Montauk Renewables Intrinsic Value Calculation – Montauk Renewables Reports Disappointing Quarterly Results, Missing Expectations

May 11, 2023

Trending News 🌧️

Montauk Renewables ($NASDAQ:MNTK), a renewable energy company based in Montauk, New York, recently reported disappointing quarterly results, significantly missing analyst expectations. The company’s GAAP earnings per share (EPS) of -$0.03 was $0.04 lower than expectations, and its revenue of $19.2M was $20.7M lower than expected. Overall, the company was unable to meet its financial goals this quarter, which has caused its stock to fall. Montauk Renewables has been struggling to keep up with the rapidly changing renewable energy market, as competitors have begun to offer more innovative products and services. As a result, the company’s market share has been declining and investors have become increasingly wary of its long-term prospects.

In addition, Montauk Renewables’ operating expenses continue to rise as the company invests heavily in research and development to stay competitive in the industry. This has resulted in a decrease in their net income and has made it difficult for the company to remain profitable. Going forward, Montauk Renewables must focus on cost reduction efforts and improving the efficiency of their operations in order to remain competitive and be successful in the long-term.

Price History

Montauk Renewables reported its latest quarterly results on Wednesday, and the numbers were disappointing. The company admitted that it had failed to meet the expectations of its investors, citing a decrease in demand for renewable energy sources and the subsequent lower revenues. Despite the market conditions, Montauk Renewables is still committed to providing energy solutions that are sustainable and environmentally friendly. However, investors will likely be leery of investing in the company’s stocks due to the lack of progress in this quarter’s results. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Montauk Renewables. More…

| Total Revenues | Net Income | Net Margin |

| 205.56 | 35.19 | 19.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Montauk Renewables. More…

| Operations | Investing | Financing |

| 81.07 | -20.79 | -8.28 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Montauk Renewables. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 332.32 | 105.22 | 1.6 |

Key Ratios Snapshot

Some of the financial key ratios for Montauk Renewables are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 24.2% | 53.4% | 21.9% |

