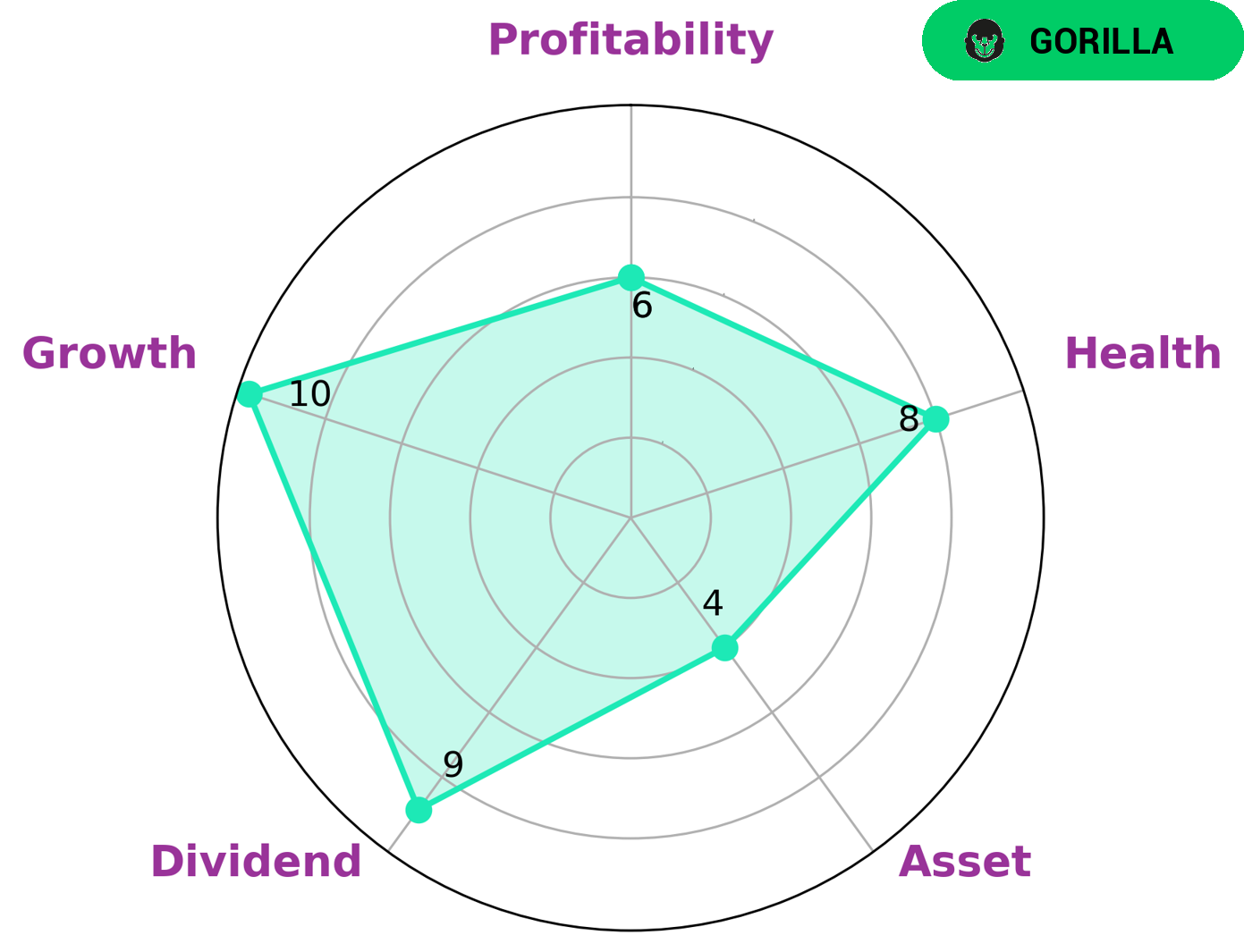

GoodWhale’s Star Chart classifies AGNICO EAGLE MINES as a ‘gorilla’, a type of company that has achieved stable and high revenue/earning growth due to its strong competitive advantage. As such, investors interested in companies with a strong competitive edge are likely to be attracted to AGNICO EAGLE MINES. The GoodWhale Health Score of 8/10 for AGNICO EAGLE MINES indicates that the company is in a strong position with regard to its cash flow and debt. This allows AGNICO EAGLE MINES to pay off debt and fund future operations, making it an attractive option for investors. In terms of profitability and asset performance, AGNICO EAGLE MINES is strong in dividend growth and medium in asset and profitability performance, making it a balanced option for investors. More…

Summary

Investing analysis of Agnico Eagle Mines shows that it has delivered a return of 35% in recent months, making it an attractive stock for investors. As a gold producer, the company is well-positioned to benefit from the rise in demand for the metal as it continues to be seen as a haven asset and as a hedge against inflation. The company has consistently reported solid earnings, and has been able to increase its dividend payments to shareholders over time.

In terms of outlook, Agnico Eagle Mines’ strong balance sheet, low debt levels, and strong cash flow generation are seen as positive factors that suggest there is room for further upside. Investors should also factor in the potential for continued cost savings from operating efficiencies and increased production.

Recent Posts