| FCF Margin | ROE | ROA |

| 28.6% | 12.6% | 8.5% |

Analysis – Montauk Renewables Intrinsic Value Calculation

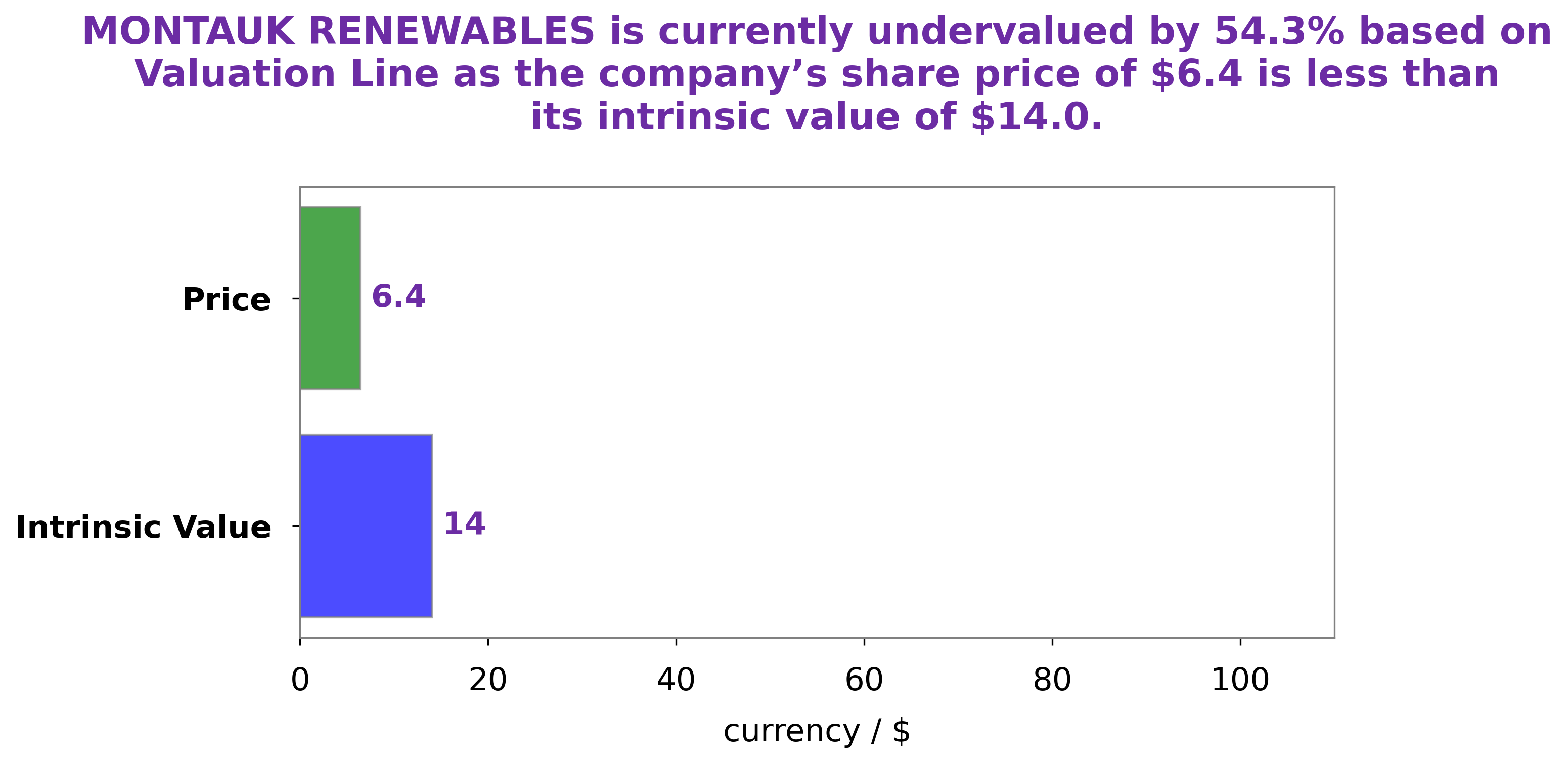

At GoodWhale, we have conducted an in-depth analysis of MONTAUK RENEWABLES‘ financials. Our proprietary Valuation Line suggests that the intrinsic value of MONTAUK RENEWABLES’ share is around $14.0. Currently, MONTAUK RENEWABLES stock is traded at $6.4, indicating a significant discount of 54.2%. This presents a unique opportunity for investors to buy MONTAUK RENEWABLES stock at an attractive price. More…

Peers

The competition among Montauk Renewables Inc and its competitors is fierce. The company is up against Canadian Utilities Ltd, REN-Redes Energeticas Nacionais Sgps SA, and Energy Company of Minas Gerais. All of these companies are vying for a share of the renewable energy market.

– Canadian Utilities Ltd ($TSX:CU)

Canadian Utilities Ltd is a leading Canadian energy company with a market cap of 9.57B as of 2022. The company has a strong focus on electricity generation, transmission and distribution, as well as natural gas and pipeline transportation. Canadian Utilities Ltd has a diversified portfolio of assets and operations across North America, with a particular focus on the Canadian market. The company’s return on equity is 11.45%.

– REN-Redes Energeticas Nacionais Sgps SA ($LTS:0KBT)

REN-Redes Energeticas Nacionais Sgps SA is a Portuguese electricity and gas utility company. The company is involved in the generation, transmission, distribution, and sale of electricity and natural gas. REN-Redes Energeticas Nacionais Sgps SA has a market capitalization of 1.69 billion as of 2022 and a return on equity of 10.08%. The company’s primary business is providing electricity and gas services to customers in Portugal.

– Energy Company of Minas Gerais ($NYSE:CIG)

Eletrobras is a Brazilian electric utility company. It is the largest power utility company in Brazil and Latin America, and the fourth largest in the world. The company is involved in the generation, transmission, and distribution of electricity. Eletrobras also has a presence in the renewable energy sector, with a number of hydroelectric, solar, and wind power plants.

Eletrobras has a market capitalization of 5.31 billion as of 2022. The company’s return on equity is 13.36%. Eletrobras is the largest power utility company in Brazil and Latin America, and the fourth largest in the world. The company is involved in the generation, transmission, and distribution of electricity. Eletrobras also has a presence in the renewable energy sector, with a number of hydroelectric, solar, and wind power plants.

Summary

Montauk Renewables’ most recent results have come in below expectations, with the company posting a GAAP EPS of -$0.03, which missed analysts’ expectations by $0.04. Revenue of $19.2M was also below the expected $20.7M. In the short-term, this could indicate that investors may not want to invest in Montauk Renewables due to its current financial performance, but longer-term investors may want to consider the company’s prospects if it succeeds in securing new contracts and improving its financial performance. To determine if an investment in Montauk Renewables is a good idea, investors should analyze the company’s balance sheet, cash flow, and management team to assess the company’s overall stability and potential for growth.

Recent Posts